Omdia: Spain Leads Europe in FAST Viewing as Global Revenues Climb Toward $11bn by 2030

Omdia: Spain Leads Europe in FAST Viewing as Global Revenues Climb Toward $11bn by 2030

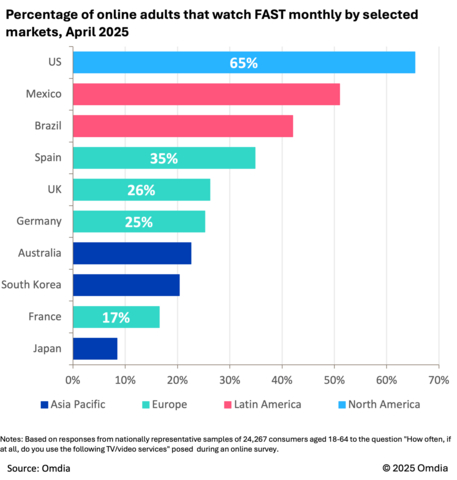

LONDON--(BUSINESS WIRE)--New research from Omdia presented at Content London 2025 revealed that Spain is now Europe’s leading free ad supported streaming TV (FAST) market, with 35% of online adults watching FAST services each month. This places Spain ahead of the UK (26%), Germany (25%) and France (17%), making it the strongest European market in terms of FAST viewing.

Omdia forecasts that FAST revenues in Spain will reach $32bn in 2025 and will almost double over the next five years, rising to $65bn by 2030.

Share

At the same time, the FAST business is entering a new phase of global expansion, with revenues forecast to reach $11bn by 2030, up from $6bn in 2025.

Omdia forecasts that FAST revenues in Spain will reach $32bn in 2025 and will almost double over the next five years, rising to $65bn by 2030.

FAST growth is being driven by strong investment from major hardware and platform providers, including Roku Channels, Samsung TV Plus, LG Channels, Pluto TV, Fire TV Channels, combined with rising consumer demand for free, easy-to-access streaming options. Adoption continues to accelerate across both developed and emerging markets, with the US, Mexico, Brazil, and Spain among the most dynamic growth regions.

“There is a clear and growing appetite for free, linear content and Spain is leading Europe in this trend,” said Maria Rua Aguete Head of Media & Entertainment at Omdia. “FAST has become a compelling alternative for viewers who want high-quality entertainment without a subscription, and Spain’s strong uptake shows just how powerful this model has become across the region.”

On the rise of creators in FAST, Rua Aguete added: “We are seeing YouTubers and digital creators launching their content as FAST channels, helping them diversify audiences and monetization. But it’s important to remember that YouTube content on a TV screen does not automatically make it ‘TV’. Otherwise, playing PlayStation games on a television would also count as TV. Distribution alone does not redefine the underlying medium.”

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

Contacts

Fasiha Khan: fasiha.khan@omdia.com

Eric Thoo: eric.thoo@omdia.com