6G and AI Investment to Drive Global Communications Industry Growth, Omdia Forecasts

6G and AI Investment to Drive Global Communications Industry Growth, Omdia Forecasts

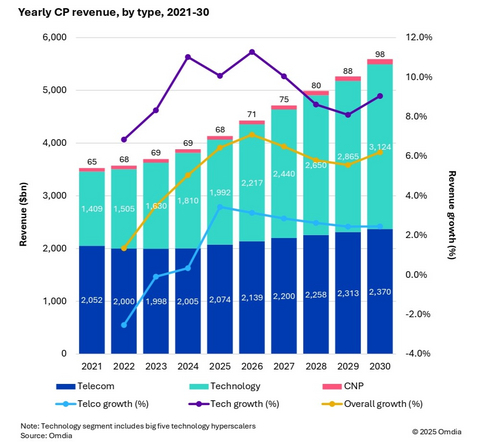

LONDON--(BUSINESS WIRE)--Global Communications Providers (CP) revenue is expected to reach $5.6 trillion by 2030, growing at a 6.2% CAGR from 2025, according to Omdia’s latest global forecast for CP revenue and capital expenditure (capex). This steady growth is driven by technology innovation, infrastructure expansion, and strategic investment in 6G and AI.

“Telecom operators are entering a new phase of strategic investment,” said Dario Talmesio, Research Director at Omdia.

Share

The report shows that while traditional telecom revenue will grow modestly at 2.7% CAGR, the technology segment, led by hyperscale platforms such as Amazon, Alphabet, Apple, Meta, and Microsoft, is set to expand at a robust 9.4% CAGR, accounting for 55.9% of total CP revenue by 2030.

“Telecom operators are entering a new phase of strategic investment,” said Dario Talmesio, Research Director at Omdia. “With 6G on the horizon and AI infrastructure demands accelerating, the connectivity business is shifting from volume-based pricing to value-driven connectivity.”

CAPEX Trends and Investment Drivers

Omdia forecasts telecom capex to reach $395 billion by 2030, with a 3.6% CAGR, while technology capex will surge to $545 billion, reflecting a 9.3% CAGR. Investment momentum is expected to shift toward mobile networks from 2028 onward, as Tier 1 markets prepare for 6G deployments. Fixed telecom capex will gradually decline due to market saturation. Meanwhile, AI infrastructure, cloud services, and digital sovereignty policies are driving telecom operators to expand data centers and invest in specialized hardware.

Key Market Trends

- CP capex per person will increase from $74 in 2024 to $116 in 2030, with CP capex reaching 2.5% of global GDP investment.

- Capital intensity in telecom will decline until 2027, then rise due to mobile network upgrades.

- Regional leaders in revenue and capex include North America, Oceania & Eastern Asia, and Western Europe, with Central & Southern Asia showing the highest growth potential.

Omdia’s forecast is based on a comprehensive model incorporating historical data from 67 countries, local market dynamics, regulatory trends, and technology migration patterns.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

Contacts

Fasiha Khan: fasiha.khan@omdia.com