Credit Benchmark Launches Credit Risk Index (CRI): A New Gauge of Risk Sentiment on Private Markets

Credit Benchmark Launches Credit Risk Index (CRI): A New Gauge of Risk Sentiment on Private Markets

New monthly index delivers the definitive measure of credit quality trends among U.S. Private Corporates - filling a critical data gap for risk managers and investors.

NEW YORK--(BUSINESS WIRE)--Credit Benchmark, the leading provider of consensus-based credit risk data from global banks, today announced the launch of our flagship Credit Risk Index (CRI) – the first monthly measure designed to track credit deterioration and improvement among U.S. private corporates and financials. Recent corporate defaults have underscored the need for more transparency within private markets. The CRI will help address this by providing a gauge of risk sentiment in a part of the market that is otherwise opaque.

“The CRI addresses a blind spot in regard to understanding credit risk trends in private markets,” said Michael Crumpler, CEO at Credit Benchmark.

Share

Built on Credit Benchmark’s proprietary dataset covering roughly $9 trillion in loans outstanding, the flagship CRI tracks nearly 3,000 private companies in the U.S. Unlike public-market indices or ratings-agency data, the CRI is grounded in actual credit risk sentiment from global financial institutions, providing a uniquely independent and timely measure of credit risk across industries.

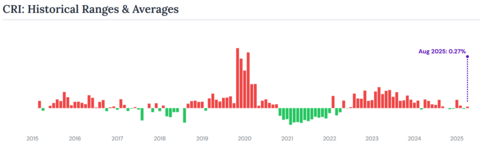

The index captures net credit downgrades versus upgrades, where a positive reading signals rising risk and a negative reading reflects improvement. The August 2025 CRI for U.S. Private Corporates rose 0.3%, marking the third increase in four months after moderate improvement earlier this year. That means downgrades once again exceeded upgrades for exposures held on bank balance sheets—a sign that credit pressures are building after a brief period of relief. Over the past three years, the 3,000 companies in the index have seen 4,053 downgrades versus 2,872 upgrades, with net downgrades recorded in 30 of the past 36 months.

Sector-level data reveal significant divergences: risk in the auto sector surged more than 12% in August and 66% over the past year, driven by strains in auto parts suppliers. Health care has seen a 15% rise in risk since May, while industrial goods, household goods, media, and tech have also deteriorated. By contrast, financial services, insurance, real estate, and utilities have shown resilience and modest improvement.

“The CRI addresses a blind spot in regard to understanding credit risk trends in private markets,” said Michael Crumpler, CEO at Credit Benchmark. “It will help risk professionals better monitor these markets by providing an objective, data-driven risk view based on bank sentiment — not secondary market pricing. The CRI will also help market practitioners detect and get ahead of credit deterioration early, so they can more proactively manage their exposures.”

The CRI offers a trusted, transparent, and independent lens into private market credit risk, enabling use cases from portfolio monitoring to macro stress testing and investment committee reporting. Each monthly release includes a “Quick Take” summary for rapid insights into market stress.

The Credit Risk Index for U.S. Private Corporates will be updated on the first Friday of each month, with the index now available and additional industry aggregates and portfolio-mapped views available for customers.

For full access, visit www.creditbenchmark.com.

Contacts

Media Contacts:

Michael Crumpler, CEO – michael.crumpler@creditbenchmark.com

Christa Ancri, Global Head of Marketing – christa.ancri@creditbenchmark.com

Ryan Hoffman, Analytics Product Manager – ryan.hoffman@creditbenchmark.com