$30K Grant from FHLB Dallas and Texas Capital Supports Small Business Growth

$30K Grant from FHLB Dallas and Texas Capital Supports Small Business Growth

Entrepreneurial Center to Fund In-Depth Technical Assistance with Grant

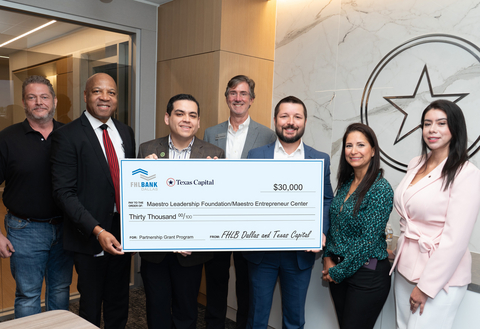

SAN ANTONIO, Texas--(BUSINESS WIRE)--San Antonio, Texas, entrepreneurs are getting a boost from $30,000 in grant funds from the Federal Home Loan Bank of Dallas (FHLB Dallas) and Texas Capital. The banks awarded the Partnership Grant Program (PGP) funds to The Maestro Entrepreneur Center during a ceremonial check presentation today.

The Maestro Entrepreneur Center provides resources and tools to help support small businesses by helping them scale beyond the $1 million threshold.

The center plans to use the PGP funds for its “Accelerate Your Venture” program, which provides in-depth, in-person technical assistance to small business owners. The grant will help pay for instructors, training materials and support staff.

FHLB Dallas’ PGP offers up to a 5:1 match of member contributions—up to $25,000 per FHLB Dallas member—to support community-based organizations involved in affordable housing or economic development activities that complement other FHLB Dallas community investment programs. The program is funded annually, with grants distributed through participating FHLB Dallas members—in this case Texas Capital.

“PGP funds will provide Maestro Center the ability to help local small businesses increase their revenue potential,” said Ricky Maldonado, San Antonio Market President at Texas Capital.

Geremy Landin, executive director of The Maestro Entrepreneur Center, said the grant will fund added capacity.

“It will allow us to deepen our impact and continue empowering small business owners who are the backbone of San Antonio,” he said.

Greg Hettrick, senior vice president and director of Community Investment at FHLB Dallas, emphasized the importance of PGP funding for grassroots organizations.

“We’re proud to collaborate with Texas Capital to deliver PGP funding that helps small nonprofits expand their reach,” Mr. Hettrick said. “These grants are vital for building capacity and sustaining the essential services they provide to our communities.”

About Texas Capital Bancshares, Inc.

Texas Capital Bancshares, Inc. (NASDAQ®: TCBI), a member of the Russell 2000® Index and the S&P MidCap 400®, is the parent company of Texas Capital Bank (“TCB”). Texas Capital is the collective brand name for TCB and its separate, non-bank affiliates and wholly-owned subsidiaries. Texas Capital is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs and individual customers. Founded in 1998, the institution is headquartered in Dallas with offices in Austin, Houston, San Antonio and Fort Worth, and has built a network of clients across the country. With the ability to service clients through their entire lifecycles, Texas Capital has established commercial banking, consumer banking, investment banking and wealth management capabilities. All services are subject to applicable laws, regulations and service terms. Deposit and lending products and services are offered by TCB. For deposit products, member FDIC. For more information, please visit www.texascapital.com.

About the Federal Home Loan Bank of Dallas

The Federal Home Loan Bank of Dallas is one of 11 district banks in the FHLBank System created by Congress in 1932. FHLB Dallas, with total assets of $116.1 billion as of June 30, 2025, is a member-owned cooperative that supports housing and community development by providing competitively priced loans and other credit products to approximately 800 members and associated institutions in Arkansas, Louisiana, Mississippi, New Mexico and Texas. For more information, visit fhlb.com.

Contacts

Corporate Communications

Federal Home Loan Bank of Dallas

fhlb.com, (214) 441-8445