Survey: Majority of Middle-Income Canadians Not Interested in Using AI for Financial Advice

Survey: Majority of Middle-Income Canadians Not Interested in Using AI for Financial Advice

82% prefer working with a human financial professional over an algorithm

MISSISSAUGA, Ontario--(BUSINESS WIRE)--Middle-income Canadians are signaling a strong preference for human financial guidance over artificial intelligence, according to the latest data from Primerica Canada’s Financial Security Monitor™ (FSM™) survey.

Despite the rapid growth of digital tools, the survey found 68% are not interested in using AI tools for personal financial tasks such as budgeting, saving, investing or retirement planning. This reluctance runs deeper than mere preference — it reflects broader trust concerns and apprehension that AI adoption aimed at providing financial guidance could have a negative impact on them.

“Middle-income Canadians are facing increasing financial pressure, and many are saving less as a result,” said John A. Adams, CEO of Primerica Canada. “The fact that most of these households prefer human advice over AI shows just how much they value trusted, personal guidance in challenging times.”

The survey also highlights broader anxiety around the economy, with inflation remaining the top financial concern for Canadians at all income levels. The majority (87%) of middle-income households worry about paying more for everyday essentials, and nearly three-quarters (71%) fear they won’t have enough money to retire when they want to.

At the same time, only 16% of middle-income Canadians are actively engaged in all five core financial preparedness behaviors, which include saving for the future and safeguarding their families through life insurance.

“The results demonstrate that access to trusted financial advice is more important than ever and securing it should be within reach of everyone,” Adams said. “No matter their income level, families can benefit from working with a licensed financial professional. Personalized guidance can help them build long-term financial habits, improve confidence and stay on track toward their goals.”

Key Findings from Primerica Canada’s Financial Security Monitor™ Survey

- Many say their financial situation is getting worse. Nearly half (48%) of middle-income Canadians report their financial situation has declined over the past year.

- Interest in AI tools to help with personal financial tasks remains low even among younger Canadians. Only a little more than a quarter (28%) of middle-income Canadians say they are interested in using AI for financial help. Even among younger adults, a majority express little to no interest in using AI.

- Most worry AI will hurt their careers. Many middle-income Canadians fear AI’s broader economic impact. More than half (54%) believe widespread AI adoption will negatively affect their salaries and job opportunities — a concern especially pronounced among those with lower financial preparedness scores.

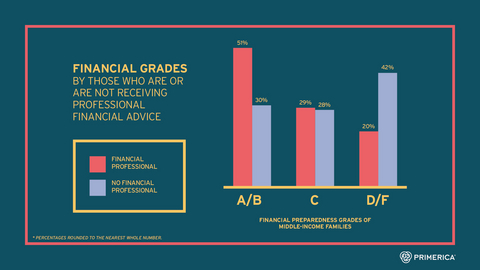

- Professional financial advice pays off. Those who work with a licensed financial professional are significantly more likely to score a “B” or higher on Primerica’s Financial Security Scorecard, highlighting the value of trusted, personalized guidance.

About Primerica Canada’s Financial Security Monitor™ (FSM™) Survey

Since 2020, the Canadian Financial Security Monitor™ survey has polled middle-income households across Canada to gain a clear picture of their financial situation. Using Dynamic Online Sampling, Change Research polled 909 adults nationwide in Canada, from July 10-15, 2025. Post-stratification weights were made on gender, age and province/territory region to reflect the population of these adults based on the 2016 Canadian Census. Polling was done in both English and French. The margin of error is +/-3.4 percentage points.

About Primerica Canada

Primerica Canada, headquartered in Mississauga, Ontario and a business unit of Primerica, Inc., is a leading provider of financial products and services to middle-income households in Canada. Independent licensed representatives, located in every province, provide financial education and products such as term life insurance, mutual funds and annuities to Primerica clients to better prepare them for a more secure financial future. We conduct our core business activities in Canada through two principal entities: Primerica Life Insurance Company of Canada and PFSL Investments Canada Ltd. From coast to coast, Canadian families have more than $151 billion of life insurance coverage through Primerica Canada, and we administered more than $23 billion in Canadian assets as of December 31, 2024.

About Primerica, Inc.

Primerica, Inc., headquartered in Duluth, GA, is a leading provider of financial products and services to middle-income households in North America. Independent licensed representatives educate Primerica clients about how to better prepare for a more secure financial future by assessing their needs and providing appropriate solutions through term life insurance, which we underwrite, and mutual funds, annuities and other financial products, which we distribute primarily on behalf of third parties. We insured over 5.5 million lives and had approximately 3.0 million client investment accounts on December 31, 2024. Primerica, through its insurance company subsidiaries, was the #3 issuer of Term Life insurance coverage in the United States and Canada in 2024. Primerica stock is included in the S&P MidCap 400 and the Russell 1000 stock indices and is traded on The New York Stock Exchange under the symbol “PRI”. For more information, visit www.primerica.com.

Contacts

Media Contact:

Gana Ahn

678-431-9266

Email: Gana.Ahn@primerica.com

Investor Contact:

Nicole Russell

470-564-6663

Email: Nicole.Russell@primerica.com