Wi-Fi HaLow Market Shows Promise With Steady Growth Projected Through 2029

Wi-Fi HaLow Market Shows Promise With Steady Growth Projected Through 2029

LONDON--(BUSINESS WIRE)--The Wi-Fi HaLow (802.11ah) market is expected to grow steadily over the next five years, at a compound annual growth rate (CAGR) of 79%, according to Omdia’s new report released month: “Wi-Fi HaLow (802.11ah) Market Assessment”.

"If HaLow can establish a market beachhead in video, the infrastructure can then be leveraged for non-video IoT applications such as sensors, actuators, lighting, and more," said Andrew Brown, Practice Lead for IoT at Omdia.

Share

Bridging the IoT Connectivity Gap

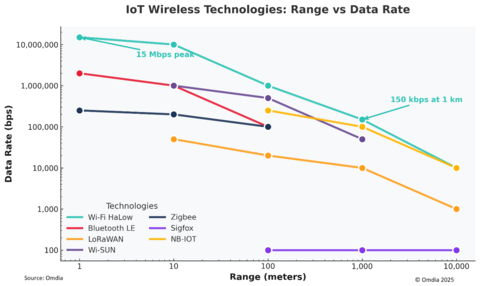

Wi-Fi HaLow addresses a market gap in wireless connectivity by offering middle ground between traditional Wi-Fi and low-power alternatives. For applications requiring more bandwidth than LoRaWAN but greater range and power efficiency than conventional Wi-Fi, HaLow presents an ideal solution.

"If HaLow can establish a market beachhead in video, the infrastructure can then be leveraged for non-video IoT applications such as sensors, actuators, lighting, and more," said Andrew Brown, Practice Lead for IoT at Omdia. "While HaLow may not have a marked advantage in these applications, the presence of existing infrastructure will make it more attractive than deploying another wireless technology."

Market Outlook and Growth Sectors

The industrial sector is expected to drive initial adoption, particularly for video-intensive applications like security, surveillance, and automation. As infrastructure expands, HaLow is projected to gain traction in smart home security cameras and doorbells starting in 2026, followed by smart city applications and consumer drones in 2027.

"HaLow has a distinct advantage over other low power wireless technologies in the transmission of high-resolution video," added Brown. "Among other common low power standards, only LTE-M is capable of video transmission, and even then, it is limited to mid-resolution due to its lower bandwidth."

Despite facing challenges from established technologies and a currently limited ecosystem, HaLow's technical advantages and growing vendor support indicate potential for growth.

About Omdia

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

Contacts

Fasiha Khan: fasiha.khan@omdia.com