Smartphones Now Shipping With Fewer Cameras, Omdia Reports

Smartphones Now Shipping With Fewer Cameras, Omdia Reports

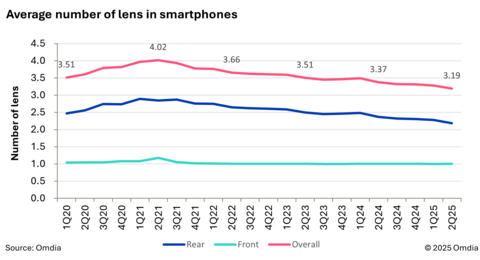

LONDON--(BUSINESS WIRE)--The number of camera lenses embedded in smartphones is on the decline according to Omdia’s Smartphone Model Market Tracker 2Q25 report. Globally, smartphones shipped in the second quarter of 2025 featured an average of 3.19 camera lenses, down from 3.37 in the same period last year. This figure includes both rear and front cameras, as most smartphones still use a single front-facing lens, the reduction is being driven largely by fewer rear cameras.

“The reduction in camera lenses not only lowers costs but also frees up space for larger batteries,” said Jusy Hong, Senior Research Manager at Omdia.

Share

In 2Q25, smartphones shipped with an average of 2.18 rear cameras, compared to 2.37 a year earlier, marking a consistent downward trend since 2021. After peaking at 2.89 in 1Q21, the average has now fallen for 13 consecutive quarters.

By share of shipments, smartphones equipped with dual rear cameras accounted for 41% in 2Q25, followed by triple-cameras at 36%. Single-camera models grew to 21% of shipments, boosted by launches such as Apple’s iPhone 16e and Samsung’s Galaxy S25 Edge.

While the number of cameras decline, resolution is on the rise. Once a key marketing metric, camera count is now giving way to higher resolution as the new priority. In 2Q25, 50MP-class cameras represented 58% of total shipments, while sensors above 100MP accounted for 9%. Conversely, the share of cameras with resolutions below 15MP dropped to 12%, a sharp decline from 54% five years ago.

“The reduction in camera lenses not only lowers costs but also frees up space for larger batteries,” said Jusy Hong, Senior Research Manager at Omdia. “With advances in AI-driven photography, the number of lenses will continue to decline.”

This shift is also expected to impact component demand. Reflecting the falling lens count, Omdia forecasts global demand for smartphone CIS (CMOS Image Sensors) to drop 4.3% year on year in 2025, reaching 4.19 billion units.

About Omdia

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

Contacts

Fasiha Khan: fasiha.khan@omdia.com