Primerica Household Budget Index™: Purchasing Power for Middle-Income Households Improves Slightly as Gas Prices and Auto Insurance Costs Decline

Primerica Household Budget Index™: Purchasing Power for Middle-Income Households Improves Slightly as Gas Prices and Auto Insurance Costs Decline

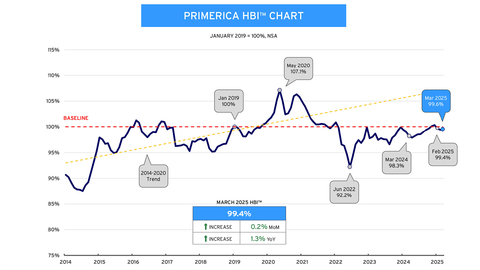

The latest Primerica Household Budget Index™ (HBI™), a monthly economic snapshot measuring the impact of inflation on middle-income households alongside their earned income, found the average purchasing power for necessities rose to 99.6% in March, a 0.2% increase from a month ago and up 1.3% from a year ago. Purchasing power improved slightly in March as gas prices and auto insurance costs fell. However, rising food, utilities and healthcare costs offset against the falling gas and car insurance costs.

DULUTH, Ga.--(BUSINESS WIRE)--The latest Primerica Household Budget Index™ (HBI™), a monthly economic snapshot measuring the impact of inflation on middle-income households alongside their earned income, found the average purchasing power for necessities rose to 99.6% in March, a 0.2% increase from a month ago and up 1.3% from a year ago.

Purchasing power improved slightly in March as gas prices and auto insurance costs fell. Gas prices declined 0.9% and auto insurance costs fell 0.6% in March. However, rising food, utilities and healthcare costs offset against the falling gas and car insurance costs. Food prices rose 0.3% for the month and 3.4% for the year.

The Consumer Price Index (CPI) that measures inflation for a comprehensive basket of goods for all U.S. households came in at 2.4% in March. Adjusting the CPI to narrow the impact of inflation to focus specifically on middle-income households increases its impact to an estimated 3.0% year-over-year. Further narrowing the CPI to assess the impact of inflation on the cost of middle-income household necessity items used in the HBI™ (food, utilities, gas, auto insurance, and health care), the estimated adjusted CPI measure shows an increase of 2.9% year-over-year.

For more information on the Primerica Household Budget Index™, visit www.householdbudgetindex.com.

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant Amy Crews Cutts, PhD, CBE®. The index measures the purchasing power of middle-income families with household incomes from $30,000 to $130,000 and is developed using data from the U.S. Bureau of Labor Statistics, the U.S. Bureau of the Census, and the Federal Reserve Bank of Kansas City. The index looks at the cost of necessities including food, gas, auto insurance, utilities, and health care and earned income to track differences in inflation and wage growth.

The HBI™ uses January 2019 as its baseline, with the value set to 100% at that point in time.

Periodically, prior HBI™ values may be modified due to revisions in the CPI series and Consumer Expenditure Survey releases by the U.S. Bureau of Labor Statistics (BLS). Beginning with the December 2024 release of the index, the expenditure weights have been updated to the most recent (Q1 2024) data and auto insurance has been added to the group of necessity items. For more information, visit householdbudgetindex.com.

About Primerica, Inc.

Primerica, Inc., headquartered in Duluth, GA, is a leading provider of financial products and services to middle-income households in North America. Independent licensed representatives educate Primerica clients about how to better prepare for a more secure financial future by assessing their needs and providing appropriate solutions through term life insurance, which we underwrite, and mutual funds, annuities and other financial products, which we distribute primarily on behalf of third parties. We insured over 5.5 million lives and had approximately 3.0 million client investment accounts on December 31, 2024. Primerica, through its insurance company subsidiaries, was the #3 issuer of Term Life insurance coverage in the United States and Canada in 2024. Primerica stock is included in the S&P MidCap 400 and the Russell 1000 stock indices and is traded on The New York Stock Exchange under the symbol “PRI”. For more information, visit www.primerica.com.

Contacts

Media Contact:

Gana Ahn

678-431-9266

Email: Gana.Ahn@primerica.com

Investor Contact:

Nicole Russell

470-564-6663

Email: Nicole.Russell@primerica.com