Slowing Construction and Rising Capital Flows Set Stage for Life Sciences Market Rebound

Slowing Construction and Rising Capital Flows Set Stage for Life Sciences Market Rebound

Cushman & Wakefield releases its 2025 Life Sciences Update

CHICAGO--(BUSINESS WIRE)--The life sciences real estate market is undergoing significant changes as supply outpaces demand, influencing rental growth, vacancy rates, and investment trends.

The overall vacancy rate across major life sciences markets reached 20.5% in Q4 2024, up 250 basis points from Q2 2024. The total U.S. market saw negative net absorption for the second consecutive year, though key markets like Boston, Chicago, and Los Angeles-Orange County posted positive absorption in 2024.

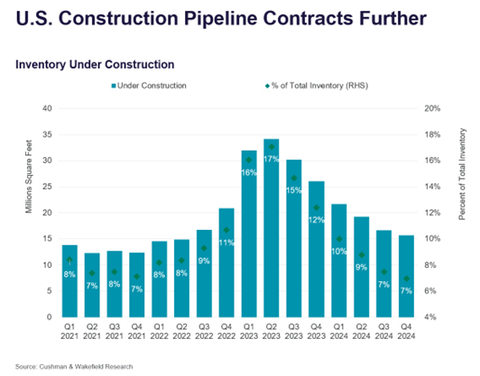

The U.S. life sciences construction pipeline has contracted significantly, with just 2 million square feet (msf) expected to be delivered beyond 2025, down from 16 msf currently under construction. At present, supply continues to exceed demand, leading to softer asking rent growth and higher vacancy rates across key markets. However, a slowdown in new construction is expected to restore balance between supply and demand.

“Despite short-term challenges, the sector is adjusting to market conditions as construction pipelines slow and capital investment gains momentum,” said Sandy Romero, Research Manager. “Occupiers seeking to expand or relocate in 2025 will benefit from an increased number of leasing options.”

Asking rent growth has softened, averaging 3% year-over-year (YOY) but remains 22% higher than in 2022. Some markets posted strong YOY rent growth, including Denver (+26%), Los Angeles-Orange County (+18%), and Chicago (+13%). Others, such as New York City (-14%) and Boston (-11%), saw declines.

U.S. Capital Markets

Sales volume is rising in 2025 as the broader commercial real estate market recovers. Capitalization (cap) rates remain elevated as investors weigh income potential and debt costs, while total returns have been negative for three consecutive years, mirroring broader property sector trends.

“While the market faces near-term challenges, long-term fundamentals remain strong. The demand for cutting-edge lab and research space, combined with strategic investment shifts, will continue to shape the life sciences real estate landscape through 2025 and beyond,” said Romero.

The full report can be downloaded here.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2024, the firm reported revenue of $9.4 billion across its core service lines of Services, Leasing, Capital markets, and Valuation and other. Built around the belief that Better never settles, the firm receives numerous industry and business accolades for its award-winning culture. For additional information, visit www.cushmanwakefield.com.

Contacts

Mike Boonshoft

michael.boonshoft@cushwake.com