Same Day ACH Passes Major Milestone in 2024 as the ACH Network Shows Higher Growth

Same Day ACH Passes Major Milestone in 2024 as the ACH Network Shows Higher Growth

RESTON, Va.--(BUSINESS WIRE)--Led by phenomenal growth in Same Day ACH, Nacha reported across-the-board gains in ACH payments volume and value in 2024.

Same Day ACH payment volume topped the 1 billion mark, with more than 1.2 billion payments for the year. The value of those payments was $3.2 trillion. From 2023 to 2024, Same Day ACH volume soared 45.3%, more than double the growth rate from 2022 to 2023.

“This rapid acceptance and adoption of Same Day ACH is truly heartening,” said Jane Larimer, Nacha President and CEO. “ACH payments remain at the core of the U.S. payments system and an essential payment method for consumers, businesses and other organizations.”

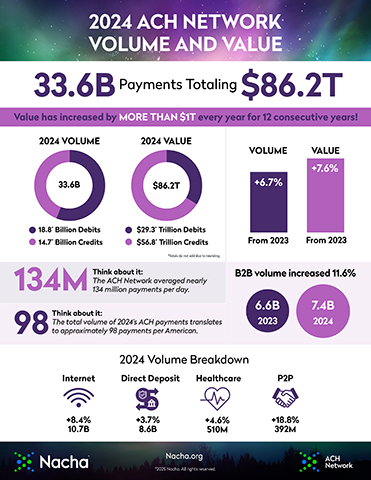

Overall, ACH Network payment volume rose 6.7% from 2023 to 2024, to 33.6 billion payments in 2024. The value of those payments was $86.2 trillion, an increase of 7.6%.

Business-to-business payments continued growing rapidly in 2024. The 7.3 billion B2B payments represent an 11.6% increase from a year earlier.

“The growth in B2B that really began accelerating during the pandemic shows no signs of abating,” said Larimer. “It’s no wonder that checks continue to lose favor, given the many problems they present, particularly safety issues. Businesses know the modern ACH Network is the logical choice for safe, smart payments.”

Today Nacha also released ACH Network results for the fourth quarter of 2024. There were 8.7 billion ACH payments valued at $22.5 trillion, respective increases of 7.4% and 9.5% over the final quarter of 2023.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. There were 33.6 billion ACH Network payments made in 2024, valued at $86.2 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

Contacts

Dan Roth

Nacha

571-579-0720

media@nacha.org