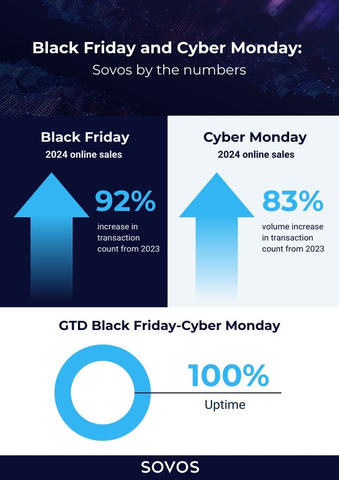

Sovos’ Global Tax Determination Processes Taxes on Nearly 300 Million Transactions Over Black Friday and Cyber Monday, Achieves 92% Growth and 100% Uptime

Sovos’ Global Tax Determination Processes Taxes on Nearly 300 Million Transactions Over Black Friday and Cyber Monday, Achieves 92% Growth and 100% Uptime

ATLANTA--(BUSINESS WIRE)--Sovos, the always-on compliance company, today announced record-breaking performance during this year’s Black Friday and Cyber Monday shopping events. The company processed taxes on nearly 300 million items on these two days alone – of the 16+ Billion processed annually – showcasing the scalability and reliability of its global tax determination engine. On Black Friday, Sovos experienced a 92% increase in transaction count and Cyber Monday experienced a similar trend with a transaction volume increase of 83% compared to 2023. Despite these unprecedented volumes, Sovos maintained 100% uptime, ensuring uninterrupted service for its customers.

“These two days represent the pinnacle of the shopping year for our retail customers. Here, even the slightest glitch or delay in processing transactions can prove costly,” said Kevin Akeroyd, CEO, Sovos. “Our ability to scale seamlessly and support record-breaking demand reflects the unmatched reliability of our platform. Sovos ensures businesses can operate confidently, even during the year’s most critical moments.”

According to data from Adobe Analytics, shoppers spent a record $10.8 billion online on Friday, over 10% more than they did last Black Friday. Cyber Monday also saw record-setting performances according to Adobe, which expects consumers to spend a record $13.2 billion on Monday, 6.1% more than last year. That would make it the season’s – and the year’s – biggest shopping day for e-commerce.

These trends not only highlight the continued growth of eCommerce but also signal positive economic momentum as businesses prepare for 2025. To meet this increasing demand for eCommerce processing, Sovos continues to prioritize investments in its platform and products to ensure seamless performance and availability during these peak spending periods.

“To handle this explosive growth, Sovos has prioritized investments in cutting-edge technology that delivers accurate, real-time tax calculations for every transaction,” added Akeroyd. “This level of precision is crucial for preventing abandoned carts and maximizing customer satisfaction.”

Sovos is helping to transform how the retail industry interacts with its customers by providing increased speed and efficiency for every transaction. As retail sales tax complexities and nuances often require quick system responses to rate changes, sales tax holidays and more, Sovos automates this entire process ensuring the proper rates are charged for every transaction. This helps to protect the customer relationship and the company’s bottom line.

About Sovos

Sovos is transforming tax compliance from a business requirement to a force for growth. Our flagship product, the Sovos Compliance Cloud platform, enables businesses to identify, determine, and report on every tax obligation across the globe. Sovos processes 16 billion+ transactions per year, helping companies scale their compliance strategy in almost 200 countries.

More than 100,000 customers – including half the Fortune 500 – trust Sovos’ tax and regulatory expertise and unparalleled integration with their business applications. Learn more at sovos.com.

Contacts

Media:

Ed Kraft

SourceCode Communications for Sovos

sovos@sourcecodecomms.com