Vault Expands Payment Capabilities by Launching Interac e-Transfers, Continuing to Build Canada’s Most Comprehensive Business Banking Platform

Vault Expands Payment Capabilities by Launching Interac e-Transfers, Continuing to Build Canada’s Most Comprehensive Business Banking Platform

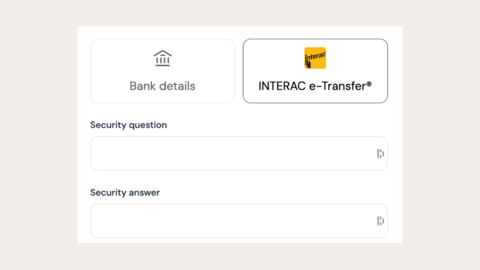

TORONTO--(BUSINESS WIRE)--Vault, the leading digital financial platform for Canadian businesses, today announced the launch of Interac e-Transfer payments, a heavily-requested feature that will significantly expand the platform’s payment capabilities. This feature will allow Vault customers to send payments via Interac through the Vault platform.

While Vault has allowed users to fund their accounts via Interac for the last year, this new product launch allows Canadian businesses to have further flexibility on how they wish to send payments - which is a first.

“While many businesses rely on wire and local transfers, we have learned that many of our customers and specifically small business owners prefer to use Interac when making payments, and we're excited to provide the option to our customers,” said Ahmed Shafik, Co-founder at Vault. “We love listening to and building for our customers because they know better than anyone else how we can improve the lives of our fellow Canadian business owners.”

The new Interac e-Transfer payment option complements Vault's existing payment methods, including local transfers through their existing multi-currency accounts (e.g., EFT, ACH, SEPA) and international wire transfers. This expansion provides businesses with more choices in how they send payments, reducing friction in financial operations and the need for juggling multiple platforms.

Key benefits of the new Interac e-Transfer feature include:

- Instant payments

- Additional flexibility in how you want to pay your vendors

- No e-Transfer fees unlike the banks

- Seamless integration with Vault’s existing financial workflows

- Scheduled or recurring e-Transfer payments to simplify contractor payments

Vault continues to innovate in the digital banking space, offering Canadian businesses a comprehensive platform that simplifies financial management, reduces banking costs, and provides powerful tools for growth.

The Interac e-Transfer payment feature is now available to all Vault business account holders. You can learn more on the Vault site.

About Vault: Vault is transforming the financial landscape for Canadian businesses by providing them with a digital banking platform to manage their finances and save on high banking fees. By offering a range of financial products such as multi-currency accounts, global bank transfers, automated accounting, and corporate cards, Vault enables business owners to manage their entire financial operations on a single platform.

Contacts

Media Inquiries: media@tryvault.com