Same Day ACH Volume Rose 67.5% in the Third Quarter of 2024

Same Day ACH Volume Rose 67.5% in the Third Quarter of 2024

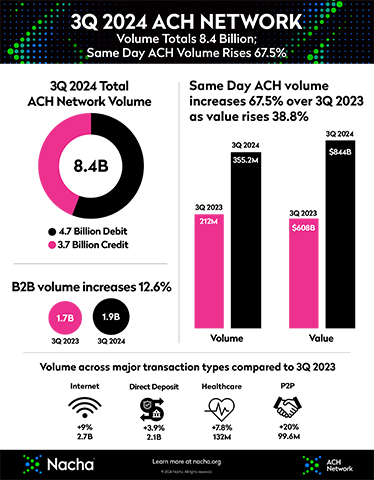

RESTON, Va.--(BUSINESS WIRE)--Same Day ACH volume soared 67.5% in the third quarter of 2024, and total ACH Network payment volume rose 7.4% from a year earlier, new figures from Nacha showed.

There were 355.2 million Same Day ACH payments in the third quarter; the value of those payments rose 38.8% to $844 billion.

“These results are continued proof of the robust adoption of Same Day ACH. Since its debut, Same Day ACH has handled nearly 4 billion payments valued at $8 trillion,” said Jane Larimer, Nacha President and CEO.

Larimer noted that Nacha is currently seeking comments on a proposal to expand the operating hours of Same Day ACH to align with the close of the business day in the Pacific time zone. This would provide an estimated additional 3 1/4 hours each day for users to submit same-day payments.

“Nacha has already made several enhancements to Same Day ACH, including higher dollar limits, expanded hours, and accelerated funds availability. We will continue working to ensure that Same Day ACH helps meet the needs of the payments community,” said Larimer.

Volume across all major ACH Network payment categories climbed in the third quarter of this year. Those include business-to-business (B2B) and healthcare claim payments, which increased 12.6% and 7.8% respectively from the third quarter of 2023. Consumer internet-initiated payment volume increased 9% to 2.7 billion.

Total third quarter ACH Network volume was 8.4 billion payments valued at $21.5 trillion, respective increases of 7.4% and 8.9% over a year earlier.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. There were 31.5 billion ACH Network payments made in 2023, valued at $80.1 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

Contacts

Dan Roth

Nacha

571-579-0720

media@nacha.org