Same Day ACH Reaches New Heights as ACH Network Volume Increases

Same Day ACH Reaches New Heights as ACH Network Volume Increases

HERNDON, Va.--(BUSINESS WIRE)--Same Day ACH reached new heights of payment volume and value as the modern ACH Network posted significant volume and value increases in the second quarter of 2024, Nacha reported.

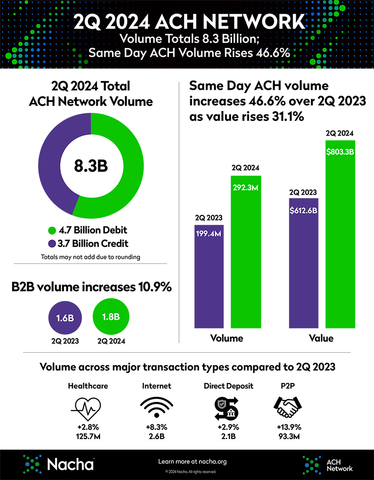

There were 8.3 billion ACH payments in the second quarter, an increase of 6.3% over the same time period in 2023. The dollar value of these ACH payments totaled $21.6 trillion, a 7% increase.

Same Day ACH exceeded 100 million payments in a month for the first time in April 2024, with 107.8 million. April also had the highest monthly value ever of Same Day ACH payments ($293 billion) and the highest average daily volume (4.9 million).

In the second quarter of this year there were a total of 292.3 million Same Day ACH payments, up 46.6% from a year earlier. Same Day ACH payment values rose 31.1% to $803.3 billion for the second quarter.

“We cannot overstate the impact Same Day ACH is having to help meet America’s faster payment needs,” said Jane Larimer, Nacha President and CEO. “The proof is in the numbers that clearly show that Same Day ACH continues to gain acceptance among users of the payments system.”

Growth in ACH business-to-business (B2B) payments also continued, with 1.8 billion payments in the second quarter, an increase of 10.9% from 2023.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. There were 31.5 billion ACH Network payments made in 2023, valued at $80.1 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

Contacts

Dan Roth

Nacha

571-579-0720

media@nacha.org