Same Day ACH and B2B Propel ACH Network Growth in the First Quarter

Same Day ACH and B2B Propel ACH Network Growth in the First Quarter

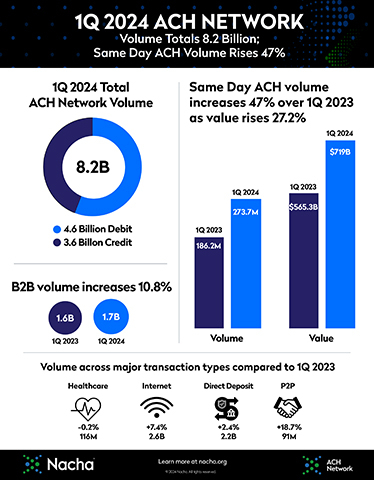

HERNDON, Va.--(BUSINESS WIRE)--A 47% increase in Same Day ACH volume helped lead the way as the ACH Network began 2024 by handling 8.2 billion payments in the first quarter.

There were 273.7 million Same Day ACH payments in the first quarter. The value of those payments was $719 billion, up 27.2% from a year earlier. Same Day ACH volume in March 2024 was 95.6 million, averaging more than 4.5 million payments per day, both all-time monthly highs since Same Day ACH launched.

“As strong adoption of Same Day ACH continues, Nacha will work with stakeholders across the payments community to keep this faster payment method moving forward,” said Jane Larimer, Nacha President and CEO.

Business-to-business (B2B) payment growth remained strong, with 1.7 billion payments in the first quarter, a 10.8% increase.

Consumer internet-initiated debits increased 7.4% from a year earlier, with 2.6 billion payments. Their value was $1.5 trillion, up more than 5%. These debits accounted for 56.6% of all ACH debits in the first quarter.

Total first quarter ACH Network volume was 8.2 billion payments valued at $20.7 trillion, respective gains of 5.6% and 5%.

“As Nacha marks its 50th anniversary in 2024, these numbers show the ACH Network is a vital part of the payments landscape, and one with a bright future indeed,” said Larimer.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. There were 31.5 billion ACH Network payments made in 2023, valued at $80.1 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

Contacts

Dan Roth

Nacha

571-579-0720

media@nacha.org