Nacha Unveils Top 50 ACH Originating and Receiving Financial Institutions for 2023

Nacha Unveils Top 50 ACH Originating and Receiving Financial Institutions for 2023

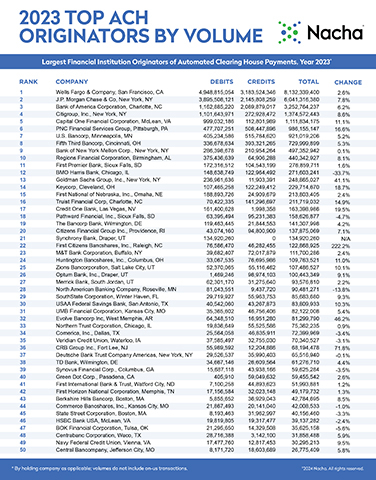

HERNDON, Va.--(BUSINESS WIRE)--Nacha’s Top 50 ranking of financial institution originators and receivers of ACH payments for 2023 was released today.

The Top 50 originating institutions had total ACH Network volume of nearly 27.7 billion payments last year, an increase of 5.7% over 2022. They accounted for 93.1% of the ACH Network’s total commercial payments volume.

For the Top 50 receiving institutions of 2023, ACH Network volume totaled almost 20 billion payments, up 6.4% from 2022. They accounted for 63.3% of total ACH Network volume, which includes payments received from the federal government.

“From Direct Deposit, bill payments and account transfers to business-to-business payments and more, American consumer and businesses depend on the ACH Network and the financial institutions that send and receive payments on their behalf,” said Michael Herd, Nacha Executive Vice President, ACH Network Administration.

Additionally, Nacha reported 6.1 billion “off-Network” ACH payments last year. These are primarily “on-us” ACH payments for which the originating and receiving financial institution are the same, and therefore not submitted to an ACH Operator. Including these off-Network payments, total ACH payment volume for 2023 was 37.5 billion, up 6.3% over 2022.

The complete Top 50 lists are available on Nacha’s website.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. There were 31.5 billion ACH Network payments made in 2023, valued at $80.1 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

Contacts

Dan Roth

Nacha

571-579-0720

media@nacha.org