ACH Network Records Strong Growth in 2023 as Same Day ACH Surpasses 3 Billion Payments Since Inception

ACH Network Records Strong Growth in 2023 as Same Day ACH Surpasses 3 Billion Payments Since Inception

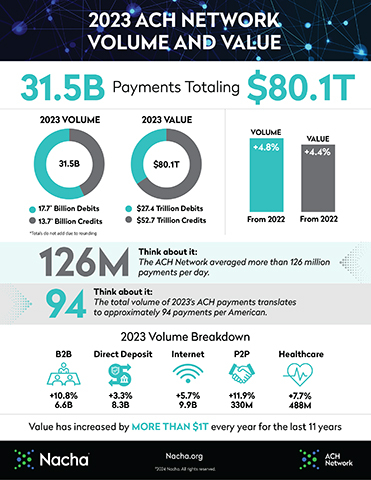

HERNDON, Va.--(BUSINESS WIRE)--Led by strong growth in Same Day ACH and business-to-business (B2B) payments, the ACH Network securely handled 31.5 billion payments valued at $80.1 trillion in 2023. Payment volume for the year was up 4.8% from 2022 while payment value grew 4.4%. 2023 marked the 11th consecutive year in which ACH Network value has increased by more than $1 trillion.

Same Day ACH volume increased 22.3% and 41.2% in value, to 853.4 million payments worth $2.4 trillion. Since its inception in September 2016, Same Day ACH volume has surpassed 3 billion payments and $6 trillion.

“The results speak loud and clear: Payments system users are embracing Same Day ACH,” said Jane Larimer, Nacha President and CEO. “Same Day ACH is helping meet the nation’s faster payments needs, with uses from payroll to insurance claims, account transfers and more, a $1 million per payment limit and three daily settlements.”

B2B payments continued to grow in 2023, with 6.6 billion payments, a 10.8% increase, as businesses continue to use fewer checks. Healthcare claim payments to medical and dental providers rose 7.7% to 488 million.

Consumer internet-initiated payments rose 5.7% to 9.9 billion, primarily supporting bill payment and account transfer use cases. Direct Deposit volume increased 3.3% over 2022, with 8.3 billion payments to consumers.

Nacha also released ACH Network results for the fourth quarter of 2023, in which 8.1 billion ACH payments were made with a total value of $20.5 trillion, increases of 5.8% and 5.6% respectively over the same period in 2022. There were 255.8 million Same Day ACH payments, up 41%, while the value of those payments was $662 billion, up 31.5%.

“I often say that the modern ACH Network is thriving; the 2023 figures reinforce that,” said Larimer. “In 2024, the ACH Network’s focus will include ways to continue growing Same Day ACH. We look forward to a bright future in which the ACH Network continues to be the backbone of the nation’s electronic payment system.”

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. There were 31.5 billion ACH Network payments made in 2023, valued at $80.1 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

Contacts

Dan Roth

Nacha

571-579-0720

media@nacha.org