Ryder Reports Third Quarter 2023 Results

Ryder Reports Third Quarter 2023 Results

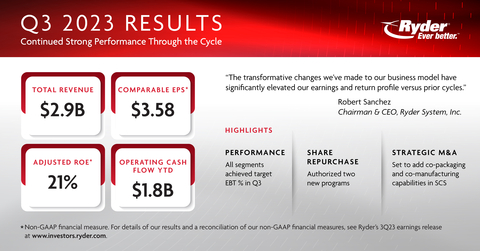

Continues to Deliver Strong Returns in Weak Freight Environment; Raises Full-Year Guidance

Third-Quarter 2023 Highlights

- GAAP EPS from continuing operations of $3.44 compared to $4.82 in prior year

- Comparable EPS (non-GAAP) from continuing operations of $3.58, as compared to a record $4.45 in prior year, reflecting weaker market conditions in used vehicle sales and rental, partially offset by strong Supply Chain Solutions (SCS) results

- Total revenue of $2.9 billion compared to $3.0 billion in prior year

- Operating revenue (non-GAAP) of $2.4 billion, up 1%, reflecting contractual revenue growth across all segments, partially offset by lower commercial rental revenue in Fleet Management Solutions (FMS)

Full-Year 2023 Forecast

- Increasing comparable EPS (non-GAAP) forecast to $12.60 - $12.85 from prior forecast of $12.20 - $12.70

- Increasing adjusted ROE (ROE) forecast to 18% - 19% from 17% - 19%

- Reaffirming operating revenue (non-GAAP) growth forecast of 2%

- Reaffirming net cash provided by operating activities from continuing operations forecast of $2.5 billion and free cash flow (non-GAAP) forecast of ~$100 million

MIAMI--(BUSINESS WIRE)--Ryder System, Inc. (NYSE: R), a leader in supply chain, dedicated transportation, and fleet management solutions, reported results for the three months ended September 30 as follows:

(In millions, except EPS) |

|

Earnings

|

|

Earnings |

|

Diluted

|

|||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|||

Continuing operations (GAAP) |

|

$ |

213 |

|

334 |

|

$ |

160 |

|

247 |

|

$ |

3.44 |

|

4.82 |

Comparable (non-GAAP) |

|

$ |

227 |

|

309 |

|

$ |

165 |

|

227 |

|

$ |

3.58 |

|

4.45 |

Total and operating revenue for the three months ended September 30 were as follows:

(In millions) |

|

Total Revenue |

|

Operating Revenue

|

||||||||||

|

|

2023 |

|

2022 |

|

Change |

|

2023 |

|

2022 |

|

Change |

||

Total |

|

$ |

2,924 |

|

3,035 |

|

(4)% |

|

$ |

2,379 |

|

2,347 |

|

1% |

Fleet Management Solutions (FMS) |

|

$ |

1,487 |

|

1,582 |

|

(6)% |

|

$ |

1,266 |

|

1,303 |

|

(3)% |

Supply Chain Solutions (SCS) |

|

$ |

1,194 |

|

1,206 |

|

(1)% |

|

$ |

909 |

|

835 |

|

9% |

Dedicated Transportation Solutions (DTS) |

|

$ |

448 |

|

455 |

|

(1)% |

|

$ |

325 |

|

317 |

|

3% |

CEO Comment

"Our strong third quarter performance and increased 2023 guidance demonstrate the ongoing effectiveness of our balanced growth strategy despite a challenging freight environment,” says Ryder Chairman and CEO Robert Sanchez. “ROE of 21% remained above our high-teens target and all three business segments achieved their pre-tax earnings targets during the quarter.

"The transformative changes we’ve made to de-risk the business model, enhance returns, and drive profitable growth are contributing to our significant outperformance versus prior cycles and are providing us with additional opportunities to increase shareholder value. Our recently announced agreement to acquire Impact Fulfillment Services supports our strategy to accelerate growth in our supply chain business. The transaction is set to add contract packaging and manufacturing capabilities that complement our existing suite of port-to-door logistics services, allowing us to expand with existing customers while adding new brands to our extensive customer base.

"Our enhanced asset management playbook is also leading to improved returns over the cycle. We reduced our tractor rental fleet by 18% year over year to align with lower market demand by redeploying vehicles into longer-term lease, dedicated, and supply chain applications. In addition, our expanded retail sales capacity has allowed us to sell a higher number of used vehicles through the retail channel and maximize proceeds.

"The stronger earnings profile of the business and our disciplined capital allocation provide ample capacity for organic growth, strategic acquisitions, and returning capital to shareholders through share repurchases and dividends. Our board recently authorized new discretionary and anti-dilutive share repurchase programs, as well as payment of our 189th consecutive quarterly dividend, demonstrating that returning capital to shareholders continues to be a key priority for us.

"We remain confident that our transformed business model is set to deliver a stronger, more resilient return profile while remaining well positioned to benefit from a cycle upturn."

Third Quarter 2023 Segment Review

Fleet Management Solutions: Strong Earnings Despite Weaker Used Vehicle Sales and Rental Market Conditions

(In millions) |

|

3Q23 |

|

3Q22 |

|

Change |

|

Total Revenue |

|

$ |

1,487 |

|

1,582 |

|

(6)% |

Operating Revenue (1) |

|

$ |

1,266 |

|

1,303 |

|

(3)% |

|

|

|

|

|

|

|

|

Earnings Before Tax (EBT) |

|

$ |

169 |

|

266 |

|

(36)% |

EBT as a % of total revenue |

|

11.4% |

|

16.8% |

|

(540) bps |

|

EBT as a % of operating revenue (1) |

|

13.4% |

|

20.4% |

|

(700) bps |

|

|

|

|

|

|

|

|

|

Trailing 12-months EBT as % of total and operating revenue |

|

3Q23 |

|

3Q22 |

|

Change |

|

EBT as a % of total revenue |

|

13.0% |

|

17.0% |

|

(400) bps |

|

EBT as a % of operating revenue (1) |

|

15.4% |

|

20.4% |

|

(500) bps |

|

|

|

|

|

|

|

|

|

(1) Non-GAAP financial measure excluding fuel service revenue. |

|||||||

-

FMS total revenue and operating revenue decreased 6% and 3%, respectively

- Total revenue reflects lower fuel revenue passed through to customers and lower operating revenue

- Operating revenue reflects lower rental demand and 2% negative impact from UK exit, partially offset by higher ChoiceLease and SelectCare revenue

-

FMS EBT decreased to $169 million

- Reflects lower used vehicle sales and rental results

- Lower used vehicle gains due to a 30% and 31% decrease in used truck and tractor pricing, respectively, partially offset by higher volumes; sequentially from second quarter of 2023, used truck and tractor pricing decreased 6% and 8%, respectively

- Rental power-fleet utilization was 75%, down from a record level of 83% in prior year on a 7% smaller average power fleet

- FMS EBT as a percentage of FMS operating revenue is at the high end of the company's long-term target of low double digits for the third quarter and above the target for the trailing 12-month period

Supply Chain Solutions: Higher Earnings Primarily Reflect Operating Revenue Growth

(In millions) |

|

3Q23 |

|

3Q22 |

|

Change |

|

Total Revenue |

|

$ |

1,194 |

|

1,206 |

|

(1)% |

Operating Revenue (1) |

|

$ |

909 |

|

835 |

|

9% |

|

|

|

|

|

|

|

|

Earnings Before Tax (EBT) |

|

$ |

81 |

|

71 |

|

14% |

EBT as a % of total revenue |

|

6.8% |

|

5.9% |

|

90 bps |

|

EBT as a % of operating revenue (1) |

|

9.0% |

|

8.6% |

|

40 bps |

|

|

|

|

|

|

|

|

|

Trailing 12-month EBT as % of total and operating revenue |

|

3Q23 |

|

3Q22 |

|

Change |

|

EBT as a % of total revenue |

|

4.5% |

|

4.6% |

|

(10) bps |

|

EBT as a % of operating revenue (1) |

|

6.1% |

|

6.7% |

|

(60) bps |

|

|

|

|

|

|

|

|

|

(1) Non-GAAP financial measure excluding fuel and subcontracted transportation. |

|||||||

-

SCS total revenue decreased 1% and operating revenue grew 9%

- Decrease in total revenue primarily reflects lower subcontracted transportation passed through to customers, partially offset by higher operating revenue

- Increase in operating revenue primarily driven by new business and increased pricing

-

SCS EBT grew 14%

- Increase primarily due to higher operating revenue and lower incentive-based compensation costs, partially offset by lower volumes in the omnichannel retail vertical

- SCS EBT as a percentage of SCS operating revenue is within the company's long-term target of high single digits for the third quarter but below target for the trailing 12-month period

Dedicated Transportation Solutions: Strong Earnings Results Despite Weak Freight Environment

(In millions) |

|

3Q23 |

|

3Q22 |

|

Change |

|

Total Revenue |

|

$ |

448 |

|

455 |

|

(1)% |

Operating Revenue (1) |

|

$ |

325 |

|

317 |

|

3% |

|

|

|

|

|

|

|

|

Earnings Before Tax (EBT) |

|

$ |

28 |

|

28 |

|

(2)% |

EBT as a % of total revenue |

|

6.2% |

|

6.2% |

|

— bps |

|

EBT as a % of operating revenue (1) |

|

8.5% |

|

8.9% |

|

(40) bps |

|

|

|

|

|

|

|

|

|

Trailing 12-months EBT as % of total and operating revenue |

|

3Q23 |

|

3Q22 |

|

Change |

|

EBT as a % of total revenue |

|

6.7% |

|

4.9% |

|

180 bps |

|

EBT as a % of operating revenue (1) |

|

9.4% |

|

6.9% |

|

250 bps |

|

|

|

|

|

|

|

|

|

(1) Non-GAAP financial measure excluding fuel and subcontracted transportation. |

|||||||

-

DTS total revenue decreased 1% and operating revenue grew 3%

- Total revenue reflects lower fuel revenue passed through to customers, largely offset by higher operating revenue

- Operating revenue increased primarily due to inflationary cost recovery

- DTS EBT is generally in line with prior year

- DTS EBT as a percentage of DTS operating revenue is within the company's long-term target of high single digits for the third quarter and at the high end for the trailing 12-month period

Corporate Financial Information

Unallocated Central Support Services (CSS)

Unallocated CSS costs declined to $20 million from $21 million in the prior year, primarily due to lower professional fees.

Capital Expenditures, Cash Flow, and Leverage

Year-to-date capital expenditures increased to $2.6 billion in 2023, compared to $2.0 billion in 2022, reflecting higher investments in the lease fleet and accelerated timing of OEM deliveries, partially offset by lower investments in commercial rental.

Year-to-date net cash provided by operating activities from continuing operations was $1.8 billion, consistent with the prior year, as lower working capital needs were offset by reduced earnings. Free cash flow (non-GAAP) of $32 million, compared to $887 million in 2022, primarily reflects an increase in capital expenditures and prior-year proceeds of approximately $300 million from the FMS UK exit.

Debt-to-equity as of September 30, 2023 was 214%, compared to 216% at year-end 2022, and remains below the company's long-term target of 250% to 300%.

Share Repurchase Programs

In October, the Board of Directors authorized two new share repurchase programs. Under a new discretionary repurchase program, Ryder management is authorized to repurchase up to 2.0 million shares of common stock at its discretion. Under a new anti-dilutive repurchase program, Ryder management is authorized to repurchase up to 2.0 million shares of common stock issued to employees under the company’s employee stock plans since August 31, 2023. Both programs commenced October 12, 2023 and expire October 12, 2025. Our previously authorized discretionary repurchase program was completed in September, and our anti-dilutive repurchase program expired in October.

Outlook

"Our business model transformation is enabling us to achieve our earnings and return targets throughout the cycle," says Ryder Chief Financial Officer John Diez. "Despite weakening freight conditions and used vehicle pricing that peaked over a year ago, we have demonstrated the ability to deliver strong results in a difficult environment. We remain confident that the continued execution of our balanced growth strategy will drive long-term value creation and shareholder returns."

|

Full Year 2023 |

Total Revenue Growth |

~(2%) |

Operating Revenue Growth (non-GAAP) |

~2% |

FY23 GAAP EPS (includes ~$3.96 cumulative currency translation charge for FMS UK exit) |

$8.44 - $8.69 |

FY23 Comparable EPS (non-GAAP) |

$12.60 - $12.85 |

|

|

Adjusted ROE (1) |

18% - 19% |

Net Cash from Operating Activities from Continuing Operations |

~$2.5B |

Free Cash Flow (non-GAAP) |

~$100M |

Capital Expenditures |

~$3.2B |

Debt-to-Equity |

~220% |

|

|

|

Fourth Quarter 2023 |

4Q23 GAAP EPS |

$2.45 - $2.70 |

4Q23 Comparable EPS (non-GAAP) |

$2.60 - $2.85 |

———————————— |

|

| (1) The non-GAAP elements of this calculation have been reconciled to the corresponding GAAP measures. A numerical reconciliation of net earnings to adjusted net earnings and average shareholders' equity to adjusted average equity is provided in the Appendix - Non-GAAP Financial Measures Reconciliations at the end of this release. | |

Supplemental Company Information

Third Quarter Net Earnings |

||||||||||||

|

|

|

|

|

|

|

|

|

||||

(In millions, except EPS) |

|

Earnings |

|

Diluted EPS |

||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||

Earnings from continuing operations |

|

$ |

160 |

|

247 |

|

|

$ |

3.44 |

|

4.82 |

|

Discontinued operations |

|

|

1 |

|

(1 |

) |

|

|

0.03 |

|

(0.01 |

) |

Net earnings |

|

$ |

161 |

|

246 |

|

|

$ |

3.47 |

|

4.82 |

|

|

|

|

|

|

|

|

Year-to-Date Operating Results |

|

|

|

|

|

|

|

Nine months ended September 30, |

|||||

(In millions, except EPS) |

2023 |

|

2022 |

|

Change |

|

Total revenue |

$ |

8,760 |

|

8,923 |

|

(2)% |

Operating revenue (non-GAAP) |

$ |

7,051 |

|

6,870 |

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from continuing operations |

$ |

282 |

|

663 |

|

(57)% |

Comparable earnings from continuing operations (non-GAAP) |

$ |

468 |

|

641 |

|

(27)% |

Net earnings |

$ |

282 |

|

661 |

|

(57)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share (EPS) - Diluted |

|

|

|

|

|

|

Continuing operations |

$ |

6.01 |

|

12.86 |

|

(53)% |

Comparable (non-GAAP) |

$ |

10.00 |

|

12.44 |

|

(20)% |

Net earnings |

$ |

6.02 |

|

12.82 |

|

(53)% |

Business Description

Ryder System, Inc. is a leading supply chain, dedicated transportation, and fleet management solutions company. Ryder's stock (NYSE: R) is a component of the Dow Jones Transportation Average and the S&P MidCap 400® index. The company's financial performance is reported in the following three, inter-related business segments:

- Supply Chain Solutions – Ryder's SCS business segment optimizes logistics networks to make them more responsive and able to be leveraged as a competitive advantage. Globally-recognized brands in the automotive, consumer goods, food and beverage, healthcare, industrial, oil and gas, technology, and retail industries rely on Ryder's leading-edge technologies and world-class logistics engineers to help them deliver the goods that consumers use every day.

- Dedicated Transportation Solutions – Ryder's DTS business segment combines the best of Ryder's leasing and maintenance capabilities with the safest and most professional drivers in the industry. With a dedicated transportation solution, Ryder helps customers increase their competitive position, reduce risk, and integrate their transportation needs with their overall supply chain.

- Fleet Management Solutions – Ryder's FMS business segment provides a broad range of services to help businesses of all sizes, across virtually every industry, deliver for their customers. From leasing, maintenance, and fueling, to rental and used vehicle sales, customers rely on Ryder's expertise to help them lower their costs, redirect capital to other parts of their business, and focus on what they do best – so they can grow.

For more information on Ryder System, Inc., visit investors.ryder.com and ryder.com.

Note: Regarding Forward-Looking Statements

Certain statements and information included in this news release are “forward-looking statements” under the Federal Private Securities Litigation Reform Act of 1995, including: our forecast; our expectations regarding market trends and economic environment, such as decreasing rental demand, challenging freight environment, weakening used vehicle sales, and declining volumes in our omnichannel retail vertical; our expectations regarding total and operating revenue, earnings per share, comparable earnings per share, adjusted ROE, earnings before income tax, net cash from operating activities from continuing operations, debt-to-equity, capital expenditures, operating cash flow, and free cash flow; our ability to execute our balanced growth strategy; anticipated impact of inflationary pressures; our expectations with respect to ChoiceLease and SelectCare growth; our expectations regarding commercial rental demand and utilization and used vehicle sales volume and pricing; our expectations regarding long-term profitable growth; our expectations with respect to the timing of OEM deliveries; our expectations with respect to our actions to increase returns and long-term value creation; our ability to outperform prior cycles; and our ability to support organic growth, make strategic investments and acquisitions, including the timing and completion of our anticipated acquisition of Impact Fulfillment Services, and return capital to shareholders, including through share repurchases and dividends. Our forward-looking statements also include our estimates of the impact of residual value estimates on earnings and depreciation expense. The expected impact of residual value estimates is based on our current assessment of the residual values and useful lives of revenue-earning equipment based on multi-year trends and our outlook for the expected near- and long-term used vehicle market. A variety of factors, many of which are outside of our control, could cause residual value estimates to differ from actual used vehicle sales pricing, such as changes in supply and demand of used vehicles; volatility in market conditions; changes in vehicle technology; competitor pricing; regulatory requirements; driver shortages; customer requirements and preferences; and changes in underlying assumption factors.

All of our forward-looking statements should be evaluated by considering the many risks and uncertainties inherent in our business that could cause actual results and events to differ materially from those in the forward-looking statements. Important factors that could cause such differences include: changes in general economic and financial conditions in the U.S. and worldwide; ongoing supply chain and labor challenges and vehicle production constraints; the effect of geopolitical events; our ability to adapt to changing market conditions, including lower than expected contractual sales, decreases in commercial rental demand or utilization, poor acceptance of rental pricing, declining market demand for or excess supply of used vehicles impacting current or estimated pricing, and our anticipated proportion of retail versus wholesale sales; declining customer demand for our services; higher than expected maintenance costs; lower than expected benefits from our cost-savings initiatives; our ability to effectively and efficiently integrate acquisitions into our business; lower than expected benefits from our sales, marketing, and new product initiatives; setbacks in the economic market or in our ability to retain profitable customer accounts; impact of changing laws and regulations; difficulty in obtaining adequate profit margins for our services; inability to maintain current pricing levels due to, for example, economic conditions, business interruptions, expenditures, labor disputes such as the United Auto Workers strike, and severe weather or other natural occurrences; competition from other service providers; changes in technology and new entrants; professional driver and technician shortages resulting in higher procurement costs and turnover rates; impact of supply chain disruptions; higher than expected bad debt reserves or write-offs; decrease in credit ratings; increased debt costs; adequacy of accounting estimates; our ability to effectively and efficiently integrate acquisitions into our business; higher than expected reserves and accruals particularly with respect to pension, taxes, insurance, and revenue; impact of changes in our residual value estimates and accounting policies; unanticipated changes in fuel and alternative energy prices; unanticipated currency exchange rate fluctuations; increases in inflation or interest rates; our ability to manage our cost structure; and the risks described in our filings with the Securities and Exchange Commission (SEC). The risks included here are not exhaustive. New risks emerge from time to time, and it is not possible for management to predict all such risk factors or to assess the impact of such risks on our business. Accordingly, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Note: Regarding Non-GAAP Financial Measures

This news release includes certain non-GAAP financial measures as defined under SEC rules. Refer to Appendix - Non-GAAP Financial Measure Reconciliations at the end of the tables following this press release for reconciliations of the most important comparable GAAP measure to the non-GAAP financial measure and the reasons why management believes this measure is important to investors. Additional information regarding non-GAAP financial measures as required by Regulation G and Item 10(e) of Regulation S-K can be found in our most recent Form 10-K, Form 10-Q, and our Form 8-K filed as of the date of this release with the SEC, which are available at http://investors.ryder.com.

CONFERENCE CALL AND WEBCAST INFORMATION

Ryder’s earnings conference call and webcast is scheduled for October 25, 2023 at 11:00 a.m. ET. To join, click here.

LIVE AUDIO VIA PHONE

Toll Free Number: 888-204-4368

USA Toll Number: 323-994-2093

Audio Passcode: Ryder

Conference Leader: Calene Candela

WEBCAST REPLAY

An audio replay including the slide presentation will be available within four hours following the call. Click here then select Financials/Quarterly Results and the date.

ryder-financial

| RYDER SYSTEM, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS - UNAUDITED |

||||||||||||||

(In millions, except per share amounts) |

|

Three months ended

|

|

Nine months ended

|

||||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||

Lease & related maintenance and rental revenues |

|

$ |

986 |

|

|

1,044 |

|

|

$ |

2,941 |

|

|

3,119 |

|

Services revenue |

|

|

1,799 |

|

|

1,811 |

|

|

|

5,399 |

|

|

5,258 |

|

Fuel services revenue |

|

|

139 |

|

|

180 |

|

|

|

420 |

|

|

546 |

|

Total revenues |

|

|

2,924 |

|

|

3,035 |

|

|

|

8,760 |

|

|

8,923 |

|

|

|

|

|

|

|

|

|

|

||||||

Cost of lease & related maintenance and rental |

|

|

666 |

|

|

691 |

|

|

|

2,001 |

|

|

2,078 |

|

Cost of services |

|

|

1,524 |

|

|

1,550 |

|

|

|

4,638 |

|

|

4,523 |

|

Cost of fuel services |

|

|

137 |

|

|

176 |

|

|

|

412 |

|

|

530 |

|

Selling, general and administrative expenses |

|

|

347 |

|

|

350 |

|

|

|

1,053 |

|

|

1,053 |

|

Non-operating pension costs, net |

|

|

10 |

|

|

3 |

|

|

|

30 |

|

|

8 |

|

Used vehicle sales, net |

|

|

(47 |

) |

|

(113 |

) |

|

|

(174 |

) |

|

(356 |

) |

Interest expense |

|

|

75 |

|

|

57 |

|

|

|

212 |

|

|

165 |

|

Miscellaneous income, net |

|

|

(5 |

) |

|

(9 |

) |

|

|

(36 |

) |

|

(23 |

) |

Currency translation adjustment loss |

|

|

— |

|

|

— |

|

|

|

188 |

|

|

— |

|

Restructuring and other items, net |

|

|

4 |

|

|

(4 |

) |

|

|

(22 |

) |

|

21 |

|

|

|

|

2,711 |

|

|

2,701 |

|

|

|

8,302 |

|

|

7,999 |

|

|

|

|

|

|

|

|

|

|

||||||

Earnings from continuing operations before income taxes |

|

|

213 |

|

|

334 |

|

|

|

458 |

|

|

924 |

|

Provision for income taxes |

|

|

53 |

|

|

87 |

|

|

|

176 |

|

|

261 |

|

Earnings from continuing operations |

|

|

160 |

|

|

247 |

|

|

|

282 |

|

|

663 |

|

Earnings (loss) from discontinued operations, net of tax |

|

|

1 |

|

|

(1 |

) |

|

|

— |

|

|

(2 |

) |

Net earnings |

|

$ |

161 |

|

|

246 |

|

|

$ |

282 |

|

|

661 |

|

|

|

|

|

|

|

|

|

|

||||||

Earnings (loss) per common share — Diluted |

|

|

|

|

|

|

|

|

||||||

Continuing operations |

|

$ |

3.44 |

|

|

4.82 |

|

|

$ |

6.01 |

|

|

12.86 |

|

Discontinued operations |

|

|

0.03 |

|

|

(0.01 |

) |

|

|

0.01 |

|

|

(0.03 |

) |

Net earnings |

|

$ |

3.47 |

|

|

4.82 |

|

|

$ |

6.02 |

|

|

12.82 |

|

|

|

|

|

|

|

|

|

|

||||||

Weighted average common shares outstanding — Diluted |

|

|

46.3 |

|

|

51.1 |

|

|

|

46.9 |

|

|

51.3 |

|

|

|

|

|

|

|

|

|

|

||||||

Diluted EPS from continuing operations |

|

$ |

3.44 |

|

|

4.82 |

|

|

$ |

6.01 |

|

|

12.86 |

|

Non-operating pension costs, net |

|

|

0.17 |

|

|

0.03 |

|

|

|

0.51 |

|

|

0.10 |

|

FMS U.K. exit |

|

|

0.09 |

|

|

(0.53 |

) |

|

|

(0.68 |

) |

|

(1.13 |

) |

Currency translation adjustment loss |

|

|

— |

|

|

— |

|

|

|

3.91 |

|

|

— |

|

Other, net |

|

|

— |

|

|

(0.01 |

) |

|

|

(0.02 |

) |

|

0.06 |

|

Tax adjustments, net |

|

|

(0.12 |

) |

|

0.14 |

|

|

|

0.27 |

|

|

0.55 |

|

Comparable EPS from continuing operations (1) |

|

$ |

3.58 |

|

|

4.45 |

|

|

$ |

10.00 |

|

|

12.44 |

|

|

|

|

|

|

|

|

|

|

||||||

(1) Non-GAAP financial measure. A reconciliation of GAAP EPS from continuing operations to comparable EPS from continuing operations is set forth in this table. |

||||||||||||||

Note: Amounts may not be additive due to rounding. |

||||||||||||||

RYDER SYSTEM, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS - UNAUDITED |

|||||

(In millions) |

|

September 30,

|

|

December 31,

|

|

Assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

159 |

|

267 |

Other current assets |

|

|

1,953 |

|

1,933 |

Revenue earning equipment, net |

|

|

8,875 |

|

8,190 |

Operating property and equipment, net |

|

|

1,164 |

|

1,148 |

Other assets |

|

|

3,179 |

|

2,857 |

|

|

$ |

15,330 |

|

14,395 |

|

|

|

|

|

|

Liabilities and shareholders' equity: |

|

|

|

|

|

Current liabilities |

|

$ |

2,099 |

|

1,967 |

Total debt (including current portion) |

|

|

6,621 |

|

6,352 |

Other non-current liabilities (including deferred income taxes) |

|

|

3,513 |

|

3,139 |

Shareholders' equity |

|

|

3,097 |

|

2,937 |

|

|

$ |

15,330 |

|

14,395 |

SELECTED KEY RATIOS AND METRICS |

|||||

|

|

September 30,

|

|

December 31,

|

|

Debt to equity |

|

214% |

|

216% |

|

|

|

Three months ended

|

|

Nine months ended

|

||||||||||

(In millions) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||

Comparable EBITDA (1) |

|

$ |

680 |

|

|

696 |

|

|

$ |

1,982 |

|

|

2,031 |

|

Effective interest rate |

|

|

4.6 |

% |

|

3.6 |

% |

|

|

4.4 |

% |

|

3.4 |

% |

|

|

Nine months ended

|

|||

(In millions) |

|

2023 |

|

2022 |

|

Net cash provided by operating activities from continuing operations |

|

$ |

1,842 |

|

1,786 |

Free cash flow (1) |

|

|

32 |

|

887 |

Capital expenditures paid |

|

|

2,457 |

|

1,917 |

Gross capital expenditures |

|

|

2,582 |

|

2,033 |

|

|

Twelve months ended

|

||

|

|

2023 |

|

2022 |

Adjusted ROE (2) |

|

21% |

|

30% |

———————————— |

||||

(1) Non-GAAP financial measure. See reconciliation of the non-GAAP elements of this calculation reconciled to the corresponding GAAP measures included in the Appendix - Non-GAAP Financial Measures section at the end of this release. |

||||

(2) The non-GAAP elements of the calculation have been reconciled to the corresponding GAAP measures. A numerical reconciliation of net earnings to adjusted net earnings and average shareholders' equity to adjusted average equity is provided in the Appendix - Non-GAAP Financial Measures section at the end of this release. |

||||

Note: Amounts may not be additive due to rounding. |

||||

RYDER SYSTEM, INC. AND SUBSIDIARIES BUSINESS SEGMENT REVENUE AND EARNINGS - UNAUDITED |

||||||||||||||||||

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||||||||||||

(In millions) |

|

2023 |

|

2022 |

|

Change |

|

2023 |

|

2022 |

|

Change |

||||||

Total Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Fleet Management Solutions: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

ChoiceLease |

|

$ |

799 |

|

|

772 |

|

|

3% |

|

$ |

2,356 |

|

|

2,299 |

|

|

2% |

Commercial rental |

|

|

293 |

|

|

349 |

|

|

(16)% |

|

|

898 |

|

|

991 |

|

|

(9)% |

SelectCare and other |

|

|

174 |

|

|

159 |

|

|

9% |

|

|

528 |

|

|

460 |

|

|

15% |

FMS Europe |

|

|

— |

|

|

23 |

|

|

(100)% |

|

|

— |

|

|

142 |

|

|

(100)% |

Fuel services revenue |

|

|

221 |

|

|

279 |

|

|

(21)% |

|

|

667 |

|

|

840 |

|

|

(21)% |

Fleet Management Solutions |

|

|

1,487 |

|

|

1,582 |

|

|

(6)% |

|

|

4,449 |

|

|

4,732 |

|

|

(6)% |

Supply Chain Solutions |

|

|

1,194 |

|

|

1,206 |

|

|

(1)% |

|

|

3,574 |

|

|

3,469 |

|

|

3% |

Dedicated Transportation Solutions |

|

|

448 |

|

|

455 |

|

|

(2)% |

|

|

1,342 |

|

|

1,330 |

|

|

1% |

Eliminations |

|

|

(205 |

) |

|

(208 |

) |

|

1% |

|

|

(605 |

) |

|

(608 |

) |

|

—% |

Total revenue |

|

$ |

2,924 |

|

|

3,035 |

|

|

(4)% |

|

$ |

8,760 |

|

|

8,923 |

|

|

(2)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Operating Revenue: (1) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Fleet Management Solutions |

|

$ |

1,266 |

|

|

1,303 |

|

|

(3)% |

|

$ |

3,782 |

|

|

3,892 |

|

|

(3)% |

Supply Chain Solutions |

|

|

909 |

|

|

835 |

|

|

9% |

|

|

2,653 |

|

|

2,371 |

|

|

12% |

Dedicated Transportation Solutions |

|

|

325 |

|

|

317 |

|

|

3% |

|

|

974 |

|

|

919 |

|

|

6% |

Eliminations |

|

|

(121 |

) |

|

(108 |

) |

|

(12)% |

|

|

(358 |

) |

|

(312 |

) |

|

(15)% |

Operating revenue |

|

$ |

2,379 |

|

|

2,347 |

|

|

1% |

|

$ |

7,051 |

|

|

6,870 |

|

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Business Segment Earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Earnings from continuing operations before income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Fleet Management Solutions |

|

$ |

169 |

|

|

266 |

|

|

(36)% |

|

$ |

531 |

|

|

801 |

|

|

(34)% |

Supply Chain Solutions |

|

|

81 |

|

|

71 |

|

|

14% |

|

|

174 |

|

|

176 |

|

|

(1)% |

Dedicated Transportation Solutions |

|

|

28 |

|

|

28 |

|

|

(2)% |

|

|

90 |

|

|

72 |

|

|

26% |

Eliminations |

|

|

(23 |

) |

|

(27 |

) |

|

17% |

|

|

(73 |

) |

|

(84 |

) |

|

13% |

|

|

|

255 |

|

|

338 |

|

|

(25)% |

|

|

722 |

|

|

965 |

|

|

(25)% |

Unallocated Central Support Services |

|

|

(20 |

) |

|

(21 |

) |

|

(5)% |

|

|

(54 |

) |

|

(61 |

) |

|

(11)% |

Intangible amortization expense |

|

|

(8 |

) |

|

(8 |

) |

|

(1)% |

|

|

(25 |

) |

|

(27 |

) |

|

(8)% |

Non-operating pension costs, net |

|

|

(10 |

) |

|

(3 |

) |

|

NM |

|

|

(30 |

) |

|

(8 |

) |

|

NM |

Other items impacting comparability, net |

|

|

(4 |

) |

|

28 |

|

|

NM |

|

|

(155 |

) |

|

55 |

|

|

NM |

Earnings from continuing operations before income taxes |

|

|

213 |

|

|

334 |

|

|

(36)% |

|

|

458 |

|

|

924 |

|

|

(50)% |

Provision for income taxes |

|

|

53 |

|

|

87 |

|

|

(39)% |

|

|

176 |

|

|

261 |

|

|

(33)% |

Earnings from continuing operations |

|

$ |

160 |

|

|

247 |

|

|

(35)% |

|

$ |

282 |

|

|

663 |

|

|

(57)% |

———————————— |

|

|||||||||||||||||

(1) Non-GAAP financial measure. See reconciliation of GAAP total revenue to operating revenue in the Appendix - Non-GAAP Financial Measures section at the end of this release. |

||||||||||||||||||

Note: Amounts may not be additive due to rounding. |

||||||||||||||||||

RYDER SYSTEM, INC. AND SUBSIDIARIES BUSINESS SEGMENT REVENUE AND EARNINGS - UNAUDITED |

||||||||||||||||||

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||||||||||||

(In millions) |

|

2023 |

|

2022 |

|

Change |

|

2023 |

|

2022 |

|

Change |

||||||

Fleet Management Solutions |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

FMS total revenue |

|

$ |

1,487 |

|

|

1,582 |

|

|

(6)% |

|

$ |

4,449 |

|

|

4,732 |

|

|

(6)% |

Fuel services revenue (1) |

|

|

(221 |

) |

|

(279 |

) |

|

(21)% |

|

|

(667 |

) |

|

(840 |

) |

|

(21)% |

FMS operating revenue (2) |

|

$ |

1,266 |

|

|

1,303 |

|

|

(3)% |

|

$ |

3,782 |

|

|

3,892 |

|

|

(3)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Segment earnings before income taxes |

|

$ |

169 |

|

|

266 |

|

|

(36)% |

|

$ |

531 |

|

|

801 |

|

|

(34)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

FMS earnings before income taxes as % of FMS total revenue |

|

11.4% |

|

16.8% |

|

|

|

11.9% |

|

16.9% |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

FMS earnings before income taxes as % of FMS operating revenue (2) |

|

13.4% |

|

20.4% |

|

|

|

14.0% |

|

20.6% |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||||||||||||

|

|

2023 |

|

2022 |

|

Change |

|

2023 |

|

2022 |

|

Change |

||||||

Supply Chain Solutions |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

SCS total revenue |

|

$ |

1,194 |

|

|

1,206 |

|

|

(1)% |

|

$ |

3,574 |

|

|

3,469 |

|

|

3% |

Subcontracted transportation and fuel |

|

|

(285 |

) |

|

(371 |

) |

|

(23)% |

|

|

(921 |

) |

|

(1,098 |

) |

|

(16)% |

SCS operating revenue (2) |

|

$ |

909 |

|

|

835 |

|

|

9% |

|

$ |

2,653 |

|

|

2,371 |

|

|

12% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Segment earnings before income taxes |

|

$ |

81 |

|

|

71 |

|

|

14% |

|

$ |

174 |

|

|

176 |

|

|

(1)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

SCS earnings before income taxes as % of SCS total revenue |

|

6.8% |

|

5.9% |

|

|

|

4.9% |

|

5.1% |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

SCS earnings before income taxes as % of SCS operating revenue (2) |

|

9.0% |

|

8.6% |

|

|

|

6.6% |

|

7.4% |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||||||||||||

|

|

2023 |

|

2022 |

|

Change |

|

2023 |

|

2022 |

|

Change |

||||||

Dedicated Transportation Solutions |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

DTS total revenue |

|

$ |

448 |

|

|

455 |

|

|

(1)% |

|

$ |

1,342 |

|

|

1,330 |

|

|

1% |

Subcontracted transportation and fuel |

|

|

(123 |

) |

|

(138 |

) |

|

(11)% |

|

|

(368 |

) |

|

(411 |

) |

|

(10)% |

DTS operating revenue (2) |

|

$ |

325 |

|

|

317 |

|

|

3% |

|

$ |

974 |

|

|

919 |

|

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Segment earnings before income taxes |

|

$ |

28 |

|

|

28 |

|

|

(2)% |

|

$ |

90 |

|

|

72 |

|

|

26% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

DTS earnings before income taxes as % of DTS total revenue |

|

6.2% |

|

6.2% |

|

|

|

6.7% |

|

5.4% |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

DTS earnings before income taxes as % of DTS operating revenue (2) |

|

8.5% |

|

8.9% |

|

|

|

9.3% |

|

7.8% |

|

|

||||||

———————————— |

||||||||||||||||||

(1) Includes intercompany fuel sales from FMS to SCS and DTS. |

||||||||||||||||||

(2) Non-GAAP financial measure. A reconciliation of (1) GAAP total revenue to operating revenue for each business segment (FMS, SCS and DTS) and (2) segment earnings before taxes (EBT) as % of segment total revenue to segment EBT as % of segment operating revenue for each business segment is set forth in this table. |

||||||||||||||||||

Note: Amounts may not be additive due to rounding. |

||||||||||||||||||

RYDER SYSTEM, INC. AND SUBSIDIARIES BUSINESS SEGMENT INFORMATION - TRAILING TWELVE MONTHS ENDED - UNAUDITED |

||||||||

|

|

Twelve months ended

|

||||||

(In millions) |

|

2023 |

|

2022 |

|

|||

Fleet Management Solutions |

|

|

|

|

|

|||

|

|

|

|

|

|

|||

FMS total revenue |

|

$ |

6,044 |

|

|

6,231 |

|

|

Fuel services revenue (1) |

|

|

(941 |

) |

|

(1,039 |

) |

|

FMS operating revenue (2) |

|

$ |

5,103 |

|

|

5,192 |

|

|

|

|

|

|

|

|

|||

Segment earnings before income taxes |

|

$ |

787 |

|

|

1,057 |

|

|

|

|

|

|

|

|

|||

FMS earnings before income taxes as % of FMS total revenue |

|

13.0% |

|

17.0% |

|

|||

|

|

|

|

|

|

|||

FMS earnings before income taxes as % of FMS operating revenue (2) |

|

15.4% |

|

20.4% |

|

|||

|

|

|

|

|

|

|||

|

|

Twelve months ended

|

||||||

|

|

2023 |

|

2022 |

|

|||

Supply Chain Solutions |

|

|

|

|

|

|||

|

|

|

|

|

|

|||

SCS total revenue |

|

$ |

4,825 |

|

|

4,339 |

|

|

Subcontracted transportation and fuel |

|

|

(1,289 |

) |

|

(1,354 |

) |

|

SCS operating revenue (2) |

|

$ |

3,536 |

|

|

2,985 |

|

|

|

|

|

|

|

|

|||

Segment earnings before income taxes |

|

$ |

217 |

|

|

200 |

|

|

|

|

|

|

|

|

|||

SCS earnings before income taxes as % of SCS total revenue |

|

4.5% |

|

4.6% |

|

|||

|

|

|

|

|

|

|||

SCS earnings before income taxes as % of SCS operating revenue (2) |

|

6.1% |

|

6.7% |

|

|||

|

|

|

|

|

|

|||

|

|

Twelve months ended

|

||||||

|

|

2023 |

|

2022 |

|

|||

Dedicated Transportation Solutions |

|

|

|

|

|

|||

|

|

|

|

|

|

|||

DTS total revenue |

|

$ |

1,798 |

|

|

1,731 |

|

|

Subcontracted transportation and fuel |

|

|

(504 |

) |

|

(521 |

) |

|

DTS operating revenue (2) |

|

$ |

1,294 |

|

|

1,210 |

|

|

|

|

|

|

|

|

|||

Segment earnings before income taxes |

|

$ |

121 |

|

|

84 |

|

|

|

|

|

|

|

|

|||

DTS earnings before income taxes as % of DTS total revenue |

|

6.7% |

|

4.9% |

|

|||

|

|

|

|

|

|

|||

DTS earnings before income taxes as % of DTS operating revenue (2) |

|

9.4% |

|

6.9% |

|

|||

———————————— |

||||||||

(1) Includes intercompany fuel sales from FMS to SCS and DTS. |

||||||||

(2) Non-GAAP financial measure. A reconciliation of (1) GAAP total revenue to operating revenue for each business segment (FMS, SCS and DTS) and (2) segment earnings before taxes (EBT) as % of segment total revenue to segment EBT as % of segment operating revenue for each business segment is set forth in this table. |

||||||||

Note: Amounts may not be additive due to rounding. |

||||||||

RYDER SYSTEM, INC. AND SUBSIDIARIES BUSINESS SEGMENT INFORMATION - UNAUDITED KEY PERFORMANCE INDICATORS

Our North America fleet of owned and leased revenue earning equipment and SelectCare vehicles, including vehicles under on-demand maintenance and used vehicles sold, is summarized as follows (number of units rounded to the nearest hundred): |

||||||||||||||||

|

|

Three months ended

|

|

Nine months ended

|

|

2023/2022 |

||||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Three

|

|

Nine

|

||||

ChoiceLease |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Average fleet count |

|

139,200 |

|

|

133,900 |

|

|

137,400 |

|

|

133,800 |

|

|

4% |

|

3% |

End of period fleet count |

|

139,300 |

|

|

134,100 |

|

|

139,300 |

|

|

134,100 |

|

|

4% |

|

4% |

Average active fleet count (1) |

|

130,500 |

|

|

128,800 |

|

|

129,600 |

|

|

128,700 |

|

|

1% |

|

1% |

End of period active fleet count (1) |

|

130,500 |

|

|

129,100 |

|

|

130,500 |

|

|

129,100 |

|

|

1% |

|

1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Commercial rental |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Average fleet count |

|

38,700 |

|

|

41,500 |

|

|

40,000 |

|

|

40,400 |

|

|

(7)% |

|

(1)% |

End of period fleet count |

|

37,900 |

|

|

41,800 |

|

|

37,900 |

|

|

41,800 |

|

|

(9)% |

|

(9)% |

Rental utilization - power units (2) |

|

75 |

% |

|

83 |

% |

|

75 |

% |

|

83 |

% |

|

(800)bps |

|

(800)bps |

Rental rate change - % (3) |

|

1 |

% |

|

7 |

% |

|

2 |

% |

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Customer vehicles under SelectCare contracts |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Average fleet count |

|

52,100 |

|

|

55,000 |

|

|

52,900 |

|

|

54,600 |

|

|

(5)% |

|

(3)% |

End of period fleet count |

|

52,300 |

|

|

55,100 |

|

|

52,300 |

|

|

55,100 |

|

|

(5)% |

|

(5)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Customer vehicles under SCS |

|

|

|

|

|

|

|

|

|

|

|

|

||||

End of period fleet count (4) |

|

14,100 |

|

|

12,500 |

|

|

14,100 |

|

|

12,500 |

|

|

13% |

|

13% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

DTS |

|

|

|

|

|

|

|

|

|

|

|

|

||||

End of period fleet count (4) |

|

11,100 |

|

|

11,400 |

|

|

11,100 |

|

|

11,400 |

|

|

(3)% |

|

(3)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Used vehicle sales (UVS) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

End of period fleet count |

|

7,800 |

|

|

3,600 |

|

|

7,800 |

|

|

3,600 |

|

|

117% |

|

117% |

Used vehicles sold |

|

6,500 |

|

|

5,000 |

|

|

17,000 |

|

|

12,700 |

|

|

30% |

|

34% |

UVS pricing change (5) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Tractors |

|

(31 |

)% |

|

14 |

% |

|

(35 |

)% |

|

72 |

% |

|

|

|

|

Trucks |

|

(30 |

)% |

|

26 |

% |

|

(27 |

)% |

|

69 |

% |

|

|

|

|

———————————— |

||||||||||||||||

(1) Active fleet count is calculated as those units currently earning revenue and not classified as not yet earning or no longer earning units. |

||||||||||||||||

(2) Rental utilization is calculated using the number of days units are rented divided by the number of days units available to rent based on the days in a calendar year (excluding trailers). |

||||||||||||||||

(3) Represents percentage change compared to prior year period in average rental rate per day on power units using constant currency. |

||||||||||||||||

(4) These vehicle counts are also included within the fleet counts for ChoiceLease, Commercial rental and SelectCare. |

||||||||||||||||

(5) Represents percentage change compared to prior year period in average sales proceeds on used vehicle sales using constant currency. |

||||||||||||||||

RYDER SYSTEM, INC. AND SUBSIDIARIES APPENDIX - NON-GAAP FINANCIAL MEASURE RECONCILIATIONS - UNAUDITED

This press release and accompanying tables include “non-GAAP financial measures” as defined by SEC rules. As required by SEC rules, we provide a reconciliation of each non-GAAP financial measure to the most comparable GAAP measure. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP.

Specifically, the following non-GAAP financial measures are included in this press release: |

||

Non-GAAP Financial Measure |

Comparable GAAP Measure |

Reconciliation in Section Entitled |

Operating Revenue Measures: |

||

Operating Revenue |

Total Revenue |

Appendix - Non-GAAP Financial Measure Reconciliations |

FMS Operating Revenue |

FMS Total Revenue |

Business Segment Information - Unaudited |

SCS Operating Revenue |

SCS Total Revenue |

|

DTS Operating Revenue |

DTS Total Revenue |

|

Operating Revenue Growth |

Total Revenue Growth |

Appendix - Non-GAAP Financial Measure Reconciliations |

FMS EBT as a % of FMS Operating Revenue |

FMS EBT as a % of FMS Total Revenue |

Business Segment Information - Unaudited |

SCS EBT as a % of SCS Operating Revenue |

SCS EBT as a % of SCS Total Revenue |

|

DTS EBT as a % of DTS Operating Revenue |

DTS EBT as a % of DTS Total Revenue |

|

Comparable Earnings Measures: |

||

Comparable Earnings Before Income Tax and Comparable Tax Rate |

Earnings Before Income Tax and Effective Tax Rate from Continuing Operations |

Appendix - Non-GAAP Financial Measure Reconciliations |

Comparable Earnings |

Earnings from Continuing Operations |

Appendix - Non-GAAP Financial Measure Reconciliations |

Comparable EPS |

EPS from Continuing Operations |

Condensed Consolidated Statements of Earnings - Unaudited

Appendix - Non-GAAP Financial Measure Reconciliations |

Adjusted Return on Equity (ROE) |

Not Applicable. However, the non-GAAP elements of the calculation have been reconciled to the corresponding GAAP measures. A numerical reconciliation of net earnings to adjusted net earnings and average shareholders' equity to adjusted average equity is provided in the following reconciliations. |

Appendix - Non-GAAP Financial Measure Reconciliations |

Comparable Earnings Before Interest, Taxes, Depreciation and Amortization |

Net Earnings |

Appendix - Non-GAAP Financial Measure Reconciliations |

Cash Flow Measures: |

||

Total Cash Generated and Free Cash Flow |

Cash Provided by Operating Activities from Continuing Operations |

Appendix - Non-GAAP Financial Measure Reconciliations |

RYDER SYSTEM, INC. AND SUBSIDIARIES APPENDIX - NON-GAAP FINANCIAL MEASURE RECONCILIATIONS - UNAUDITED

Set forth in the table below is an overview of each non-GAAP financial measure and why management believes that presentation of each non-GAAP financial measure provides useful information to investors. See reconciliations for each of these measures following this table. |

|

Operating Revenue Measures: |

|

Operating Revenue

FMS Operating Revenue

SCS Operating Revenue

DTS Operating Revenue

Operating Revenue Growth

FMS EBT as a % of FMS Operating Revenue

SCS EBT as a % of SCS Operating Revenue

DTS EBT as a % of DTS Operating Revenue

|

Operating revenue is defined as total revenue for Ryder or each business segment (FMS, SCS and DTS) excluding any (1) fuel and (2) subcontracted transportation. We believe operating revenue provides useful information to investors as we use it to evaluate the operating performance of our core businesses and as a measure of sales activity at the consolidated level for Ryder System, Inc., as well as for each of our business segments. We also use segment EBT as a percentage of segment operating revenue for each business segment for the same reason. Note: FMS EBT, SCS EBT and DTS EBT, our primary measures of segment performance, are not non-GAAP measures.

Fuel: We exclude FMS, SCS and DTS fuel from the calculation of our operating revenue measures, as fuel is an ancillary service that we provide our customers. Fuel revenue is impacted by fluctuations in market fuel prices and the costs are largely a pass-through to our customers, resulting in minimal changes in our profitability during periods of steady market fuel prices. However, profitability may be positively or negatively impacted by rapid changes in market fuel prices during a short period of time, as customer pricing for fuel services is established based on current market fuel costs.

Subcontracted transportation: We exclude subcontracted transportation from the calculation of our operating revenue measures, as these services are also typically a pass-through to our customers and, therefore, fluctuations result in minimal changes to our profitability. While our SCS and DTS business segments subcontract certain transportation services to third party providers, our FMS business segment does not engage in subcontracted transportation and, therefore, this item is not applicable to FMS. |

Comparable Earnings Measures: |

|

Comparable Earnings before Income Taxes (EBT)

Comparable Earnings

Comparable Earnings per Diluted Common Share (EPS)

Comparable Tax Rate

Adjusted Return on Equity (ROE)

|

Comparable EBT, Comparable Earnings and Comparable EPS are defined, respectively, as GAAP EBT, earnings and EPS, all from continuing operations, excluding (1) non-operating pension costs, net and (2) other items impacting comparability (as further described below). We believe these comparable earnings measures provide useful information to investors and allow for better year-over-year comparison of operating performance.

Non-operating pension costs, net: Our comparable earnings measures exclude non-operating pension costs, net, which include the amortization of net actuarial loss and prior service cost, interest cost and expected return on plan assets components of pension and postretirement benefit costs, as well as any significant charges for settlements or curtailments if recognized. We exclude non-operating pension costs, net because we consider these to be impacted by financial market performance and outside the operational performance of our business.

Other Items Impacting Comparability: Our comparable and adjusted earnings measures also exclude other significant items that are not representative of our business operations as detailed in the reconciliation table below. These other significant items vary from period to period and, in some periods, there may be no such significant items.

Comparable Tax Rate is computed using the same methodology as the GAAP provision for income taxes. Income tax effects of non-GAAP adjustments are calculated based on the marginal tax rates to which the non-GAAP adjustments are related.

Adjusted ROE is defined as adjusted net earnings divided by adjusted average shareholders' equity and represents the rate of return on shareholders' investment. Other items impacting comparability described above are excluded, as applicable, from the calculation of adjusted net earnings and adjusted average shareholders' equity. We use adjusted ROE as an internal measure of how effectively we use the owned capital invested in our operations. |

Comparable Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) |

Comparable EBITDA is defined as net earnings, first adjusted to exclude discontinued operations and the following items, all from continuing operations: (1) non-operating pension costs, net and (2) any other items that are not representative of our business operations (these items are the same items that are excluded from comparable earnings measures for the relevant periods as described immediately above) and then adjusted further for (1) interest expense, (2) income taxes, (3) depreciation, (4) used vehicle sales results and (5) amortization.

We believe comparable EBITDA provides investors with useful information, as it is a standard measure commonly reported and widely used by analysts, investors and other interested parties to measure financial performance and our ability to service debt and meet our payment obligations. In addition, we believe that the inclusion of comparable EBITDA provides consistency in financial reporting and enables analysts and investors to perform meaningful comparisons of past, present and future operating results. Other companies may calculate comparable EBITDA differently; therefore, our presentation of comparable EBITDA may not be comparable to similarly-titled measures used by other companies.

Comparable EBITDA should not be considered as an alternative to net earnings, earnings from continuing operations before income taxes or earnings from continuing operations determined in accordance with GAAP, as an indicator of our operating performance, as an alternative to cash flows from operating activities (determined in accordance with GAAP), as an indicator of cash flows, or as a measure of liquidity. |

Cash Flow Measures: |

|

Total Cash Generated

Free Cash Flow

|

We consider total cash generated and free cash flow to be important measures of comparative operating performance, as our principal sources of operating liquidity are cash from operations and proceeds from the sale of revenue earning equipment.

Total Cash Generated is defined as the sum of (1) net cash provided by operating activities, (2) net cash provided by the sale of revenue earning equipment, (3) net cash provided by the sale of operating property and equipment and (4) other cash inflows from investing activities. We believe total cash generated is an important measure of total cash flows generated from our ongoing business activities.

Free Cash Flow is defined as the net amount of cash generated from operating activities and investing activities (excluding acquisitions) from continuing operations. We calculate free cash flow as the sum of (1) net cash provided by operating activities, (2) net cash provided by the sale of revenue earning equipment and operating property and equipment, and (3) other cash inflows from investing activities, less (4) purchases of property and revenue earning equipment. We believe free cash flow provides investors with an important perspective on the cash available for debt service and for shareholders, after making capital investments required to support ongoing business operations. Our calculation of free cash flow may be different from the calculation used by other companies and, therefore, comparability may be limited. |

RYDER SYSTEM, INC. AND SUBSIDIARIES APPENDIX - NON-GAAP FINANCIAL MEASURE RECONCILIATIONS - UNAUDITED |

||||||||||||||

OPERATING REVENUE RECONCILIATION |

|

|

|

|

|

|

|

|

||||||

|

|

Three months ended

|

|

Nine months ended

|

||||||||||

(In millions) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||

Total revenue |

|

$ |

2,924 |

|

|

3,035 |

|

|

$ |

8,760 |

|

|

8,923 |

|

Subcontracted transportation and fuel |

|

|

(545 |

) |

|

(688 |

) |

|

|

(1,709 |

) |

|

(2,053 |

) |

Operating revenue (1) |

|

$ |

2,379 |

|

|

2,347 |

|

|

$ |

7,051 |

|

|

6,870 |

|

TOTAL CASH GENERATED / FREE CASH FLOW RECONCILIATION |

|

|

|

|

|||

|

|

Nine months ended

|

|||||

(In millions) |

|

2023 |

|

2022 |

|||

Net cash provided by operating activities from continuing operations |

|

$ |

1,842 |

|

|

1,786 |

|

Proceeds from sales (primarily revenue earning equipment) (2) |

|

|

647 |

|

|

976 |

|

Other (2) |

|

|

— |

|

|

42 |

|

Total cash generated (1) |

|

|

2,489 |

|

|

2,804 |

|

Purchases of property and revenue earning equipment (2) |

|

|

(2,457 |

) |

|

(1,917 |

) |

Free cash flow (1) |

|

$ |

32 |

|

|

887 |

|

———————————— |

|||||||

(1) Non-GAAP financial measure. |

|||||||

(2) Included in cash flows from investing activities |

|||||||

Note: Amounts may not be additive due to rounding. |

|||||||

COMPARABLE EARNINGS RECONCILIATION |

||||||||||||||

|

|

Three months ended

|

|

Nine months ended

|

||||||||||

(In millions) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||

Earnings from continuing operations |

|

$ |

160 |

|

|

247 |

|

|

$ |

282 |

|

|

663 |

|

Non-operating pension costs, net |

|

|

8 |

|

|

2 |

|

|

|

24 |

|

|

5 |

|

FMS U.K. exit (1) |

|

|

4 |

|

|

(27 |

) |

|

|

(32 |

) |

|

(58 |

) |

Currency translation adjustment loss |

|

|

— |

|

|

— |

|

|

|

183 |

|

|

— |

|

Other, net |

|

|

— |

|

|

(3 |

) |

|

|

(1 |

) |

|

2 |

|

Tax adjustments, net (2) |

|

|

(7 |

) |

|

8 |

|

|

|

12 |

|

|

29 |

|

Comparable earnings from continuing operations (3), (4) |

|

$ |

165 |

|

|

227 |

|

|

$ |

468 |

|

|

641 |

|

|

|

|

|

|

|

|

|

|

||||||

Tax rate on continuing operations |

|

25.2% |

|

26.3% |

|

38.5% |

|

28.3% |

||||||

Tax adjustments and income tax effects of non-GAAP adjustments (3) |

|

1.8% |

|

—% |

|

(11.3)% |

|

(1.4)% |

||||||

Comparable tax rate on continuing operations (4) |

|

27.0% |

|

26.3% |

|

27.2% |

|

26.9% |

||||||

———————————— |

||||||||||||||

(1) Primarily includes gains on sales of properties and net commercial claims proceeds. |

||||||||||||||

(2) Adjustments include the global tax impacts related to the FMS U.K. exit in 2023 and 2022. |

||||||||||||||

(3) The comparable provision for income taxes is computed using the same methodology as the GAAP provision for income taxes. Income tax effects of non-GAAP adjustments are calculated based on the marginal tax rates to which the non-GAAP adjustments are related. |

||||||||||||||

(4) Non-GAAP financial measure. |

||||||||||||||