OnsiteIQ Raises $14 Million in Series B Funding To Provide Construction Intelligence For Real Estate Investors

OnsiteIQ Raises $14 Million in Series B Funding To Provide Construction Intelligence For Real Estate Investors

On the heels of company doubling revenue in 2022, this raise will support expansion of product offerings and delivery of elevated analytics

NEW YORK--(BUSINESS WIRE)--OnsiteIQ, a leading construction intelligence platform for commercial real estate investors, developers, and owners, today announced the completion of a $14-million Series B financing round. The round was led by existing investor Vertical Venture Partners — joined by a number of its Limited Partners — with additional participation from leading real estate technology VC RET Ventures as well as Interplay VC.

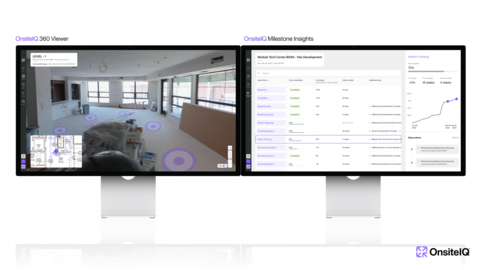

Founded in 2017 by Ardalan Khosrowpour, OnsiteIQ was developed to help real estate investors from across the industry improve job site transparency and manage risk throughout their portfolio of development projects. OnsiteIQ’s network of ‘capture specialists’ regularly walks its clients' projects to capture 100% of the job site with 360-degree videos, which are then automatically mapped to each project’s floor plans. In doing so, OnsiteIQ creates an objective, consistent, and comprehensive record of all of the firm’s active projects, which users can instantly access and monitor from any device. The platform analyzes this visual data and leverages artificial intelligence to track progress across 18 major milestones, provide status updates, identify patterns of inactivity to predict potential delays and create trend reports across an entire portfolio.

By serving as a single source of truth for all project stakeholders, OnsiteIQ promotes transparency and provides a centralized platform for institutional investors to document projects, monitor progress, and verify payments. In a construction landscape in which more than 70% of projects fall behind schedule, this platform is particularly valuable for developers, equity partners, and lenders with geographically dispersed investments, who have previously struggled to gain visibility and access a holistic dashboard of accurate status reports for their entire portfolio.

“OnsiteIQ was founded to empower commercial real estate investors, developers, and owners with real-time insights into projects’ status, helping to increase transparency and enhance risk management across a portfolio. We do so not only by delivering accurate, high-quality data — in what has historically been a highly fragmented industry — but also by tapping into artificial intelligence to flag potential risks before delays occur,” said Ardalan Khosrowpour, founder and CEO of OnsiteIQ. “The typical development loses roughly $2 million per month of delay; for a large fund with numerous parallel projects, construction delays cost tens of millions which has a direct impact on funds’ Internal Rate of Return (IRR). With this latest capital injection, we will be focused on improving our product offerings, including expanding our analytics suite to better identify trends and patterns of inactivity that lead to project delays and budget overruns.”

OnsiteIQ has seen significant traction since its founding and is currently monitoring construction projects across a wide variety of property types in more than 65 markets throughout the United States and Canada. To date, the company has captured over three billion square feet of 360-degree project footage, monitoring over 1,600 projects valued at a cumulative $17 billion.

“While rising construction costs and interest rates have created serious challenges for real estate developers, OnsiteIQ provides stakeholders with much-needed visibility into active projects’ progress, making it easier to keep portfolios on track,” said Christopher Yip, Partner at RET Ventures. “A number of the multifamily owners and investors who comprise RET’s strategic investor base have been utilizing OnsiteIQ to monitor their active developments for several years, and have found value in the platform. We are confident that, as OnsiteIQ continues to refine its technology and analytics, it will increasingly solidify its position as an indispensable tool for the industry.”

In addition to improving key risk indicators and analytics data, this latest funding will support the refinement of the solution’s payment verification platform, as well as the deployment of an elevated portfolio dashboard that allows for the data-backed cross-comparison of various projects within a portfolio.

"In the large and untapped construction sector, the need for clear, objective insights is more crucial than ever. This is where OnsiteIQ steps in, leading the charge in blending technology with construction know-how, and paving the way for a more open approach to building and developing real estate,” said David C. Schwab, Managing Director at Vertical Venture Partners. “We are excited to follow our original Series A investment and lead this Series B to support OnsiteIQ's commitment to making the construction world more transparent, offering real, practical insights that can be used by all real estate investors. As they expand their services and fine-tune their analytical tools, we are eager to see the big, positive changes OnsiteIQ will bring to the real estate investment scene."

About OnsiteIQ

OnsiteIQ is the construction intelligence platform for real estate developers. Since 2017, we’ve worked with real estate owners, developers, and investors to deliver the construction intelligence they need to make business-critical decisions about their portfolios. OnsiteIQ delivers 360º imagery of active builds across your real estate portfolio, offering a perfect record of progress to date, along with real-time project analysis and actionable insight.

Learn more at www.onsiteiq.io.

About Vertical Venture Partners

Vertical Venture Partners (VVP) is a Silicon Valley-based venture capital firm founded in 2015 by Dave Schwab, a 20-year veteran in early-stage technology investing. VVP focuses on making Seed and Series A investments in B2B technology companies targeting pain points in specific vertical sectors as opposed to those providing horizontal technologies to many industry sectors.

The VVP team has decades of operating and investment experience gained from diverse backgrounds in venture capital, research & development, investment banking and advanced technology. Please visit www.vvp.vc to learn more.

About RET Ventures

A leading real estate technology venture capital firm, RET Ventures elevates real estate innovation by investing in cutting-edge technologies out of its core venture funds and a Housing Impact Fund. RET works in partnership with its base of more than 40 Strategic Investors who own and manage over $600 billion of real estate assets, with a particular focus on multifamily and single-family rental real estate. In these asset classes, the group includes some of the largest REITs and private real estate owners, operators and developers, who together control approximately 2.5 million rental units.

Through its deep expertise and network, RET has created a unique real estate innovation ecosystem that delivers significant value to the companies it backs, providing them with access to thought leaders, development partners and ongoing strategic guidance. For more information, please visit www.ret.vc.

Contacts

MEDIA CONTACT

Shlomo Morgulis

Antenna | Spaces

retventures@antennagroup.com