SPDR® Gold MiniShares® Trust Marks 5th Anniversary with Over $6 Billion in Assets

SPDR® Gold MiniShares® Trust Marks 5th Anniversary with Over $6 Billion in Assets

New SPDR Survey Shows Investors in Gold and Gold ETFs Likely to Increase Their Investments in Next 12 Months

- Gold investors say the benefits of owning the precious metal are maintaining/increasing value in an economic downturn (68%), diversification (67%), and a hedge against inflation (67%).

- 73% of gold ETF investors say their exposure improved portfolio performance.

- Millennials have a higher percentage of gold in their investment portfolio than Gen X and Boomers.

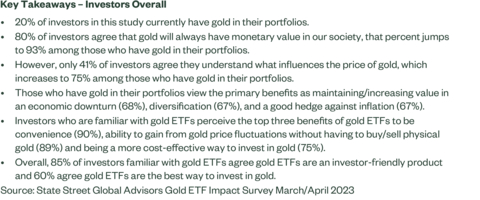

- 80% of all investors believe gold will always have monetary value, but only 41% say they understand what influences its price.

BOSTON--(BUSINESS WIRE)--State Street Global Advisors, the asset management business of State Street Corporation (NYSE: STT), has marked the 5th anniversary of its SPDR Gold MiniShares® Trust (GLDM®). Launched on June 25, 2018, GLDM is the leader among low-cost gold ETFs in the market with more than $6.2 billion in assets.1 Since its launch GLDM has grown to be the third largest gold ETF in the US.2

“At just 10 basis points, GLDM has proven to be a great low-cost choice for long-term buy and hold investors seeking access to the benefits of gold,” said George Milling-Stanley, Chief Gold Strategist at State Street Global Advisors. “The launch of the world’s first gold ETF, SPDR® Gold Shares (GLD®), nearly two decades ago broke many perceived barriers to investing in gold. It paved the way for GLDM’s introduction as a cost-effective option that further democratized investing in gold, which has increasingly become a core holding for retail investors looking to build diversified portfolios.”

Gold Holds Its Value in Investors’ Eyes: Allocations Expected to Rise in Next Year

To mark the 5th anniversary of GLDM, State Street Global Advisors released the results of its Gold ETF Impact Study, which was designed to better understand investor attitudes and behaviors around investing in gold. According to the research, 20% of U.S. investors currently have gold in their portfolios. Among these investors, the average gold allocation is 14% of portfolio assets and nearly half (47%) hold gold ETFs.

“With recession risk still looming, the allure of gold as an investment in today’s market environment continues to be very strong,” said Milling-Stanley. “Year-to-date, SPDR gold ETFs have attracted over $2 billion of inflows, which is a testament to the unique attributes of the asset class and the accessibility, transparency, and cost effectiveness of the ETF wrapper.” 3

According to the study, among investors who invest in gold, more than half are likely to increase their investment in the next 6-12 months, with the percentage of investors in gold ETFs (57%) slightly outweighing investors who may also hold other types of gold assets (e.g. bars and coins, gold mining stocks, commodity funds etc.) at 53%.

Millennials Have Bigger Appetite for Gold Than Generation X or Boomers, Despite Education Woes

Notably, Millennials have a bigger appetite for gold than Generation X or Boomers. On average, Millennials (17%) have a higher percentage of gold in their investment portfolio than Gen X and Boomers (10% each).

More Millennials than Gen X and Boomers agree that gold ETFs are the best way to invest in gold (69% versus 35% and 55% respectively).

The survey also revealed that 80% of all investors believe gold will always have monetary value but only 41% say they understand what influences its price. Comparatively, of investors with gold in their portfolios, the majority (75%) say they understand the variables impacting its price.

“Our Gold ETF Impact Survey indicates there is still significant room for more investor education about the benefits of gold and the role it can play in a portfolio,” said Milling-Stanley. “As the entire gold industry continues to improve the education around how to invest in gold and the portfolio benefits it can provide, we expect to see growth in gold investment demand.”

What’s Attracting Investors to Gold ETFs?

As for perceptions about gold’s impact on investment performance, nearly nine in ten gold investors (88%) feel gold is a long-term, strategic investment.

Furthermore, approximately three in four gold ETF investors (73%) say the holding improved the performance of their investment portfolio, with three-fourths saying ETFs are a more cost effective way to invest in gold.

Gold investors who participated in the study felt that the primary benefits of owning the precious metal are its potential to maintain/increase in value during an economic downturn (68%), diversification (67%), and its role as a hedge against inflation (67%).

For investors familiar with gold ETFs, 60% believe gold ETFs are the best way to invest in the commodity. The three key perceived benefits of gold ETFs that rise to the top are:

- Convenience (90%)

- Ability to gain from price fluctuations without having to buy/sell physical gold (89%)

- Gold ETFs are an investor-friendly product (85%)

“Our study found that investors holding gold ETFs are more likely to be optimistic about their financial future (83%) than those who do not (73%),” said Milling-Stanley. “Gold ETFs have proven to be resilient during times of market turbulence. We expect the three Rs of rates, recession and risk to be key drivers for gold prices and investor demand this year.”

For more on SPDR’s forecast for gold, read our 2023 Midyear Gold Outlook.

About State Street Global Advisors Gold ETF Impact Survey, March – April 2023

State Street Global Advisors, in partnership with A2Bplanning and Prodege, conducted an online survey among individual investors in the US. Data was collected from March 24 to April 19, 2023 from a nationally representative sample of 1,000 adults ages 25+ who have investable assets of $250,000 or more.

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of international and domestic asset classes. The funds provide investors with the flexibility to select investments that are aligned to their investment strategy. For more information, visit www.ssga.com.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the world’s governments, institutions and financial advisors. With a rigorous, risk-aware approach built on research, analysis and market-tested experience, we build from a breadth of index and active strategies to create cost-effective solutions. And, as pioneers in index, ETF, and ESG investing, we are always inventing new ways to invest. As a result, we have become the world’s fourth-largest asset manager* with US $3.62 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/21.

†This figure is presented as of March 31, 2023 and includes approximately $65.03 billion USD of assets with respect to SPDR products for which State Street Global Advisors Funds Distributors, LLC (SSGA FD) acts solely as the marketing agent. SSGA FD and State Street Global Advisors are affiliated. Please note all AUM is unaudited.

1 Bloomberg Financial L.P. & State Street Global Advisors, data as of June 22, 2023.

2 Source: Bloomberg Financial L.P. & State Street Global Advisors, data as of May 31, 2023. Note: Third largest is measured by total assets under management for US listed gold-backed.

3 Bloomberg Financial L.P. & State Street Global Advisors, data as of May 31, 2023.

Important Risk Disclosures

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

Past performance is not a reliable indicator of future performance.

Diversification does not ensure a profit or guarantee against loss.

The views expressed in this material are the views of State Street SPDR through the period ended June 26, 2023 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

Investing involves risk including the risk of loss of principal.

This communication is not intended to be an investment recommendation or investment advice and should not be relied upon as such.

Investing involves risk, and you could lose money on an investment in each of SPDR® Gold Shares Trust (“GLD®” or “GLD”) and SPDR® Gold MiniShares® Trust (“GLDM®” or “GLDM”), a series of the World Gold Trust (together, the “Funds”).

Commodities and commodity-index linked securities may be affected by changes in overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities.

Investing in commodities entails significant risk and is not appropriate for all investors.

Important Information Relating to GLD® and GLDM®:

GLD and the World Gold Trust have each filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for GLD and GLDM, respectively. Before you invest, you should read the prospectus in the registration statement and other documents each Fund has filed with the SEC for more complete information about each Fund and these offerings. Please see each Fund’s prospectus for a detailed discussion of the risks of investing in each Fund’s shares. The GLD prospectus is available by clicking here, and the GLDM prospectus is available by clicking here. You may get these documents for free by visiting EDGAR on the SEC website at sec.gov or by visiting spdrgoldshares.com. Alternatively, the Funds or any authorized participant will arrange to send you the prospectus if you request it by calling 866.320.4053.

None of the Funds is an investment company registered under the Investment Company Act of 1940 (the “1940 Act”). As a result, shareholders of each Fund do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act. GLD and GLDM are not subject to regulation under the Commodity Exchange Act of 1936 (the “CEA”). As a result, shareholders of each of GLD and GLDM do not have the protections afforded by the CEA.

Shares of each Fund trade like stocks, are subject to investment risk and will fluctuate in market value.

The values of GLD shares and GLDM shares relate directly to the value of the gold held by each Fund (less its expenses), respectively. Fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them.

None of the Funds generate any income, and as each Fund regularly sells gold to pay for its ongoing expenses, the amount of gold represented by each Fund share will decline over time to that extent.

The World Gold Council name and logo are a registered trademark and used with the permission of the World Gold Council pursuant to a license agreement. The World Gold Council is not responsible for the content of, and is not liable for the use of or reliance on, this material. World Gold Council is an affiliate of the Sponsor of each of GLD and GLDM.

MiniShares® is a registered trademark of WGC USA Asset Management Company, LLC used with the permission of WGC USA Asset Management Company, LLC. GLD® and GLDM® are registered trademarks of World Gold Trust Services, LLC used with the permission of World Gold Trust Services, LLC.

For more information, please contact the Marketing Agent for GLD and GLDM: State Street Global Advisors Funds Distributors, LLC, One Iron Street, Boston, MA, 02210; T: +1 866 320 4053 spdrgoldshares.com

Intellectual Property Information: The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and have been licensed for use by State Street Global Advisors. S&P®, SPDR®, S&P 500®, US 500 and the 500 are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by State Street Global Advisors. The fund is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of these indices.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured · No Bank Guarantee · May Lose Value

Distributor:

State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

© 2023 State Street Corporation.

All Rights Reserved.

Contacts

Deborah Heindel

+1 617 662 9927

DHEINDEL@StateStreet.com