Walker & Dunlop Arranges $131 Million Construction Financing from PCCP, LLC and Corebridge Financial for Werwaiss Properties’ Long Island City Residential Tower

Walker & Dunlop Arranges $131 Million Construction Financing from PCCP, LLC and Corebridge Financial for Werwaiss Properties’ Long Island City Residential Tower

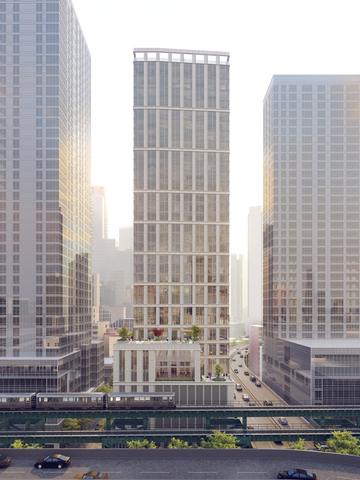

BETHESDA, Md.--(BUSINESS WIRE)--Walker & Dunlop Inc., New York Capital Markets team announced today that it arranged a $131 million construction loan for 23-10 42nd Road, a 35-story residential development situated at the convergence of the Court Square and Queens Plaza subdistricts in Long Island City, New York – one of the fastest growing neighborhoods in America.

The building will be developed with a classic yet contemporary curtain wall façade and include 240 thoughtfully designed studio one-and two-bedroom apartments featuring premium unit finishes. In addition, the project will include more than 15,000 square feet of indoor and outdoor amenities, including a triple-height fitness center, a residents’ lounge with co-working spaces, a roof-level sky lounge, and multiple amenity terraces, all with expansive views of the Manhattan skyline.

Foundation work was completed in Fall 2022, and the project is anticipated to be completed in Summer 2025. The site’s superior location provides exceptional western-facing views of Manhattan as well as unparalleled transportation access across New York City. Werwaiss Properties has partnered with Albanese Development Corporation to act as their development manager supporting the project.

Walker & Dunlop represented the sponsor, Werwaiss Properties, a multi-generational, family-owned real estate development company, to secure the floating rate construction loan through Corebridge Financial (formerly AIG) and PCCP, LLC.

“PCCP is pleased to work alongside Corebridge Financial to provide capital to Werwaiss Properties, a long-term oriented repeat PCCP borrower, for this thoughtfully conceived residential tower in one of New York’s most rapidly growing, transit-rich neighborhoods. We’re proud to work with experienced developers to help create additional market rates and attainable housing options in New York City,” said Brian Haber, managing director with PCCP.

The Walker & Dunlop capital markets team, representing the sponsor, was led by Jonathan Schwartz, Aaron Appel, Adam Schwartz, Keith Kurland, and Michael Diaz.

“We are thrilled to work with a premier sponsor like Werwaiss Properties to help them capitalize this marquee building,” said Jonathan Schwartz, senior managing director at Walker & Dunlop. “In this challenging capital markets environment, we thank PCCP and Corebridge for recognizing this outstanding opportunity.”

In 2022, Walker & Dunlop’s Capital Markets group sourced capital for transactions totaling nearly $26 billion from non-Agency capital providers. This vast experience has made them a top advisor on all asset classes for many of the industry’s top developers, owners, and operators. To learn more about Walker & Dunlop’s broad financing options, visit our website.

About Walker & Dunlop

Walker & Dunlop (NYSE: WD) is one of the largest commercial real estate finance and advisory services firms in the United States. Our ideas and capital create communities where people live, work, shop, and play. The diversity of our people, breadth of our brand and technological capabilities make us one of the most insightful and client-focused firms in the commercial real estate industry.

About PCCP, LLC

PCCP, LLC is a real estate finance and investment management firm focused on commercial real estate debt and equity investments. PCCP has $21.0 billion in assets under management on behalf of institutional investors. With offices in New York, San Francisco, Atlanta, and Los Angeles, PCCP has a 24-year track record of providing real estate owners and investors with a broad range of funding options to meet capital requirements. PCCP underwrites the entire capital stack to exploit inefficiencies in the market and provide investors with attractive risk-adjusted returns. Since its inception in 1998, PCCP has managed, raised or invested over $36.8 billion of capital through a series of investment vehicles including private equity funds, separate accounts and joint ventures. PCCP continues to seek investment opportunities with experienced operators seeking fast and reliable capital. Learn more about PCCP at www.pccpllc.com.

About Werwaiss Properties

Werwaiss Properties is a multi-generational, family-owned real estate management and development company based in Long Island City, New York, where we have been active members of the community for more than a century. We are long-term owners and hands-on operators who own, develop and manage more than one million square feet of commercial, industrial, residential, and retail real estate in more than 75 buildings located primarily in and around Long Island City with additional commercial, retail and residential properties located in Manhattan, Pennsylvania and Florida. In 2023, Werwaiss Properties expects to complete construction of 8 Court Square, a 20-story, 157-unit premium residential and retail development in the heart of Long Island City. Learn more about Werwaiss Properties at www.werwaiss.com.

Contacts

Investors:

Kelsey Duffey

Investor Relations

Phone 301.202.3207

investorrelations@walkeranddunlop.com

Media:

Nina H. von Waldegg

VP, Public Relations

Phone 301.564.3291

info@walkeranddunlop.com

Phone 301.215.5500

7272 Wisconsin Avenue, Suite 1300

Bethesda, Maryland 20814