Insurtech Overalls Secures $4.6M in Funding to Pioneer Behavioral Insurance

Insurtech Overalls Secures $4.6M in Funding to Pioneer Behavioral Insurance

Signs with AllState Identity Protection, Matic Insurance and rolls out new consumer concierge product to employers

NEW YORK--(BUSINESS WIRE)--Overalls, a tech-enabled benefits company that combines concierge-like services with personalized financial protection to help people save time, money and stress, today announced that it has closed $4.6M in new funding to accelerate its growth and product development. RPM Ventures, which has been investing in businesses revolutionizing insurance and financial services for two decades, led the round. Other participants in the round include Frontier Ventures, angel investor and former NFL player Jerod Mayo, and various other existing investors. With cumulative funding of $8.6M, Overalls is poised to achieve its vision of making financial resilience obtainable by the masses.

The pandemic has reinforced the importance of financial, mental and personal well-being, with employees placing increased value on receiving those types of support mechanisms from their employers. A recent study by PwC found that 63% of employees felt their financial stress had increased since the beginning of the pandemic and that 45% of those under financial stress had been distracted at work and an incredible 72% would be attracted to another employer who cared more about their financial well-being. Yet, another recent study by SHRM and JP Morgan that polled Human Resource professionals found that 74% of employers had not added new benefits or extended existing benefits to help employees ease their financial stress.

Overalls is addressing this need by creating a personalized and dynamic insurance model and partnering with employers across the country to deliver well-rounded benefits for the modern workforce.

Founded in 2021 by fintech veterans Jon Cooper and Emily Johnson at Redesign Health, Overalls’ insurtech platform integrates seamlessly with existing benefits programs and enables companies to help their people save time, money and stress, while also improving adoption of voluntary benefits. It aims to improve people’s overall financial resilience and make insurance more relatable and accessible to everyone. Overall’s insurance platform provides a consumer-centric experience that is centered around three core product areas:

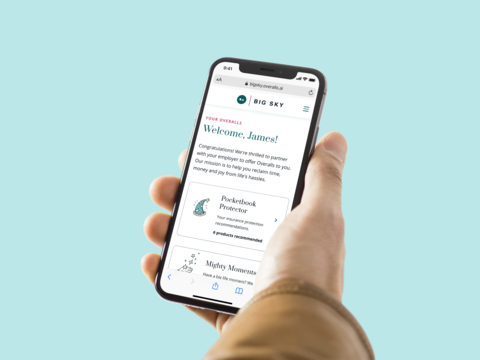

- Hassle Helper: A digitally enabled human support assistant to help individuals save time and navigate life’s hassles such as household and car repairs, credit monitoring, identity theft, travel issues and more.

- Pocketbook Protector: Personalized portfolio of insurance and financial products curated to a person’s lifestyle, helping them save money now and reduce risk in the future.

- Mighty Moments: Celebrates individuals around important life events such as weddings, new home and car, new baby, with rewards and planning support.

“Overalls is bringing much needed innovation to the area of supplemental benefits by making insurance engaging, relatable and personal,” said Adam Boyden, Managing Director, RPM Ventures. “Overalls will fundamentally reshape how consumers think about insurance and employers think about benefits. The team’s ambitious vision aligns perfectly with RPM’s approach to investing in companies that profoundly improve financial services.”

Since Overalls’ launch last year, they’ve built significant momentum, securing partnerships with leading companies and infrastructure solutions including AllState Identity Protection, Matic, Boost and Ladder. The company has signed over twenty-five employers to pilot their new offering. This new funding round will be used to accelerate its market expansion and insurance offerings.

“A majority of people dread dealing with insurance issues and don’t think about insurance until it’s too late,” said Jon Cooper, CEO, Overalls. “We want to demystify insurance and focus attention on what matters most to people–saving time, celebrating important milestones and planning for the future. We’re excited by the incredible employer feedback and early adoption we’re seeing in the market, and today’s investment will allow us to further expand our suite of insurance offerings.’

Overalls helps employers bring more competitive and innovative benefits to their teams– save time and frustration, celebrate life milestones and help protect the people and things they care about most. Overalls also joined the newest cohort of emerging tech solutions at EHIR Academy, Employer Health Innovation Roundtable, a coalition of nearly 100 of the largest and most progressive Employers.

About Overalls

Overalls is a modern benefits offering that unburdens you from life’s big (and small) hassles by combining concierge-like services with financial protection products. Overalls goes much further than traditional insurance, helping you reclaim the time and money spent dealing with day-to-day disruptions while celebrating life’s big moments along the way. Overalls was founded in 2021 by Jon Cooper and Emily Johnson at Redesign Health. For more information on Overalls, please visit Overalls.ai.

About Redesign Health

Redesign Health is a company that powers innovation in healthcare by developing technologies, tools, and insights that lower the barriers to change across the industry. Since 2018, exceptional founders have built over two dozen companies at Redesign Health, impacting more than ten million lives across many aspects of the healthcare ecosystem including cancer care, teleaudiology, COVID-19 testing, metabolic health and more. To learn more, visit redesignhealth.com.

Contacts

Bethany Dufresne

Director of Product Communications, Redesign Health

bethany.dufresne@redesignhealth.com