Counterpoint Research: Foldable Smartphone Volume at 1.5 mn Units in Q1 2022, up 111.2% YoY

Counterpoint Research: Foldable Smartphone Volume at 1.5 mn Units in Q1 2022, up 111.2% YoY

- The global foldable smartphone market’s volume increased 111.2% YoY in Q1 2022.

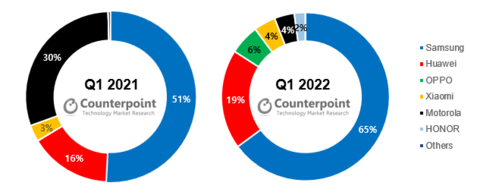

- Samsung continued to lead the foldable market in Q1 2022.

- Chinese OEMs’ market share grew significantly from the end of 2021 due to new launches.

- The global foldable market is expected to grow 83.5% YoY in 2022 and see intensified competition from 2023.

SEOUL & NEW DELHI & HONG KONG & LONDON & BEIJING & SAN DIEGO & BUENOS AIRES--(BUSINESS WIRE)--Despite a weak economic climate, the global foldable smartphone market volume managed to grow 111.2% YoY to 1.5 million units in Q1 2022, according to the latest research from Counterpoint’s Global Foldable Smartphone Tracker. This shipment growth was largely driven by the sales growth of Samsung’s Galaxy Z Flip 3 and Z Fold 3, which were released last year and proved to be a groundbreaker in foldable sales.

Foldable smartphone launches in 2021 by Chinese brands such as OPPO, Huawei and HONOR, which mostly entered the market in Q4 2021, also helped the growth of the global foldable market in Q1 2022.

According to Counterpoint’s latest foldable smartphone market forecast, the market will grow 84% YoY in 2022 to reach 17 million units in sales, and about 30 million in 2023.

Commenting on the foldable market dynamics, Senior Analyst Jene Park said, “New foldable smartphone models from Chinese brands are focused on the home market so far. Therefore, Samsung’s foldable smartphone leadership is not expected to be shaken this year. However, from 2023, when Chinese OEMs are expected to expand into the global foldable market, full-scale competition may be seen in various markets.”

Park added, “The foldable smartphone is a technology-intensive product that requires the technical perfection of hinges and the foldable display. The degree of weight reduction and battery efficiency is also important. So, it is not easy to enter the market except for major global OEMs. Though the competition is expected to intensify from 2023, the number of participants is expected to be limited.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Contacts

Analyst Contacts:

Jene Park

press@counterpointresearch.com