First Insight Inflation Study: Gas, Groceries, and Dining Out Top the List for Rising Costs; Apparel, Footwear and Accessories in Top 7 Squeezing Consumers

First Insight Inflation Study: Gas, Groceries, and Dining Out Top the List for Rising Costs; Apparel, Footwear and Accessories in Top 7 Squeezing Consumers

--Finding is first in a series of insights on inflation’s impact on consumer spending--

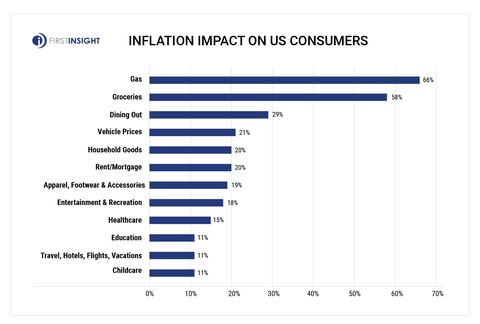

PITTSBURGH--(BUSINESS WIRE)--Gasoline, groceries, and dining out top a list of the twelve most acute inflation pain points for consumers today, according to First Insight’s latest study detailing the impacts of inflation on consumer spending. At the same time Apparel, Footwear and Accessories are in the Top 7 driving pricing concerns that are already compounded with supply chain issues and availability of goods.

“Soaring gas and food prices are just the tip of the iceberg for consumers today,” said Greg Petro, CEO, First Insight. “Record high prices on essential items will negatively impact both consumers’ confidence and their spending power. Some categories, such as Apparel, Footwear, Accessories, Travel and Entertainment may struggle as consumers cut back on discretionary spending. It will be critically important for companies to remain close to their customer base to predict how they are going to respond to all the changes out there.”

The top twelve categories affecting consumers’ daily lives the most include:

- Gas

- Groceries

- Dining

- Vehicle Prices

- Household Goods

- Rent/Mortgage

- Apparel, Footwear & Accessories

- Entertainment & Recreation

- Healthcare

- Education

- Travel, Hotels, Flights, Vacations

- Childcare

This study is the first in a series of reports which will reveal the influence inflation is having on various consumer groups and demographic segments such as people who are returning to the office. The reports also present deep dives into specific concerns by generation, regions, and other demographic groupings.

Learn more and view the infographic here.

About First Insight, Inc.

First Insight, the world leader in Next-Gen Experience Management (XM), is transforming how companies make better decisions leading to a sustainable future. Customers include some of the world’s leading vertically integrated brands, sporting goods companies, department stores, consumer products companies, mass merchant retailers and wholesalers. For further information, please visit www.firstinsight.com.

Methodology

First Insight’s findings are based upon a survey conducted through its proprietary platform. The report is based upon a sample of 1000 U.S. adults fielded by email in April, 2022. The sample was balanced by generation, geography, and gender. Further details on the findings are available upon request.

Contacts

Media:

Berns Communications Group

Stacy Berns/Michael McMullan

sberns@bcg-pr.com/mmcmullan@bcg-pr.com

First Insight:

Gretchen Jezerc

SVP of Marketing

gretchen.jezerc@firstinsight.com