Investors With Concentrated Stock Positions Face Heightened Risks From A Potential Rise in Capital Gains Tax Rates

Investors With Concentrated Stock Positions Face Heightened Risks From A Potential Rise in Capital Gains Tax Rates

Diversifying portfolios to reduce risk could carry higher capital gains liabilities, seriously eroding investment returns and personal wealth

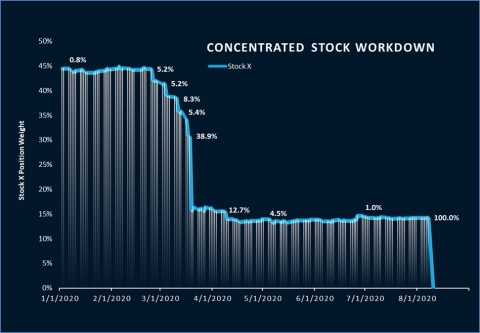

The chart (‘Concentrated Stock Work Down’) represents a real-life example of a Canvas client portfolio. The client started using Canvas with a 45% weight to a single stock (‘Stock X’). Through active tax management (% of position sold each day labeled on the curve) the position was reduced to 14% in eight months with zero net capital gains. (Photo: Business Wire)

STAMFORD, Conn.--(BUSINESS WIRE)--According to O’Shaughnessy Asset Management, LLC (OSAM), a leading quantitative asset management firm and developer of Custom Indexing platform Canvas®, investors with concentrated stock positions face heightened risks from the political uncertainty over a rise in capital gains tax rates. Large, concentrated positions are often accumulated through an initial public offering (IPO) or stock awards as a component of executive compensation and can carry an exceptionally low cost basis with significant tax liabilities resulting from sales. In the event capital gains taxes increase from an effective rate of 23.8% to 43.4% for households with income greater than $1 million, financial advisors and investors will face challenging decisions and tradeoffs with respect to the cost of diversification and wealth preservation. To solve for complex portfolio transition issues, OSAM’s Custom Indexing platform Canvas was specifically developed to optimize for investment goals, risk sensitivity, and tax efficiency.

“Individuals can acquire relatively outsized positions in a stock through an IPO or years of annual stock awards,” said Patrick O’Shaughnessy, CFA, Chief Executive Officer of OSAM. “People inherently understand that diversification is imperative in terms of reducing risk and positioning for greater long-term performance. Far less appreciated is the significant impact that capital gains taxes can have when undertaking such a momentous transition. As capital gains taxes are only likely to increase – which could significantly reduce personal wealth – individuals will need a ‘best-in-class’ transition strategy that results in a specific glidepath to work towards diversification as tax efficiently and effectively as possible.”

Financial advisors often reduce positions in stages to spread out the related tax expenses. Typically, advisors liquidate a percentage of the position each year over a preset period. Advisors conduct portfolio assessments at year end to sell negatively performing stocks to generate investment losses and tax benefits that can be used to partially offset gains from sales of low cost basis positions; a practice known as tax loss harvesting.

A preset approach to reducing concentrated single-stock risk is unlikely to produce the most efficient outcomes as loss harvesting potential is maximized by continually and systematically seeking losses throughout the tax year. Furthermore, when transitioning, unintended risk overweights can often present themselves, complicating and delaying transitions. Advisors adopting a risk-aware, opportunistic, and continual work-down strategy should yield a higher probability to achieve diversification tax efficiently; aspects that will only increase in importance with rate increases.

“An individual accumulating a large position in a stock often represents the culmination of years of work,” added O’Shaughnessy. “A non-dynamic approach which is one-size-fits-all just doesn’t meet the seriousness that the moment requires. For example, advisors who waited until the end of last year to perform tax loss harvesting missed out on a massive opportunity during the pandemic-induced market selloff in March 2020. A systematic work down of a large position is a defining event during which advisors can provide real, measurable value by focusing on preserving and building upon what their clients have worked so hard to create.”

The chart (‘Concentrated Stock Work Down’) represents a real-life example of a Canvas client portfolio. The client started using Canvas with a 45% weight to a single stock (‘Stock X’). The client’s financial advisor was eager to transition to a more diversified portfolio, but the position was owned at $0 cost basis. Through active tax management (% of position sold each day labeled on the curve) the position was reduced to 14% in 8 months with zero net capital gains. The success of this transition led the advisor to liquidate the position in August to fully achieve the target diversified model.

A work down such as this is most efficiently executed by pairing the overweight position with a pure passive strategy. In 2020 Canvas accounts that were purely passive averaged 9.3% of additional after-tax return (‘tax alpha’) versus its non-tax-managed equivalent. However, tax savings are not limited to concentrated portfolios as Canvas clients realized an average of 2.1% in additional after-tax return across all portfolios in 2020.

“Any increase in capital gains will certainly increase tax sensitivity,” added O’Shaughnessy. “Advisors should prepare for this by ensuring they have a tax management solution that optimizes for tax alpha and risk minimization on behalf of their clients.”

About OSAM

O’Shaughnessy Asset Management, LLC (OSAM) is a quantitative asset management firm based in Stamford, CT. The firm delivers a broad range of equity portfolios to institutional investors, individual investors, and high-net-worth clients of financial advisors. OSAM also serves as the investment advisor for a U.S. mutual fund and as a sub advisor to a family of mutual funds in Canada. The firm’s team has managed client assets since 1996. For more information on Canvas, please go to canvas.osam.com.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, strategy, or product, or any non-investment related content, referred to in this press release will be profitable, equal any corresponding indicated historical performance levels, be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this piece serves as the receipt of, or as a substitute for, personalized investment advice from OSAM. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation they are encouraged to consult with the professional advisor of their choosing. OSAM is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. For more information on OSAM, please go to osam.com.

Contacts

Jonathan Mairs

The IGB Group

jmairs@igbir.com

917-517-7097