New Gold Reports In-Line First Quarter Operational Results and Provides an Early-Stage Exploration Update

New Gold Reports In-Line First Quarter Operational Results and Provides an Early-Stage Exploration Update

(All amounts are in U.S. dollars unless otherwise indicated)

TORONTO--(BUSINESS WIRE)--April 13, 2021 – New Gold Inc. (“New Gold” or the “Company”) (TSX and NYSE American: NGD) reports in-line first quarter operational results for the Company as of March 31, 2021 and provides an early-stage exploration update. The Company is also providing details for the first quarter earnings conference call and webcast that is scheduled for May 5, 2021 at 8:30 am Eastern Time (details are provided at the end of this news release).

New Gold begins 2021 as a much stronger company with a growing production profile from the Rainy River Mine at lower costs, as deferred capital projects have been completed and the mine transitions to generating free cash flow. Following the receipt of the Mines Act permit, the New Afton B3 zone will begin production in the second quarter while current mining operations at New Afton continue to ramp- up following the tragic mud-rush incident in February. The focus in 2021 remains on further operational and cost optimizations at both Rainy River and New Afton, launching B3 production, advancing C-Zone development at New Afton, and following up on key targets from the exploration drilling programs.

“During the quarter, the Rainy River Mine delivered to plan. Waste stripping was strategically prioritized during the winter months, which will set the mine up for higher grades and a stronger production profile in the second half of the year. The New Afton Mine continues to safely and sequentially ramp-up operations and we look forward to initiating ore extraction from the B3 zone. I am very proud of the progress the team has made at New Afton, and coupled with the execution at Rainy River, we remain on-track to achieve our annual guidance estimates,” stated Renaud Adams, President & CEO. “Late last year, we re-launched exploration drilling programs at both operations after an extended period of inactivity. We are encouraged by the early-stage results to date.”

Consolidated First Quarter and Recent Highlights

- Total production for the first quarter was 96,026 gold equivalent1 ("gold eq.") ounces (66,650 ounces of gold, 187,224 ounces of silver and 13.8 million pounds of copper), in-line with plan.

- The Rainy River Mine produced 56,513 gold eq. ounces (54,656 ounces of gold and 133,730 ounces of silver) for the quarter, in-line with plan.

- The New Afton Mine produced 39,512 gold eq. ounces (11,994 ounces of gold and 13.8 million pounds of copper) for the quarter, slightly below plan, as underground mining operations continue to be safely and sequentially ramped-up following the tragic mud-rush incident on February 2, 2021. (Refer to the Company's news releases dated February 2, 4, 5, and 8, 2021 for further information).

- Anne Day, Vice President, Investor Relations will leave the Company June 30, 2021, and all Investor Relations responsibilities are now being assumed by Ankit Shah, Vice President, Strategy & Business Development.

Consolidated First Quarter Operational Results

|

Q1 2021 |

2021 Guidance |

Gold eq. production (ounces)1 |

96,026 |

440,000 - 490,000 |

Gold production (ounces) |

66,650 |

322,000 - 352,000 |

Copper production (Mlbs) |

13.8 |

56 – 66 |

1. Total gold eq. ounces include silver and copper produced converted to a gold eq. based on a ratio of $1,800 per gold ounce, $25.00 per silver ounce and $3.50 per copper pound used for 2021 guidance estimates. All copper is produced by the New Afton Mine. |

||

1. See "Non-GAAP Measures" section of this news release.

Rainy River Mine Operational Highlights

Rainy River Mine Highlights

Rainy River Mine |

Q1 2021 |

2021 Guidance |

Gold eq. production (ounces)1 |

56,513 |

275,000 – 295,000 |

Gold eq. sold (ounces) |

53,577 |

|

Gold production (ounces) |

54,656 |

270,000 – 290,000 |

Gold sold (ounces) |

51,796 |

|

1. Gold eq. ounces for Rainy River in Q1 2021 includes 133,730 ounces of silver converted to a gold eq. based on a ratio of $1,800 per gold ounce and $25.00 per silver ounce used for 2021 guidance estimates. |

||

Rainy River Mine Operating KPI’s

Rainy River Mine (Open Pit Mine only) |

FY 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Tonnes mined per day (ore and waste) |

118,404 |

127,684 |

126,512 |

145,701 |

158,638 |

150,767 |

Ore tonnes mined per day |

18,712 |

26,012 |

23,101 |

36,515 |

42,918 |

35,681 |

Operating waste tonnes per day |

73,702 |

75,596 |

72,575 |

62,818 |

73,921 |

65,643 |

Capitalized waste tonnes per day |

25,990 |

26,077 |

30,836 |

46,368 |

41,799 |

49,442 |

Total waste tonnes per day |

99,692 |

101,673 |

103,411 |

109,186 |

115,720 |

115,085 |

Strip ratio (waste:ore) |

5.33 |

3.91 |

4.48 |

2.99 |

2.70 |

3.23 |

Tonnes milled per calendar day |

21,980 |

18,441 |

23,880 |

26,998 |

26,999 |

26,301 |

Gold grade milled (g/t) |

1.08 |

1.03 |

0.78 |

0.88 |

0.93 |

0.80 |

Gold recovery (%) |

91 |

90 |

89 |

89 |

90 |

89 |

Mill availability (%) |

88 |

91 |

90 |

90 |

94 |

89 |

Gold production (oz) |

253,772 |

50,381 |

48,800 |

63,004 |

66,734 |

54,656 |

Gold eq. production1 (oz) |

257,051 |

51,106 |

49,633 |

64,221 |

68,241 |

56,513 |

1. Gold eq. ounces for Rainy River in Q1 2021 includes 133,730 ounces of silver converted to a gold eq. based on a ratio of $1,800 per gold ounce and $25.00 per silver ounce used for 2021 guidance estimates. |

||||||

In 2021, the Rainy River Mine is expected to achieve production increases and decreases in both operating and capital costs as it transitions to generating sustainable free cash flow. During the year, the focus will remain on further operational and cost optimizations and the continued conversion of underground reserves for inclusion in an optimized underground mine plan. Production is expected to be lower in the first half of the year due to planned lower grades as the mine plan focuses on waste stripping. Production is expected to increase in the second half of the year as grades improve, as mining returns to the planned higher-grade Phase 2 area of the pit. Sustaining capital is expected to be lower in 2021 as key deferred capital projects were completed in 2020. Growth capital for the year is expected to increase over 2020 as the decline development towards the Intrepid underground ore zone advances over the year.

- Our COVID-19 response continued to be effective with the implementation of rapid testing at Rainy River. The site had two COVID-19 cases in the quarter. Contact tracing was completed by the site team and through Public Health. The individuals were isolated immediately, and all other close contacts tested negative. These isolated cases posed minimal risk to the operation. As of today, two employees have tested non-negative with the in-house PCR device and the mine is awaiting confirmation from Public Health. Further information on the Company’s response to COVID-19 is available via the following link: https://newgold.com/covid-19/.

- First quarter gold eq. production was 56,513 ounces (54,656 ounces of gold and 133,730 ounces of silver). Lower grades were expected during the quarter as mining operations were focused on Phase 3 stripping to bring pit walls to the final pit limit. During the second half of the year, grades are expected to increase as the mine returns to Phase 2 area of the pit.

- During the quarter, the open pit mine achieved 150,767 tonnes per day, a decrease over the prior quarter due to lower drilling rates as a result of extreme winter weather conditions, but in-line with the 2021 target of ~151,000 tonnes per day. Approximately 3.2 million ore tonnes and 10.4 million waste tonnes (including 4.4 million capitalized waste tonnes) were mined from the open pit at an average strip ratio of 3.23:1. During the second half of the year, the strip ratio is expected to decrease as operations return to Phase 2 area of the pit.

- The mill processed 26,301 tonnes per day for the quarter, slightly above plan. The mill continued to process ore directly supplied by the open pit combined with ore from the medium grade stockpile and processed an average grade of 0.80 grams per tonne at a gold recovery of 89%. Mill availability for the quarter averaged 89%, lower than the prior quarter due to planned maintenance activities.

- At the end of the quarter, development of the decline towards the Intrepid underground ore zone advanced 650 metres. The first ore level was accessed and approximately 155 metres of development in ore was completed with tonnes and grades mined reconciling with the block model. Approximately 16,000 tonnes of development ore at 1.20 grams per tonne has been stockpiled.

New Afton Mine Operational Highlights

New Afton Mine Highlights

New Afton Mine |

Q1 2021 |

2021 Guidance |

Gold eq. production (ounces)1 |

39,512 |

165,000 – 195,000 |

Gold eq. sold (ounces) |

38,241 |

|

Gold production (ounces) |

11,994 |

52,000 – 62,000 |

Gold sold (ounces) |

11,744 |

|

Copper production (Mlbs) |

13.8 |

56 – 66 |

Copper sold (Mlbs) |

13.3 |

|

1. Gold eq. ounces for New Afton in Q1 2021 includes 13.8 million pounds of copper and 53,494 ounces of silver converted to a gold eq. based on a ratio of $1,800 per gold ounce, $3.50 per copper pound and $25.00 per silver ounce used for 2021 guidance estimates. |

||

New Afton Mine Operating KPI’s

New Afton Mine |

FY 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Tonnes mined per day (ore and waste) |

15,620 |

16,727 |

15,358 |

17,249 |

17,259 |

11,395 |

Tonnes milled per calendar day |

15,300 |

15,377 |

14,240 |

15,483 |

15,358 |

13,564 |

Gold grade milled (g/t) |

0.47 |

0.45 |

0.46 |

0.44 |

0.46 |

0.39 |

Gold recovery (%) |

82 |

81 |

81 |

80 |

79 |

79 |

Gold production (oz) |

68,785 |

16,409 |

15,494 |

15,955 |

16,362 |

11,994 |

Copper grade milled (%) |

0.78 |

0.73 |

0.72 |

0.71 |

0.73 |

0.64 |

Copper recovery (%) |

83 |

82 |

83 |

82 |

81 |

80 |

Copper production (Mlbs) |

79.4 |

18.5 |

16.9 |

18.2 |

18.5 |

13.8 |

Mill availability (%) |

97 |

98 |

92 |

98 |

99 |

96 |

Gold eq. production1 (oz) |

229,091 |

52,329 |

48,446 |

51,315 |

52,326 |

39,512 |

1. Gold eq. ounces for New Afton in Q1 2020 includes 13.8 million pounds of copper and 53,494 ounces of silver converted to a gold eq. based on a ratio of $1,800 per gold ounce, $3.50 per copper pound and $25.00 per silver ounce used for 2021 guidance estimates. |

||||||

The 2021 mine plan for New Afton was adjusted following the tragic mud-rush event that occurred on February 2, 2021 (for further details, refer to the Company's guidance news release dated February 18, 2021). Underground mining activities are currently being safely and sequentially ramped-up as we continue to maintain our focus on the health, safety and wellbeing of our people. 2021 mine plan contemplates lower tonnes mined from the recovery level, as mining operations will be limited to remote mucking activities. Mining in the other areas of Lift 1, including the West Cave, East Cave and Pillar, ramped-up during the quarter and returned to pre-incident mining rates at the end of the quarter.

- New Afton implemented wearable contact tracing technology and is in the process of achieving rapid testing accreditation as outlined by the Government of British Columbia. New Afton continues to take all precautions to protect employees and contractors from COVID-19. The mine had four positive cases in the quarter, and all have recovered. Contact tracing was completed by the site team and through Public Health and the individuals were isolated immediately. There are currently no active cases of COVID-19 at the New Afton Mine. Further information on the Company’s response to COVID-19 is available via the following link: https://newgold.com/covid-19/.

- First quarter gold eq. production was 39,512 ounces(11,994 ounces of gold, and 13.8 million pounds of copper).

- The underground mine averaged 11,395 tonnes per day for the quarter, lower than previous quarters as underground operations continued to ramp-up during the quarter following the tragic mud-rush incident in February. Mining rates increased in March, averaging approximately 16,200 tonnes per day, near pre-incident mining rates.

- Following the receipt of the Mines Act permit, B3 production will begin during the second quarter and ramp-up over the year as more draw points become accessible.

- During the quarter, the mill averaged 13,564 tonnes per day, and is currently incorporating the current surface stockpiles to supplement the overall lower tonnes mined. The mill processed lower than average gold and copper grades of 0.39 grams per tonne gold and 0.64% copper, respectively, with gold and copper recoveries of 79% and 80%, respectively.

- During the quarter, C-Zone development advanced by approximately 820 metres and the project remains on track.

- Construction of the TAT facility advanced during the quarter and all major equipment and major building equipment is currently on-site.

- Stabilization efforts advanced during the quarter, including the completion of Phase 1 earthworks at the Historic Afton Tailings Storage Facility as well as Phase 2 dewatering efforts. Stabilization of the New Afton Tailings Storage Facility progressed during the quarter and approximately thirteen dewatering wells are targeted for installation by the end of the year.

- The C-Zone permit process was initiated with the pre-application package submitted during the first quarter.

Exploration Update

Late in the fourth quarter of 2020, the Company launched early-stage exploration drilling programs at the New Afton and Rainy River Mines following an extended period of inactivity. The targets at New Afton are within a large area, called the "Cherry Creek Trend" characterized by distinct clusters of coincidental geophysical and soil geochemical anomalism, alteration variations, major structures and both epithermal and porphyry style mineralization signatures within the same rocks hosting New Afton deposit. Targets at the "Rainy River North East Trend" are related with coincidental geophysical and soil geochemical anomalism, reactive host rocks and quartz veining centered along an interpreted regional structural trend showing characteristic of shear zone hosted style mineralization. Initial results have been encouraging from both exploration programs, including the continued confidence in potential epithermal and porphyry systems within the Cherry Creek Trend as well the potential shear hosted mineralization on the North East Trend. Based on the initial results, follow-up drilling on key target areas are planned to be completed during 2021. The Company expects to provide regular updates on our exploration programs throughout the year.

New Afton Mine

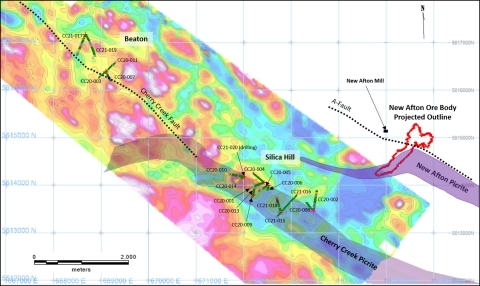

The 2021 drilling program consists of the continuation of the reconnaissance drilling program that was launched at the New Afton Mine in October 2020, which was primarily focused on the prospective Cherry Creek trend, located within three kilometers of the New Afton mill (Figure 1). Additionally, underground drilling within the mine footprint and surface reconnaissance exploration over the company’s broader regional claim holdings has been planned for 2021.

Cherry Creek Trend

The key objective of the Phase 1 reconnaissance drilling program was to identify the potential sources and mineralization causing the geochemical and geophysical anomalism that was previously identified in 2019, particularly to assess the potential for epithermal and gold-copper porphyry style deposits. Six drill holes were designed to test near surface epithermal gold targets and thirteen holes tested both near surface epithermal and deeper porphyry gold-copper targets (Figures 2 and 3).

Results to date at Silica Hill, where several drill holes have returned shallow intercepts of narrow gold and silver mineralization within the preliminary geology model and alteration domains interpreted, show characteristics of mineralization and alteration patterns that halo gold-copper mineralized porphyry systems similar to New Afton deposit. Follow-up drilling started with a deeper hole in the priority target at the Silica Hill area.

To date, 20 diamond drill holes totaling 10,518 metres have been completed in the Cherry Creek trend area (Figures 1, 2 and 3). Average length-of-hole was 515 metres at an average depth from surface of approximately 430 metres. Assay results have been received for 17 drill holes and results for the final 3 drill holes are expected by the end of April (see Table 1 at the end of this news release for full drilling results and Table 2 for drill collar locations).

Highlights include (Figures 4 and 5):

- Alteration and mineralization intercepted within the Silica Hill target is indicative of a potential porphyry system. Alteration domains at Silica Hill target show distinctive hydrothermal patterns vectoring to a potential deep mineralization source from distal propylitic, to argillic, to white-mica and dickite within and haloing a quartz-feldspar porphyry partially bound by picrite.

- Silver mineralized banded quartz veins with anomalous copper halos crosscutting argillic altered host laterally and beneath Silica Hill.

- Gold mineralization hosted in ductile deformed fuchsite-quartz-carbonate altered fine grained sedimentary rocks on the footwall of the picrite unit at Silica Hill.

- Increased thickness of the quartz-feldspar porphyry including increased pyrite content, gold and silver low level geochemical signature(background) at depth and to the northwest of Silica Hill.

- Geochronology quartz-feldspar porphyry dates matches the age date of the alteration associated with sulfosalt, secondary hypogene mineralization enrichment at New Afton deposit.

- Preliminary geological model interpreted the extent of the picrite unit along the length of the Cherry Creek trend showing similar geometry as the picrite bounding the New Afton ore body.

The Phase 2 drilling program will focus on deeper drilling within the interpreted alteration domains on the Silica Hill priority targets.

In March 2021, an underground drilling program commenced to test three targets generated within the New Afton deposit footprint based on an AI (Artificial Intelligence) study completed in 2020 (Figure 6). The program has been designed to complete up to 5,000 metres in 14 holes and is expected to be completed by August 2021. To date, two holes have been completed on the AI West target located approximately 500 metres west of the B3 block cave reserve, where primary sulphide mineralization consisting of chalcopyrite of greater than 1% has been visually described within two continuous intervals of 45 and 34 metres length down the hole (assay results pending).

The reconnaissance exploration program is inclusive of geochemical and geophysical surveys that have been designed to further define drill ready targets within the company’s broader regional claim holdings.

Rainy River Mine

An early-stage exploration program was launched at the Rainy River mine in December 2020 that tested priority targets on the north-east portion of the broader regional mineral tenure to identify areas of potential gold mineralization and to define targets for follow-up drill testing. The first phase of reconnaissance drilling has been completed and follow-up drilling is planned in the second half of 2021 as additional data is compiled and interpretations of all reconnaissance drilling have been completed.

North East Trend

The Company completed a reconnaissance drilling program designed to test targets within areas of coincident geochemical soil anomalies, magnetic geophysical anomalies, and evidence of quartz veins and/or shear zones within the North East Trend area located approximately 15 kilometres north from the Rainy River Mine site. Since the commencement of drilling in December 2020, 11 diamond drill holes totaling 4,023 metres have been completed (Figure 7) and the phase 1 reconnaissance drilling program has been finalized.

Assay results have been received for seven drill holes and results for the last four drill holes are expected by the end of April (see Table 3 at the end of this news release for full drilling results and Table 4 for drill hole collar location).

Highlights include (all results are reported with interval length down the hole):

- Hole RRNT-20-02: 0.42 g/t gold over 3.0 metres.

- Hole RRNT-20-04: 0.61 g/t gold over 3.8 metres, including 1.79 g/t gold over 0.7 metres.

To date, narrow intervals of low-grade gold mineralization has been intercepted within four holes. One drill-hole intersected the targeted shear zone with a 0.7 metres interval of 1.79 g/t gold. The updated interpretation suggests that the shear zone is dipping at 75 degrees to the west and is not subvertical as previously thought and the inclined holes planned to the west potentially missed to undercut the targeted structure.

Additional exploration activities have been planned to support a follow-up drilling program, which includes a soil geochemical survey, geological mapping and trenching to better define the orientation, dip, width, and extent of the interpreted shear zones.

First Quarter Conference Call and Webcast

The Company will host a webcast and conference call on May 5, 2021 at 8:30 am Eastern Time to discuss the Company's first quarter financial and operating results.

- Participants may listen to the webcast by registering on our website at www.newgold.com or via the following link https://onlinexperiences.com/Launch/QReg/ShowUUID=86F834BF-D9B7-4993-A7DA-B27454E7FA65

- Participants may also listen to the conference call by calling toll free 1-833-350-1329, or 1-236-389-2426 outside of the U.S. and Canada, passcode 2491156.

- A recorded playback of the conference call will be available until June 5, 2021 by calling toll free 1-800-585-8367, or 1-416-621-4642 outside of the U.S. and Canada, passcode 2491156. An archived webcast will also be available until June 5, 2021 at www.newgold.com.

About New Gold Inc.

New Gold is a Canadian-focused intermediate gold mining Company with a portfolio of two core producing assets in Canada, the Rainy River gold mine and the New Afton copper-gold Mines. The Company also holds an 8% gold stream on the Artemis Gold Blackwater project located in British Columbia and a 6% equity stake in Artemis. The Company also operates the Cerro San Pedro Mine in Mexico (in reclamation). New Gold's vision is to build a leading diversified intermediate gold company based in Canada that is committed to environment and social responsibility. For further information on the Company, visit www.newgold.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this news release, including any information relating to New Gold’s future financial or operating performance are “forward-looking”. All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that New Gold expects to occur are “forward-looking statements”. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the use of forward-looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “targeted”, “estimates”, “forecasts”, “intends”, “anticipates”, “projects”, “potential”, “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation of such terms. Forward-looking statements in this news release include, among others, statements with respect to: the Company’s plans to grow production and generate free cash flow; the Company’s production and sales; the Company’s plans to optimize operations and costs at the Rainy River Mine and the New Afton Mine; the timing of production from certain areas of the Rainy River Mine and the New Afton Mine; the timing for completion for development projects at the Rainy River Mine and the New Afton Mine; the timing and scope of exploration drilling programs at the Rainy River Mine and the New Afton Mine; and the timing of receipt of permits at the New Afton Mine.

All forward-looking statements in this news release are based on the opinions and estimates of management that, while considered reasonable as at the date of this press release in light of management’s experience and perception of current conditions and expected developments, are inherently subject to important risk factors and uncertainties, many of which are beyond New Gold’s ability to control or predict. Certain material assumptions regarding such forward-looking statements are discussed in this news release, New Gold’s latest annual management’s discussion and analysis (“MD&A”), its most recent annual information form and technical reports on the Rainy River Mine and New Afton Mine filed at www.sedar.com and on EDGAR at www.sec.gov. In addition to, and subject to, such assumptions discussed in more detail elsewhere, the forward-looking statements in this MD&A are also subject to the following assumptions: (1) there being no significant disruptions affecting New Gold’s operations other than as set out herein; (2) political and legal developments in jurisdictions where New Gold operates, or may in the future operate, being consistent with New Gold’s current expectations; (3) the accuracy of New Gold’s current mineral reserve and mineral resource estimates; (4) the exchange rate between the Canadian dollar and U.S. dollar, and to a lesser extent, the Mexican Peso, being approximately consistent with current levels; (5) prices for diesel, natural gas, fuel oil, electricity and other key supplies being approximately consistent with current levels; (6) equipment, labour and materials costs increasing on a basis consistent with New Gold’s current expectations; (7) arrangements with First Nations and other Aboriginal groups in respect of the New Afton Mine and Rainy River Mine being consistent with New Gold’s current expectations; (8) all required permits, licenses and authorizations being obtained from the relevant governments and other relevant stakeholders within the expected timelines; (9) there being no significant disruptions to the Company’s workforce at either the Rainy River or New Afton Mine due to cases of COVID-19 or any required self-isolation requirements (due, among other things, to cross-border travel to the United States or any other country); (10) the responses of the relevant governments to the COVID-19 outbreak being sufficient to contain the impact of the COVID-19 outbreak; (11) there being no material disruption to the Company’s supply chains and workforce that would interfere with the Company’s anticipated course of action at the Rainy River Mine and the systematic ramp-up of operations; (12) the long-term economic effects of the COVID-19 outbreak not having a material adverse impact on the Company’s operations or liquidity position; and (13) Artemis Gold Inc. being able to complete the remaining C$50 million cash payment due on August 24, 2021 for the acquisition of the Blackwater project.

Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. Such factors include, without limitation: significant capital requirements and the availability and management of capital resources; additional funding requirements; price volatility in the spot and forward markets for metals and other commodities; fluctuations in the international currency markets and in the rates of exchange of the currencies of Canada, the United States and, to a lesser extent, Mexico; discrepancies between actual and estimated production, between actual and estimated mineral reserves and mineral resources and between actual and estimated metallurgical recoveries; risks related to early production at the Rainy River Mine, including failure of equipment, machinery, the process circuit or other processes to perform as designed or intended; fluctuation in treatment and refining charges; changes in national and local government legislation in Canada, the United States and, to a lesser extent, Mexico or any other country in which New Gold currently or may in the future carry on business; taxation; controls, regulations and political or economic developments in the countries in which New Gold does or may carry on business; the speculative nature of mineral exploration and development, including the risks of obtaining and maintaining the validity and enforceability of the necessary licenses and permits and complying with the permitting requirements of each jurisdiction in which New Gold operates, the lack of certainty with respect to foreign legal systems, which may not be immune from the influence of political pressure, corruption or other factors that are inconsistent with the rule of law; the uncertainties inherent to current and future legal challenges New Gold is or may become a party to; diminishing quantities or grades of mineral reserves and mineral resources; competition; loss of key employees; rising costs of labour, supplies, fuel and equipment; actual results of current exploration or reclamation activities; uncertainties inherent to mining economic studies; changes in project parameters as plans continue to be refined; accidents; labour disputes; defective title to mineral claims or property or contests over claims to mineral properties; unexpected delays and costs inherent to consulting and accommodating rights of Indigenous groups; risks, uncertainties and unanticipated delays associated with obtaining and maintaining necessary licenses, permits and authorizations and complying with permitting requirements; disruptions to the Company’s workforce at either the Rainy River Mine or the New Afton Mine, or both, due to cases of COVID-19 or any required self-isolation (due to cross-border travel, exposure to a case of COVID-19 or otherwise); the responses of the relevant governments to the COVID-19 outbreak not being sufficient to contain the impact of the COVID-19 outbreak; disruptions to the Company’s supply chain and workforce due to the COVID-19 outbreak; an economic recession or downturn as a result of the COVID-19 outbreak that materially adversely affects the Company’s operations or liquidity position; there being further shutdowns at the Rainy River or New Afton Mines; the Company not being able to complete its construction projects at the Rainy River Mine or the New Afton Mines on the timing described herein or at all; the Company not being able to complete the exploration drilling program to be launched at the Rainy River Mine and Cherry Creek on the timing described herein or at all; Artemis Gold Inc. not being able to make the remaining C$50 million cash payment due in connection with its acquisition of the Blackwater Project on August 24, 2021. In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental events and hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the risk of inadequate insurance or inability to obtain insurance to cover these risks) as well as “Risk Factors” included in New Gold’s Annual Information Form, MD&A and other disclosure documents filed on and available at www.sedar.com and on EDGAR at www.sec.gov. Forward looking statements are not guarantees of future performance, and actual results and future events could materially differ from those anticipated in such statements. All forward-looking statements contained in this news release are qualified by these cautionary statements. New Gold expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, events or otherwise, except in accordance with applicable securities laws.

Technical Information

The scientific and technical information in this news release under the heading “Exploration Update” and the tables and figures below has been reviewed and approved by Mr. Michele Della Libera, Director Exploration of New Gold. All other scientific and technical information contained in this news release has been reviewed and approved by Eric Vinet, Senior Vice President, Operations of New Gold. Mr. Della Libera is a Professional Geoscientist (P.Geo.) and Practicing Member of the Association of Professional Geoscientists of Ontario and the Engineers and Geoscientist of British Columbia. Mr. Vinet is a Professional Engineer and member of the Ordre des ingénieurs du Québec. Mr. Della Libera and Mr. Vinet are "Qualified Persons" for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects. With respect to the scientific and technical information in this news release under the heading “Exploration Update” and the tables and figures below, Mr. Della Libera has verified the data disclosed, including the exploration, analytical and testing data underlying the information. His verification included a review of the applicable assay databases and reviews of the assay certificates. No limitations were imposed on Mr. Della Libera’s verification process. New Gold maintains a Quality Assurance / Quality Control (“QA/QC”) program at its New Afton mine operation using industry best practices and is consistent with the QA/QC protocols in use at all of the company’s exploration and development projects. Key elements of New Gold’s QA/QC program include chain of custody of samples, regular insertion of certified reference standards and blanks, and duplicate check assays. Drill core at New Afton is sampled commonly at 2 metres intervals or less than 2 metres upon geological changes, halved and shipped in sealed bags to Actlabs Laboratories in Kamloops, British Columbia. Drill core at Rainy River is sampled at a regular 1.5 metres interval or less than 1.5 metres upon geological changes, halved and shipped in sealed bags to Actlabs Laboratories in Thunder Bay, Ontario. Additional information regarding the company’s quality assurance processes is set out in the New Afton and Rainy River NI 43-101 Technical Reports available at www.sedar.com.

For additional technical information on New Gold’s material properties, including a detailed breakdown of Mineral Reserves and Mineral Resources by category, as well as key assumptions, parameters and risks, refer to New Gold’s Annual Information Form for the year ended December 31, 2020.

Table 1: Cherry Creek Drill Assay Results (≥ 0.2 g/t Au and/or ≥ 10 g/t Ag and interval as length down the hole)

Drill Hole |

From (metres) |

To (metres) |

Interval (metres) |

Gold (g/t) |

Silver (g/t) |

Cu (ppm) |

||

CC20-001 |

0.0 |

348.2 |

348.2 |

No significant results |

||||

348.2 |

349.6 |

1.4 |

0.01 |

20.7 |

149 |

|||

349.6 |

406.8 |

57.2 |

No significant results |

|||||

406.8 |

407.6 |

0.8 |

0.24 |

0.2 |

55 |

|||

407.6 |

430.0 |

22.4 |

No significant results |

|||||

430.0 |

432.1 |

2.1 |

0.83 |

1.5 |

9 |

|||

432.1 |

485.5 |

53.4 |

No significant results |

|||||

CC20-002 |

0.0 |

429.6 |

429.6 |

No significant results |

||||

429.6 |

431.0 |

1.4 |

0.00 |

13.5 |

174 |

|||

431.0 |

662.0 |

231.0 |

No significant results |

|||||

CC20-003 |

0.0 |

574.0 |

574.0 |

No significant results |

||||

CC20-004 |

0.0 |

395.5 |

395.5 |

No significant results |

||||

395.5 |

397.0 |

1.5 |

0.00 |

48.2 |

172 |

|||

397.0 |

461.5 |

64.5 |

No significant results |

|||||

CC20-005 |

0.0 |

489.7 |

489.7 |

No significant results |

||||

CC20-006 |

0.0 |

440.5 |

440.5 |

No significant results |

||||

CC20-007 |

0.0 |

414.0 |

414.0 |

No significant results |

||||

CC20-008 |

0.0 |

401.0 |

401.0 |

No significant results |

||||

CC20-009 |

0.0 |

164.0 |

164.0 |

No significant results |

||||

CC20-010 |

0.0 |

609.5 |

609.5 |

No significant results |

||||

CC20-011 |

0.0 |

243.7 |

243.7 |

No significant results |

||||

243.7 |

244.5 |

0.8 |

0.00 |

12.3 |

99 |

|||

244.5 |

425.3 |

180.8 |

No significant results |

|||||

CC20-012 |

0.0 |

166.0 |

166.0 |

No significant results |

||||

166.0 |

172.0 |

6.0 |

0.45 |

1.3 |

20 |

|||

172.0 |

176.7 |

4.7 |

No significant results |

|||||

176.7 |

178.0 |

1.3 |

0.28 |

1.1 |

41 |

|||

178.0 |

205.0 |

27.0 |

No significant results |

|||||

CC20-013 |

0.0 |

707.0 |

707.0 |

No significant results |

||||

CC20-014 |

0.0 |

386.0 |

386.0 |

No significant results |

||||

386.0 |

388.0 |

2.0 |

0.21 |

3.8 |

56 |

|||

388.0 |

393.7 |

5.7 |

No significant results |

|||||

393.7 |

395.2 |

1.5 |

0.32 |

1.3 |

19 |

|||

395.2 |

423.1 |

27.9 |

No significant results |

|||||

423.1 |

424.1 |

1.0 |

0.35 |

0.4 |

139 |

|||

424.1 |

465 |

40.9 |

No significant results |

|||||

CC21-015 |

0.0 |

248.0 |

248.0 |

No significant results |

||||

248.0 |

251.4 |

3.4 |

0.44 |

0.3 |

79 |

|||

251.4 |

267.7 |

16.3 |

No significant results |

|||||

267.7 |

269.0 |

1.3 |

1.10 |

0.2 |

57 |

|||

269.0 |

271.5 |

2.5 |

No significant results |

|||||

271.5 |

273.0 |

1.5 |

0.21 |

0.3 |

72 |

|||

CC21-016 |

0.0 |

825.1 |

825.1 |

No significant results |

||||

CC21-017 |

0.0 |

752.3 |

752.3 |

No significant results |

||||

CC21-018 |

0.0 |

127.0 |

127.0 |

No significant results |

||||

127.0 |

209.0 |

82.0 |

Assay Results Pending |

|||||

209.0 |

361.0 |

152.0 |

No significant results |

|||||

361.0 |

363.0 |

2.0 |

0.00 |

12.6 |

88 |

|||

363.0 |

369.0 |

6.0 |

No significant results |

|||||

369.0 |

371.0 |

2.0 |

0.00 |

18.0 |

97 |

|||

371.0 |

474.2 |

103.2 |

No significant results |

|||||

474.2 |

698.0 |

223.8 |

Assay Results Pending |

|||||

CC21-019 |

0.0 |

750.0 |

750.0 |

Assay Results Pending |

||||

CC21-020 |

0.0 |

713.8 |

713.8 |

Assay Results Pending |

||||

Table 2: New Afton Drill holes collar coordinates

Target

|

Drill Hole

|

UTM_North

|

UTM_East

|

Elevation

|

Total Depth

|

Azimuth

|

Inclination

|

Silica Hill |

CC20-001 |

5614059.96 |

672427.53 |

719.63 |

485.50 |

249.07 |

-45.23 |

Silica Hill |

CC20-002 |

5613456.04 |

673470.25 |

677.71 |

662.00 |

9.41 |

-45.40 |

Beaton |

CC20-003 |

5616385.69 |

669095.08 |

703.69 |

574.00 |

230.20 |

-67.99 |

Silica Hill |

CC20-004 |

5614062.40 |

672427.53 |

719.61 |

461.50 |

309.76 |

-46.16 |

Silica Hill |

CC20-005 |

5613998.52 |

672516.61 |

712.22 |

489.68 |

239.95 |

-60.19 |

Silica Hill |

CC20-006 |

5613997.45 |

672517.82 |

712.03 |

440.50 |

184.83 |

-75.04 |

Beaton |

CC20-007 |

5616385.85 |

669098.03 |

704.07 |

414.00 |

150.03 |

-55.08 |

Silica Hill |

CC20-008 |

5613454.77 |

673469.30 |

677.64 |

401.00 |

319.79 |

-50.09 |

Silica Hill |

CC20-009 |

5613796.00 |

672205.00 |

740.00 |

164.00 |

209.76 |

-65.25 |

Silica Hill |

CC20-010 |

5614178.22 |

672011.18 |

723.95 |

609.50 |

280.05 |

-45.09 |

Beaton |

CC20-011 |

5616389.21 |

669098.41 |

704.12 |

425.29 |

43.93 |

-44.47 |

Silica Hill |

CC20-012 |

5613796.00 |

672205.00 |

740.00 |

205.00 |

210.13 |

-85.03 |

Silica Hill |

CC20-013 |

5613804.17 |

672199.47 |

729.64 |

707.00 |

12.27 |

-60.41 |

Silica Hill |

CC20-014 |

5614176.49 |

672013.23 |

724.67 |

465.00 |

243.21 |

-56.63 |

Silica Hill |

CC21-015 |

5613434.00 |

672788.00 |

725.00 |

273.00 |

219.92 |

-56.26 |

Silica Hill |

CC21-016 |

5613434.00 |

672788.00 |

725.00 |

825.09 |

41.92 |

-50.04 |

Beaton |

CC21-017 |

5617172.00 |

668672.00 |

640.00 |

752.33 |

200.00 |

-50 |

Silica Hill |

CC21-018 |

5613434.00 |

672788.00 |

725.00 |

697.99 |

340.00 |

-60 |

Beaton |

CC21-019 |

5617172.00 |

668672.00 |

640.00 |

750.00 |

148.92 |

-49.68 |

Table 3: Rainy River Drilling Results (reported ≥ 0.1 g/t Au and intervals as length down the hole)

Drill Hole |

From

|

To

|

Interval

|

Gold

|

RRNT-20-01 |

0.0 |

53.0 |

53.0 |

No significant results |

53.0 |

54.5 |

1.5 |

0.13 |

|

54.5 |

149.0 |

94.5 |

No significant results |

|

RRNT-20-02 |

0.0 |

119.1 |

119.1 |

No significant results |

119.1 |

123.5 |

4.4 |

0.26 |

|

123.5 |

129.5 |

6.0 |

No significant results |

|

129.5 |

132.5 |

3.0 |

0.42 |

|

132.5 |

203.0 |

70.5 |

No significant results |

|

RRNT-20-03 |

0.0 |

117.5 |

117.5 |

No significant results |

117.5 |

119.0 |

1.5 |

0.11 |

|

119.0 |

410.0 |

291.0 |

No significant results |

|

410.0 |

411.5 |

1.5 |

0.11 |

|

411.5 |

431.0 |

19.5 |

No significant results |

|

RRNT-20-04 |

0.0 |

18.5 |

18.5 |

No significant results |

18.5 |

20.0 |

1.5 |

0.20 |

|

20.0 |

27.1 |

7.1 |

No significant results |

|

27.1 |

30.9 |

3.8 |

0.61 |

|

includes |

30.2 |

30.9 |

0.7 |

1.79 |

30.9 |

384.5 |

353.6 |

No significant results |

|

384.5 |

386.0 |

1.5 |

0.38 |

|

RRNT-20-05 |

0.0 |

89.0 |

89.0 |

No significant results |

RRNT-20-06 |

0.0 |

371.0 |

371.0 |

No significant results |

RRNT-20-07 |

0.0 |

401.0 |

401.0 |

No significant results |

RRNT-20-08 |

0.0 |

420.2 |

420.2 |

Assay Results Pending |

RRNT-20-09 |

0.0 |

371.0 |

371.0 |

Assay Results Pending |

RRNT-20-10 |

0.0 |

450.0 |

450.0 |

Assay Results Pending |

RRNT-20-11 |

0.0 |

401.0 |

401.0 |

Assay Results Pending |

Table 4: Rainy River North East Trend Drill holes collar Coordinates

Drill Hole |

UTM_North

|

UTM_East

|

Elevation

|

Total Depth (m) |

Azimuth

|

Inclination

|

RRNT-20-01 |

5426888 |

436814 |

408.5 |

149 |

240 |

-45 |

RRNT-20-02 |

5426888 |

436814 |

408.5 |

203 |

239.4 |

-67 |

RRNT-20-03 |

5424238 |

434561 |

356.5 |

430 |

316.1 |

-45.1 |

RRNT-20-04 |

5423971 |

434790 |

393.8 |

430 |

316 |

-45.1 |

RRNT-20-05 |

5423891 |

434934 |

394.1 |

400 |

298 |

-45 |

RRNT-21-06 |

5423663 |

435017 |

410 |

371 |

299.5 |

-50.2 |

RRNT-21-07 |

5423972 |

434906 |

391.2 |

401 |

316.6 |

-50.1 |

RRNT-21-08 |

5424772 |

434814 |

357.5 |

420.2 |

318 |

-50 |

RRNT-21-09 |

5425917 |

437013 |

396 |

371 |

259.5 |

-45.1 |

RRNT-21-10 |

5425441 |

437084 |

400 |

450 |

259.7 |

-45.4 |

RRNT-21-11 |

5424979 |

436886 |

390 |

401 |

261.5 |

-45 |

Contacts

Ankit Shah

Vice President, Strategy & Business Development

Direct: +1 (416) 324-6027

Email: ankit.shah@newgold.com