U.S. Grocery Consumers’ Confidence is Rebounding Along with a Strong Desire for Value, dunnhumby Consumer COVID-19 Study Finds

U.S. Grocery Consumers’ Confidence is Rebounding Along with a Strong Desire for Value, dunnhumby Consumer COVID-19 Study Finds

80 percent of U.S. consumers are seeking value and 52% are shopping at everyday low price stores

Walmart, Aldi, Kroger and Amazon named top retailers for value

CHICAGO--(BUSINESS WIRE)--dunnhumby, the global leader in customer data science, today released findings from a year-long worldwide study of the impact of COVID-19 on customer attitudes and behavior across 22 countries. The seventh wave of the dunnhumby Consumer Pulse Survey found that Americans, for the first time since the pandemic began, are beginning to feel noticeably better about personal finances and are now prioritizing value over speed when they shop.

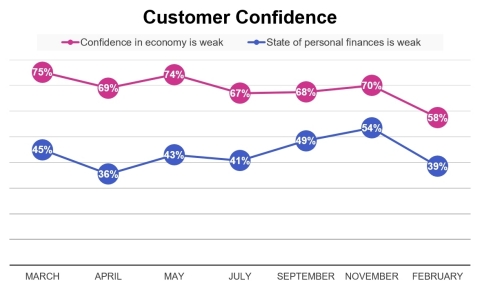

The latest wave found that 58% of U.S. consumers reported that the U.S. economy is weak, a sharp drop of 17% from last March when 75% reported the economy was weak. The study also found that 39% of consumers reported that their finances were poor, a drop of 15% from just November when 54% reported their finances were in bad shape and in the court was in the grips of the third wave of the pandemic. Americans are now at the lowest level of worry about the virus (23%) since the crisis began and have dropped nine percentage points since November on the dunnhumby Worry Index.

Even though U.S. consumers’ confidence is beginning to rebound, consumers remain concerned with the cost of food with 43% saying they are paying more than they did before the pandemic. In contrast, just 24% reported they are paying less for food. As a result, 80% are taking at least one action to seek value with the most popular action being to shop at stores with everyday low prices (52%). Consumers return to value seeking aligns with the dunnhumby 2021 Grocery Retailer Preference Index which postulated that the importance of value would return once consumers worry about the virus dissipated.

“While this wave marks the first time since the pandemic struck that consumers are feeling better financially, we are also seeing value seeking driving shopping behavior,” said Grant Steadman, President for North America at dunnhumby. “It’s noteworthy that consumers are now prioritizing value instead of speed, which was their key driver for much of 2020.”

Survey respondents rebounding confidence aligns with the University of Michigan’s consumer sentiment survey which increased more than 8% in March to its highest level in a year but still 7% below where it stood pre-pandemic. And survey respondents concerns with the higher cost of food also aligns with Consumer Price Index Summary which reported that “food at home index increased 3.5 percent over the past 12 months.”

Key findings from the study:

- Value seeking consumers (70%) far outstrip quality seeking consumers (13%) in the U.S. Quality seekers are primarily shopping high quality stores and are willing to pay more to get quality. Half of quality seekers are using one of these behaviors: shop at stores with the best quality (38%), willing to pay more for quality (19%), buy more expensive item (8%), and don’t pay attention to prices (7%).

- Consumers are utilizing multiple shopping tactics to seek value in the face of rising prices. After shopping at everyday low price stores (52%), the most popular shopping tactics by consumers are: only buying some brands on sale (36%), stocking up on products that are on sale or promotion (36%), searching online to find the best sales (34%), searching online for coupons (34%), and buying private brands when available (33%).

-

Online is now a fully adopted behavior and has grown stronger in every wave. Shopping in stores has dropped from 77% of all trips in March 2020 to 64% in February 2021, while shopping online (pickup and delivery) has increased from 23% in March 2020 to 36% in February 2021.

The number of online trips is also increasing. In March of 2020, consumers reported that online shopping trips made up 1.3 of their trips each week but by the end of February 2021, online trips now made up 3.6 of their trips each week.

- Consumer satisfaction with shopping online has been ahead of, or equal to shopping in store since September 2020. In addition, survey respondents reported a 53% net satisfaction for pickup and 49% for delivery.

- The pandemic driven changes in shopping behavior are stabilizing. From the beginning of the pandemic consumers shopped at stores when fewer people would be there (63%), made fewer trips to the store (74%) and spent more on each trip (38%). By the end of February 2021, 49% of consumers shopped at fewer stores, a 14% drop, and 53% made fewer trips to the store, a 21% drop, and just 21% spent more on each trip, a drop of 17%. In fact, respondents said they made 6.4 trips (including online) to the store weekly in February 2021 compared to 3.8 in March 2020. In February 2021, grocery led all retailers with the most weekly shopping trips (68%), followed by convenience stores (29%), hypermarkets/clubs (20%), discounters (20%), and pharmacies (15%).

- Walmart continues to dominate all stores when it comes to value. Thirty-three percent of respondents mentioned Walmart first when asked which stores provide the best value, followed by Kroger and Aldi both tied at 10%, and then by Amazon at 6%.

Methodology

For this study, dunnhumby surveyed 48,449 respondents online in 22 countries: Asia (Australia, China, South Korea, Malaysia, Thailand), Europe (Czechia, Denmark, France, Germany, Hungary, Ireland, Italy, Norway, Poland, Slovakia, Spain, United Kingdom), Latin America (Brazil, Chile, Colombia), and North America (United States, Mexico). The online interviews were conducted for Wave One from March 29 - April 1 2020; Wave Two from April 11 – 14, 2020; Wave Three from May 27-31, 2020; Wave Four from July 9 – 12, 2020 in the U.S., Canada and Mexico only; Wave Five from August 28 – September 3, 2020; Wave Six from November 20 – 25, 2020; and Wave 7 from February 18-24, 2021.

Approximately 400 individuals were interviewed in each country for each Wave of the study, and respondents were roughly 60% female and 40% male.

The dunnhumby Consumer Pulse Survey is available for download today.

About dunnhumby

dunnhumby is the global leader in Customer Data Science, empowering businesses everywhere to compete and thrive in the modern data-driven economy. We always put the Customer First.

Our mission: to enable businesses to grow and reimagine themselves by becoming advocates and champions for their Customers. With deep heritage and expertise in retail – one of the world’s most competitive markets, with a deluge of multi-dimensional data – dunnhumby today enables businesses all over the world, across industries, to be Customer First.

The dunnhumby Customer Data Science Platform is our unique mix of technology, software and consulting, enabling businesses to increase revenue and profits by delivering exceptional experiences for their Customers – in-store, offline and online. dunnhumby employs nearly 2,500 experts in offices throughout Europe, Asia, Africa, and the Americas working for transformative, iconic brands such as Tesco, Coca-Cola, Meijer, Procter & Gamble and Metro.

Contacts

Media Contact for dunnhumby

Theresa Smith

Silicon Valley Story Lab

theresa@siliconvalleystorylab.com

+1-818-681-6456