Spotify Technology S.A. Announces Financial Results for Fourth Quarter 2020

Spotify Technology S.A. Announces Financial Results for Fourth Quarter 2020

NEW YORK--(BUSINESS WIRE)--Spotify Technology S.A. (NYSE:SPOT) today reported financial results for the fourth fiscal quarter of 2020 ending December 31, 2020.

Dear Shareholders,

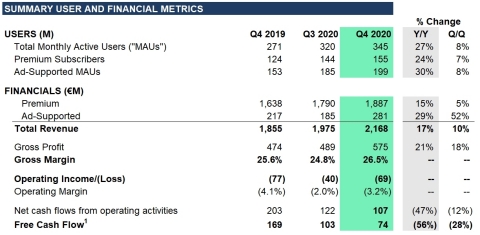

We ended 2020 with strong Q4 performance as the business delivered substantial MAU growth, subscriber additions that exceeded our guidance, an improvement in ARPU trends, acceleration of users who engage with podcast content, better than expected Gross Margin, and Free Cash Flow of €74 million. Headwinds included the negative effects from FX movements, which were more severe than forecast and impacted revenue growth by 690 bps. Given the strong Q4 performance, we believe we are well positioned for continued growth in 2021.

MONTHLY ACTIVE USERS (“MAUs”)

Total MAUs grew 27% Y/Y to 345 million in the quarter, reaching the top end of our guidance range. We continued to see healthy double digit Y/Y growth across all regions. For the full year, net additions accelerated to a record 74 million compared to 2019 net additions of 64 million. In Q4, we added 25 million MAUs and benefited from faster growth in India, US, and Western Europe, with India serving as a notable source of upside vs. our forecast driven by successful marketing campaigns. Based on the behavior we see when users first join Spotify, we are confident that podcast usage has been a factor in the accelerated net additions.

On December 2, 2020, we launched the 6th annual year-end Spotify Wrapped campaign. This year focused on engaging new audiences by demonstrating the power of listening to connect, celebrating and supporting our creator communities in a meaningful way, and evolving Wrapped to deliver a more purposeful and personal experience for our users. Within the first 24 hours of launch, the campaign exceeded the total engagement numbers for all of 2019. In total, more than 90 million users engaged with Wrapped content this year (vs. more than 60 million last year). This spurred more than 50 million shares of Wrapped stories and cards and a considerable amount of platform consumption on our three personalized playlists, with the latter driving 8% of total consumption hours on December 3, the day after launch.

Global consumption hours were up meaningfully in Q4 on a Y/Y basis. We have seen per user consumption in large regions such as Europe and North America return to growth, while Latin America and Rest of World show signs of improvement but remain slightly below pre-COVID levels.

PREMIUM SUBSCRIBERS

Our Premium Subscribers grew 24% Y/Y to 155 million in the quarter, exceeding the top end of our guidance range. For the full year, net additions accelerated to a record 30 million compared to 2019 net additions of 28 million. In Q4, we added 10 million subscribers, with all regions contributing to growth, led by Europe and North America. Europe continues to benefit from our July launch in Russia and 12 surrounding markets. Relative to our forecast, Latin America and Europe performed particularly well from a regional perspective, while Family Plan and Duo additions were strong from a product perspective.

Of note this quarter was the launch of Spotify Premium Mini in India and Indonesia, which gives users daily and weekly access to a subset of their favorite Premium features for a lower price as part of Spotify’s commitment to continuously explore new ways to improve our Premium experience. In Q4, we also announced partnership deals with Grab (Southeast Asia), Flipkart (India), Tink (Germany), and Euronics (Europe). On February 1, we announced that Spotify is now officially available in South Korea, the world's 6th largest music market.

Our average monthly Premium churn rate for the quarter was down slightly Y/Y and up modestly Q/Q. This was in line with expectations with the sequential increase due to churn from promotional plans. We expect churn to continue to decline in 2021.

FINANCIAL METRICS

Revenue

Total revenue of €2,168 million grew 17% Y/Y in Q4 or 24% Y/Y on a constant currency basis. Reported revenue was slightly above the midpoint of our guidance range, as FX headwinds of 690 bps were higher than the 600 bps incorporated into our plan. Excluding these headwinds we were slightly above plan. The depreciation of the US Dollar vs. the Euro was the primary driver of this variance. Premium revenue grew 15% Y/Y to €1,887 million (or 22% Y/Y in constant currency terms) while Ad-Supported revenue was particularly strong, growing 29% Y/Y (or 39% Y/Y in constant currency terms).

Within Premium, average revenue per user (“ARPU”) of €4.26 in Q4 was down 8% Y/Y (but down only 3% Y/Y in constant currency terms vs. down 6% Y/Y in Q3). Excluding FX, product mix accounted for the majority of the ARPU decline, followed by geographic mix, but was partially offset by reduced promotional activity. In October, we raised the price of the Family Plan in 7 markets (Australia, Belgium, Switzerland, Bolivia, Peru, Ecuador, and Colombia) alongside Duo in Colombia. Early results of the price increases have been highly encouraging, as we have seen no meaningful impacts to churn or customer intake in these markets. On February 1, we announced Family Plan price increases across an additional 25 markets (8 in Latin America, 12 in Europe, 4 in Rest of World and Canada in North America), including full portfolio price increases in Sweden, Norway, Finland, and Iceland. We expect continued sequential improvement in the Y/Y change in Premium ARPU in 2021 on a constant currency basis.

Ad-Supported revenue of €281 million outperformed our forecast. We saw strong Y/Y revenue growth across all of our regions and channels as advertiser demand continued to rebound from Q2 2020 lows. The strength in Ad-Supported revenue was led by our Podcast, Direct, and Ad Studio channels, with Podcast and Ad Studio both growing over 100% on a Y/Y basis. Podcast performance benefited from strong underlying demand from advertisers with a 50% increase in the number of companies spending in this channel vs. Q3. We saw healthy double digit CPM gains, along with contributions from The Ringer, The Joe Rogan Experience, and the acquisition of Megaphone (closed on December 8th). Streaming Ad Insertion (“SAI”), our targeted, impression-based podcast ad product, is now live across most of our Owned & Exclusive (“O&E”) portfolio and available in four markets (US, Canada, UK and Germany). Our Programmatic and Direct channels increased 12% and 7% Y/Y, respectively, due to a significant increase in impressions sold.

Gross Margin

Gross Margin finished at 26.5% in Q4, above the top end of our guidance range. Our Gross Margin expanded nearly 100 bps Y/Y, as Other Cost of Revenue efficiencies (e.g. payment fees, streaming delivery costs), a favorable revenue mix shift towards podcasts, and a change in estimated music royalties were partially offset by higher non-music and other content costs.

Premium Gross Margin was 28.9% in Q4, up from 27.3% in Q3 and up 145 bps Y/Y. Ad-Supported Gross Margin was 10.8% in Q4, up from 0.6% in Q3 and down 84 bps Y/Y. As a reminder, we now account for all content costs related to podcast investment in the Ad-Supported business.

Operating Expenses / Income (Loss)

Operating Expenses totaled €644 million in Q4, an increase of 17% Y/Y and above our plan. Higher than forecast Social Charges accounted for the overage given the increase in our share price during the quarter. Total Social Charges were €65 million, approximately €56 million higher than forecast. Excluding the impact of our share price volatility, Operating Expenses grew less than forecast at 7% Y/Y. Additionally, certain marketing expenses came in lower than expected due to campaign timing shifts and movements in FX.

As a reminder, Social Charges are payroll taxes associated with employee salaries and benefits, including share-based compensation. We are subject to social taxes in several countries in which we operate, although Sweden accounts for the bulk of the social costs. We don’t forecast stock price changes in our guidance so upward or downward movements will impact our reported operating expenses.

At the end of Q4, our workforce consisted of 6,554 FTEs globally.

Product and Platform

We continue to lean into our ubiquity strategy, launching increased podcast support on connected Google and Alexa devices during the quarter. All Spotify users can now play and control podcasts through their Google Assistant-enabled device in English globally. Spotify is also now integrated into the PlayStation 5 and Xbox Series X|S gaming consoles, with the former featuring a dedicated Spotify button on the new media controller.

With all of the new content available on Spotify, we are continually making enhancements to the Home Tab to improve discovery and activation of content. In Q4, we launched our first-ever mixed-media morning show, The Get Up, in the US, where listeners get the best of both worlds with music and news. Additionally, Spotify users everywhere can now upload custom covers and descriptions to their homemade playlists using their mobile phones.

Content

We continue to lean into our goal of becoming the world’s number one audio platform through compelling new music and exclusive non-music content. As of Q4, we had 2.2 million podcasts on the platform (up from more than 1.9 million podcasts in Q3). Of note, 25% of our Total MAUs engaged with podcast content in Q4 (up from 22% of MAUs in Q3 2020). We continue to see strong growth in podcast consumption, with consumption hours in Q4 nearly doubling since Q4 2019. We have increasing conviction in the causal relationship between the growth in podcast consumption driving higher LTV and retention among our user base.

In an effort to grow audio monetization across the industry, we acquired Megaphone on December 8. Megaphone is one of the world’s most innovative platforms for enterprise podcast hosting and monetization. With this acquisition, we have the ability over time to make SAI technology available to third-party publishers on Spotify while growing our pool of targetable podcast inventory for advertisers.

In December, The Joe Rogan Experience became exclusive to Spotify, driving a meaningful uptick in audience for the show on our platform. As of year-end, The Joe Rogan Experience was the #1 podcast on our platform in 17 markets. While it remains early days, we are very encouraged by the performance of this content since its arrival on our platform, as it has stimulated new user additions, activated first time podcast listeners, and driven favorable engagement trends, including vodcast consumption. We also announced a new multiyear partnership with The Duke and Duchess of Sussex’s Archewell Audio. We were pleased with the performance of The Duke and Duchess of Sussex’s holiday special episode that was released on our platform in December 2020 and look forward to a full scale launch of shows coming in 2021.

Other notable Q4 content launches in the US included Dare to Lead with Brene Brown (Parcast), 10 Songs that Made Me (Spotify Studios), The Ringer Music Show (The Ringer), and The Get Up Morning Show (Gimlet). Internationally, we released 57 new Original & Exclusive (“O&E”) podcasts. Select launches included Caso 63, our first Original in Chile and ranked as one of the biggest fiction shows ever launched on the platform, as well as our first podcast in Telugu, Lifetime NTR (India), and 123 Segundos in partnership with BandNews (Brazil). We also signed 6 podcasts exclusively to our creator support program in Indonesia.

On the music front, key Q4 releases included Bad Bunny’s album, El Último Tour Del Mundo, Paul McCartney’s album, McCartney III, and more from the likes of Dolly Parton to Ariana Grande. Bad Bunny’s album was the first Spanish-language release to top the Billboard 200 chart in its 64-year history and, thanks to far-reaching international support across 24 markets, Spotify helped drive the Puerto Rican artist to historic heights. With the drop of Paul McCartney’s album, fans were given the opportunity to purchase a limited edition color vinyl, exclusive to Spotify users.

Two-Sided Marketplace

Our Sponsored Recommendations have continued a strong pace of growth, with December marking the single biggest month ever. During the quarter, we saw more than a 50% increase in the number of campaigns vs. the prior quarter. Additionally, over half of the customers in Q4 were new buyers, which helped drive an 82% increase in billings from the prior quarter. Notable campaigns included number one albums, El Último Tour Del Mundo by Bad Bunny and evermore by Taylor Swift, as well as Welcome to O’Block by King Von and Pegasus by Trippie Redd.

We continue to add new features for the creator community and have seen a large increase in the number of artists and their teams using Spotify for Artists. This quarter, we expanded access to our popular feature, Canvas, which had been in limited beta. With Canvas, artists can upload short looping visuals to each of their tracks through Spotify for Artists, and in the first month since expanding access, over 180,000 artists used this tool. Canvas gives artists a powerful new way to develop fans on Spotify, and we have found that when listeners see a Canvas they are more likely to keep streaming (+5% on average vs. control group) or even share and save the track.

During December, we launched our annual Wrapped for Artists campaign, empowering artists around the world to reflect on and celebrate their year of growth on Spotify. Our 2020 Wrapped for Artists reached new heights, with over a 60% increase in peak engagement vs. 2019. We had our largest Wrapped for Artists of all time, with artists from over 200 countries around the world and more than 3 million visits to our microsite.

As part of our ongoing investments to elevate and support the songwriting community, in December, we rolled out the Songwriters Hub in Spotify — the new destination for fans and collaborators to explore their next favorite songwriter or producer. In the hub, visitors can find Written By playlists from both established and emerging songwriters, listen to podcasts about the craft of songwriting, and discover a rotating cast of featured songwriters and cultural moments each month. In our continued effort to connect fans to listeners, we debuted Weekly Music Charts for songs and albums in 46 new markets.

Free Cash Flow

Free Cash Flow was €74 million in Q4, a €95 million decrease Y/Y as the prior year included a favorable working capital benefit due to a shift in timing for select licensor payments while Q4 2020 included higher podcast-related payments. These decreases were partially offset by a decrease in net loss adjusted for non-cash items.

In addition to the positive Free Cash Flow dynamics, we maintain a strong liquidity position and are confident in the financial position of the business. At the end of Q4, we had €1.8 billion in cash and cash equivalents, restricted cash, and short term investments and no indebtedness1.

2021 OUTLOOK

In 2020, we believe the pandemic had little impact on our subscriber growth and may have actually contributed positively to pulling forward new signups. From a revenue standpoint, advertising was negatively affected in the back half of Q1 and persisted throughout the rest of the year. Looking ahead, we are optimistic about the underlying trends in the business into 2021 and beyond, however, we face increased forecasting uncertainty versus prior years due to the unknown duration of the pandemic and its ongoing effect on user, subscriber, and revenue growth.

The following forward-looking statements reflect Spotify’s expectations as of February 3, 2021 and are subject to substantial uncertainty. The estimates below utilize the same methodology we’ve used in prior quarters with respect to our guidance and the potential range of outcomes. Given the extraordinary operating circumstances we currently face with respect to the impact of COVID-19 there is a greater likelihood of variances within those ranges than typical quarters.

Q1 2021 Guidance:

- Total MAUs: 354-364 million

- Total Premium Subscribers: 155-158 million

-

Total Revenue: €1.99-€2.19 billion

- Assumes approximately 770 bps headwind to growth Y/Y due to movements in foreign exchange rates

- Gross Margin: 23.5-25.5%

- Operating Profit/Loss: €(78)-€(28) million

Full Year 2021 Guidance:

- Total MAUs: 407-427 million

- Total Premium Subscribers: 172-184 million

-

Total Revenue: €9.01-€9.41 billion

- Assumes approximately 370 bps headwind to growth Y/Y due to movements in foreign exchange rates

- Gross Margin: 23.7-25.7%

- Operating Profit/Loss: €(300)-€(200) million

EARNINGS QUESTION & ANSWER SESSION

We will host a live question and answer session starting at 8 a.m. ET today on investors.spotify.com. Daniel Ek, our Founder and CEO, and Paul Vogel, our Chief Financial Officer, will be on hand to answer questions submitted through slido.com using the event code #SpotifyEarningsQ420. Participants also may join using the listen-only conference line by registering through the following site:

Direct Event Registration Portal: http://www.directeventreg.com/registration/event/5373637

We use investors.spotify.com and newsroom.spotify.com websites as well as other social media listed in the “Resources – Social Media” tab of our Investors website to disclose material company information.

STREAM ON

Spotify will be hosting a virtual event — Stream On — on Monday, Feb 22 to share the latest on the state of global audio streaming and where it's headed in the future. The event will be live-streamed and will include a number of speakers. This event is open to all, and we'll be sharing additional details very soon.

We use investors.spotify.com and newsroom.spotify.com websites as well as other social media listed in the “Resources – Social Media” tab of our Investors website to disclose material company information.

Use of Non-IFRS Measures

To supplement our financial information presented in accordance with IFRS, we use the following non-IFRS financial measures: Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect, Ad-Supported revenue excluding foreign exchange effect, and Free Cash Flow. Management believes that Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect are useful to investors because they present measures that facilitate comparison to our historical performance. However, Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect should be considered in addition to, not as a substitute for or superior to, Revenue, Premium revenue, Ad-Supported revenue or other financial measures prepared in accordance with IFRS. Management believes that Free Cash Flow is useful to investors because it presents a measure that approximates the amount of cash generated that is available to repay debt obligations, to make investments, and for certain other activities that exclude certain infrequently occurring and/or non-cash items. However, Free Cash Flow should be considered in addition to, not as a substitute for or superior to, net cash flows (used in)/from operating activities or other financial measures prepared in accordance with IFRS. For more information on these non-IFRS financial measures, please see “Reconciliation of IFRS to Non-IFRS Results” table.

Forward Looking Statements

This shareholder letter contains estimates and forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible,” and similar words are intended to identify estimates and forward-looking statements.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or may affect our businesses and operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to numerous risks and uncertainties and are made in light of information currently available to us. Many important factors may adversely affect our results as indicated in forward-looking statements. These factors include, but are not limited to: our ability to attract prospective users and to retain existing users; competition for users, user listening time, and advertisers; risks associated with our international expansion and our ability to manage our growth; our ability to predict, recommend, and play content that our users enjoy; our ability to effectively monetize our Service; our ability to generate sufficient revenue to be profitable or to generate positive cash flow and grow on a sustained basis; risks associated with the expansion of our operations to deliver non-music content, including podcasts, including increased business, legal, financial, reputational, and competitive risks; potential disputes or liabilities associated with content made available on our Service; risks relating to the acquisition, investment, and disposition of companies or technologies; our dependence upon third-party licenses for most of the content we stream; our lack of control over the providers of our content and their effect on our access to music and other content; our ability to comply with the many complex license agreements to which we are a party; our ability to accurately estimate the amounts payable under our license agreements; the limitations on our operating flexibility due to the minimum guarantees required under certain of our license agreements; our ability to obtain accurate and comprehensive information about the compositions embodied in sound recordings in order to obtain necessary licenses or perform obligations under our existing license agreements; new copyright legislation and related regulations that may increase the cost and/or difficulty of music licensing; assertions by third parties of infringement or other violations by us of their intellectual property rights; our ability to protect our intellectual property; the dependence of streaming on operating systems, online platforms, hardware, networks, regulations, and standards that we do not control; potential breaches of our security systems; interruptions, delays, or discontinuations in service in our systems or systems of third parties; changes in laws or regulations affecting us; risks relating to privacy and data security; our ability to maintain, protect, and enhance our brand; payment-related risks; our ability to hire and retain key personnel; our ability to accurately estimate our user metrics and other estimates; risks associated with manipulation of stream counts and user accounts and unauthorized access to our services; tax-related risks; the concentration of voting power among our founders who have and will continue to have substantial control over our business; risks related to our status as a foreign private issuer; international, national or local economic, social or political conditions; risks associated with accounting estimates, currency fluctuations and foreign exchange controls; and the impact of the COVID-19 pandemic on our business and operations, including any adverse impact on advertising revenue or subscriber revenue. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from our estimates and forward-looking statements is included in our filings with the U.S. Securities and Exchange Commission (“SEC”), including our Annual Report on Form 20-F filed with the SEC on February 12, 2020, as updated in our Form 6-K filed with the SEC on October 29, 2020 (containing the interim condensed consolidated financial statements for the three months ended September 30, 2020), and subsequently filed Annual Reports or reports for our interim results on Form 6-K. We undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this shareholder letter.

Rounding

Certain monetary amounts, percentages, and other figures included in this letter have been subject to rounding adjustments. The sum of individual metrics may not always equal total amounts indicated due to rounding.

Consolidated statement of operations |

||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||

(in € millions, except share and per share data) |

||||||||||||||||||||

|

|

Three months ended |

|

Year ended |

||||||||||||||||

|

|

December 31,

|

|

September 30,

|

|

December 31,

|

|

December 31,

|

|

December 31,

|

||||||||||

Revenue |

|

|

2,168 |

|

|

|

1,975 |

|

|

|

1,855 |

|

|

|

7,880 |

|

|

|

6,764 |

|

Cost of revenue |

|

|

1,593 |

|

|

|

1,486 |

|

|

|

1,381 |

|

|

|

5,865 |

|

|

|

5,042 |

|

Gross profit |

|

|

575 |

|

|

|

489 |

|

|

|

474 |

|

|

|

2,015 |

|

|

|

1,722 |

|

Research and development |

|

|

232 |

|

|

|

176 |

|

|

|

173 |

|

|

|

837 |

|

|

|

615 |

|

Sales and marketing |

|

|

294 |

|

|

|

256 |

|

|

|

276 |

|

|

|

1,029 |

|

|

|

826 |

|

General and administrative |

|

|

118 |

|

|

|

97 |

|

|

|

102 |

|

|

|

442 |

|

|

|

354 |

|

|

|

|

644 |

|

|

|

529 |

|

|

|

551 |

|

|

|

2,308 |

|

|

|

1,795 |

|

Operating loss |

|

|

(69 |

) |

|

|

(40 |

) |

|

|

(77 |

) |

|

|

(293 |

) |

|

|

(73 |

) |

Finance income |

|

|

4 |

|

|

|

14 |

|

|

|

7 |

|

|

|

94 |

|

|

|

275 |

|

Finance costs |

|

|

(114 |

) |

|

|

(90 |

) |

|

|

(103 |

) |

|

|

(510 |

) |

|

|

(333 |

) |

Finance income/(costs) - net |

|

|

(110 |

) |

|

|

(76 |

) |

|

|

(96 |

) |

|

|

(416 |

) |

|

|

(58 |

) |

Loss before tax |

|

|

(179 |

) |

|

|

(116 |

) |

|

|

(173 |

) |

|

|

(709 |

) |

|

|

(131 |

) |

Income tax (benefit)/expense |

|

|

(54 |

) |

|

|

(15 |

) |

|

|

36 |

|

|

|

(128 |

) |

|

|

55 |

|

Net loss attributable to owners of the parent |

|

|

(125 |

) |

|

|

(101 |

) |

|

|

(209 |

) |

|

|

(581 |

) |

|

|

(186 |

) |

Loss per share attributable to owners of the parent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

(0.66 |

) |

|

|

(0.53 |

) |

|

|

(1.14 |

) |

|

|

(3.10 |

) |

|

|

(1.03 |

) |

Diluted |

|

|

(0.66 |

) |

|

|

(0.58 |

) |

|

|

(1.14 |

) |

|

|

(3.10 |

) |

|

|

(1.03 |

) |

Weighted-average ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

189,852,424 |

|

|

|

188,842,828 |

|

|

|

182,942,528 |

|

|

|

187,583,307 |

|

|

|

180,960,579 |

|

Diluted |

|

|

189,852,424 |

|

|

|

189,054,064 |

|

|

|

182,942,528 |

|

|

|

187,583,307 |

|

|

|

180,960,579 |

|

Consolidated statement of financial position |

||||||||

(Unaudited) |

||||||||

(in € millions) |

||||||||

|

|

December 31,

|

|

December 31,

|

||||

Assets |

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

Lease right-of-use assets |

|

|

444 |

|

|

|

489 |

|

Property and equipment |

|

|

313 |

|

|

|

291 |

|

Goodwill |

|

|

736 |

|

|

|

478 |

|

Intangible assets |

|

|

97 |

|

|

|

58 |

|

Long term investments |

|

|

2,277 |

|

|

|

1,497 |

|

Restricted cash and other non-current assets |

|

|

78 |

|

|

|

69 |

|

Deferred tax assets |

|

|

15 |

|

|

|

9 |

|

|

|

|

3,960 |

|

|

|

2,891 |

|

Current assets |

|

|

|

|

|

|

|

|

Trade and other receivables |

|

|

464 |

|

|

|

402 |

|

Income tax receivable |

|

|

4 |

|

|

|

4 |

|

Short term investments |

|

|

596 |

|

|

|

692 |

|

Cash and cash equivalents |

|

|

1,151 |

|

|

|

1,065 |

|

Other current assets |

|

|

151 |

|

|

|

68 |

|

|

|

|

2,366 |

|

|

|

2,231 |

|

Total assets |

|

|

6,326 |

|

|

|

5,122 |

|

Equity and liabilities |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

Share capital |

|

|

— |

|

|

|

— |

|

Other paid in capital |

|

|

4,583 |

|

|

|

4,192 |

|

Treasury shares |

|

|

(175 |

) |

|

|

(370 |

) |

Other reserves |

|

|

1,687 |

|

|

|

924 |

|

Accumulated deficit |

|

|

(3,290 |

) |

|

|

(2,709 |

) |

Equity attributable to owners of the parent |

|

|

2,805 |

|

|

|

2,037 |

|

Non-current liabilities |

|

|

|

|

|

|

|

|

Lease liabilities |

|

|

577 |

|

|

|

622 |

|

Accrued expenses and other liabilities |

|

|

42 |

|

|

|

20 |

|

Provisions |

|

|

2 |

|

|

|

2 |

|

Deferred tax liabilities |

|

|

— |

|

|

|

2 |

|

|

|

|

621 |

|

|

|

646 |

|

Current liabilities |

|

|

|

|

|

|

|

|

Trade and other payables |

|

|

638 |

|

|

|

549 |

|

Income tax payable |

|

|

9 |

|

|

|

9 |

|

Deferred revenue |

|

|

380 |

|

|

|

319 |

|

Accrued expenses and other liabilities |

|

|

1,748 |

|

|

|

1,438 |

|

Provisions |

|

|

20 |

|

|

|

13 |

|

Derivative liabilities |

|

|

105 |

|

|

|

111 |

|

|

|

|

2,900 |

|

|

|

2,439 |

|

Total liabilities |

|

|

3,521 |

|

|

|

3,085 |

|

Total equity and liabilities |

|

|

6,326 |

|

|

|

5,122 |

|

Consolidated statement of cash flows |

||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||

(in € millions) |

||||||||||||||||||||

|

|

Three months ended |

|

Year ended |

||||||||||||||||

|

|

December 31,

|

|

September 30,

|

|

December 31,

|

|

December 31,

|

|

December 31,

|

||||||||||

Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(125 |

) |

|

|

(101 |

) |

|

|

(209 |

) |

|

|

(581 |

) |

|

|

(186 |

) |

Adjustments to reconcile net loss to net cash flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation of property and equipment and lease right-of-use assets |

|

|

21 |

|

|

|

21 |

|

|

|

20 |

|

|

|

86 |

|

|

|

71 |

|

Amortization of intangible assets |

|

|

8 |

|

|

|

7 |

|

|

|

4 |

|

|

|

25 |

|

|

|

16 |

|

Share-based payments expense |

|

|

43 |

|

|

|

46 |

|

|

|

28 |

|

|

|

176 |

|

|

|

122 |

|

Finance income |

|

|

(4 |

) |

|

|

(14 |

) |

|

|

(7 |

) |

|

|

(94 |

) |

|

|

(275 |

) |

Finance costs |

|

|

114 |

|

|

|

90 |

|

|

|

103 |

|

|

|

510 |

|

|

|

333 |

|

Income tax (benefit)/expense |

|

|

(54 |

) |

|

|

(15 |

) |

|

|

36 |

|

|

|

(128 |

) |

|

|

55 |

|

Other |

|

|

4 |

|

|

|

(3 |

) |

|

|

14 |

|

|

|

7 |

|

|

|

13 |

|

Changes in working capital: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in trade receivables and other assets |

|

|

(94 |

) |

|

|

(76 |

) |

|

|

(14 |

) |

|

|

(187 |

) |

|

|

(27 |

) |

Increase in trade and other liabilities |

|

|

182 |

|

|

|

155 |

|

|

|

222 |

|

|

|

425 |

|

|

|

454 |

|

Increase in deferred revenue |

|

|

23 |

|

|

|

20 |

|

|

|

15 |

|

|

|

73 |

|

|

|

59 |

|

Increase/(decrease) in provisions |

|

|

— |

|

|

|

7 |

|

|

|

1 |

|

|

|

6 |

|

|

|

(35 |

) |

Interest paid on lease liabilities |

|

|

(12 |

) |

|

|

(13 |

) |

|

|

(12 |

) |

|

|

(55 |

) |

|

|

(37 |

) |

Interest received |

|

|

1 |

|

|

|

— |

|

|

|

2 |

|

|

|

4 |

|

|

|

14 |

|

Income tax paid |

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

(8 |

) |

|

|

(4 |

) |

Net cash flows from operating activities |

|

|

107 |

|

|

|

122 |

|

|

|

203 |

|

|

|

259 |

|

|

|

573 |

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business combinations, net of cash acquired |

|

|

(194 |

) |

|

|

(2 |

) |

|

|

— |

|

|

|

(336 |

) |

|

|

(331 |

) |

Purchases of property and equipment |

|

|

(35 |

) |

|

|

(17 |

) |

|

|

(32 |

) |

|

|

(78 |

) |

|

|

(135 |

) |

Purchases of short term investments |

|

|

(406 |

) |

|

|

(305 |

) |

|

|

(231 |

) |

|

|

(1,354 |

) |

|

|

(901 |

) |

Sales and maturities of short term investments |

|

|

505 |

|

|

|

197 |

|

|

|

165 |

|

|

|

1,421 |

|

|

|

1,163 |

|

Change in restricted cash |

|

|

2 |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

|

2 |

|

|

|

2 |

|

Other |

|

|

(4 |

) |

|

|

(5 |

) |

|

|

(5 |

) |

|

|

(27 |

) |

|

|

(16 |

) |

Net cash flows used in investing activities |

|

|

(132 |

) |

|

|

(134 |

) |

|

|

(105 |

) |

|

|

(372 |

) |

|

|

(218 |

) |

Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments of lease liabilities |

|

|

(8 |

) |

|

|

(6 |

) |

|

|

(4 |

) |

|

|

(24 |

) |

|

|

(17 |

) |

Lease incentives received |

|

|

7 |

|

|

|

6 |

|

|

|

— |

|

|

|

20 |

|

|

|

15 |

|

Repurchases of ordinary shares |

|

|

— |

|

|

|

— |

|

|

|

(30 |

) |

|

|

— |

|

|

|

(438 |

) |

Proceeds from exercise of stock options |

|

|

45 |

|

|

|

96 |

|

|

|

71 |

|

|

|

319 |

|

|

|

154 |

|

Proceeds from the issuance of warrants |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

15 |

|

Proceeds from the exercise of warrants |

|

|

— |

|

|

|

— |

|

|

|

74 |

|

|

|

— |

|

|

|

74 |

|

Other |

|

|

(11 |

) |

|

|

(11 |

) |

|

|

(2 |

) |

|

|

(30 |

) |

|

|

(6 |

) |

Net cash flows from/(used in) financing activities |

|

|

33 |

|

|

|

85 |

|

|

|

109 |

|

|

|

285 |

|

|

|

(203 |

) |

Net increase in cash and cash equivalents |

|

|

8 |

|

|

|

73 |

|

|

|

207 |

|

|

|

172 |

|

|

|

152 |

|

Cash and cash equivalents at beginning of the period |

|

|

1,182 |

|

|

|

1,148 |

|

|

|

877 |

|

|

|

1,065 |

|

|

|

891 |

|

Net exchange (losses)/gains on cash and cash equivalents |

|

|

(39 |

) |

|

|

(39 |

) |

|

|

(19 |

) |

|

|

(86 |

) |

|

|

22 |

|

Cash and cash equivalents at period end |

|

|

1,151 |

|

|

|

1,182 |

|

|

|

1,065 |

|

|

|

1,151 |

|

|

|

1,065 |

|

Calculation of basic and diluted loss per share |

||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||

(in € millions, except share and per share data) |

||||||||||||||||||||

|

|

Three months ended |

|

Year ended |

||||||||||||||||

|

|

December 31,

|

|

September 30,

|

|

December 31,

|

|

December 31,

|

|

December 31,

|

||||||||||

Basic loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to owners of the parent |

|

|

(125 |

) |

|

|

(101 |

) |

|

|

(209 |

) |

|

|

(581 |

) |

|

|

(186 |

) |

Share used in computation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average ordinary shares outstanding |

|

|

189,852,424 |

|

|

|

188,842,828 |

|

|

|

182,942,528 |

|

|

|

187,583,307 |

|

|

|

180,960,579 |

|

Basic loss per share attributable to owners of the parent |

|

|

(0.66 |

) |

|

|

(0.53 |

) |

|

|

(1.14 |

) |

|

|

(3.10 |

) |

|

|

(1.03 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to owners of the parent |

|

|

(125 |

) |

|

|

(101 |

) |

|

|

(209 |

) |

|

|

(581 |

) |

|

|

(186 |

) |

Fair value gains on dilutive warrants |

|

|

— |

|

|

|

(9 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss used in the computation of diluted loss per share |

|

|

(125 |

) |

|

|

(110 |

) |

|

|

(209 |

) |

|

|

(581 |

) |

|

|

(186 |

) |

Shares used in computation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average ordinary shares outstanding |

|

|

189,852,424 |

|

|

|

188,842,828 |

|

|

|

182,942,528 |

|

|

|

187,583,307 |

|

|

|

180,960,579 |

|

Warrants |

|

|

— |

|

|

|

211,236 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Diluted weighted-average ordinary shares |

|

|

189,852,424 |

|

|

|

189,054,064 |

|

|

|

182,942,528 |

|

|

|

187,583,307 |

|

|

|

180,960,579 |

|

Diluted loss per share attributable to owners of the parent |

|

|

(0.66 |

) |

|

|

(0.58 |

) |

|

|

(1.14 |

) |

|

|

(3.10 |

) |

|

|

(1.03 |

) |

Reconciliation of IFRS to Non-IFRS Results |

||||||||||||||||

(Unaudited) |

||||||||||||||||

(in € millions, except percentages) |

||||||||||||||||

|

|

Three months ended |

|

Year ended |

||||||||||||

|

|

December 31,

|

|

December 31,

|

|

December 31,

|

|

December 31,

|

||||||||

IFRS revenue |

|

|

2,168 |

|

|

|

1,855 |

|

|

|

7,880 |

|

|

|

6,764 |

|

Foreign exchange effect on 2020 revenue using 2019 rates |

|

|

131 |

|

|

|

|

|

|

|

243 |

|

|

|

|

|

Revenue excluding foreign exchange effect |

|

|

2,299 |

|

|

|

|

|

|

|

8,123 |

|

|

|

|

|

IFRS revenue year-over-year change % |

|

|

17 |

% |

|

|

|

|

|

|

16 |

% |

|

|

|

|

Revenue excluding foreign exchange effect year-over-year change % |

|

|

24 |

% |

|

|

|

|

|

|

20 |

% |

|

|

|

|

IFRS Premium revenue |

|

|

1,887 |

|

|

|

1,638 |

|

|

|

7,135 |

|

|

|

6,086 |

|

Foreign exchange effect on 2020 Premium revenue using 2019 rates |

|

|

110 |

|

|

|

|

|

|

|

216 |

|

|

|

|

|

Premium revenue excluding foreign exchange effect |

|

|

1,997 |

|

|

|

|

|

|

|

7,351 |

|

|

|

|

|

IFRS Premium revenue year-over-year change % |

|

|

15 |

% |

|

|

|

|

|

|

17 |

% |

|

|

|

|

Premium revenue excluding foreign exchange effect year-over-year change % |

|

|

22 |

% |

|

|

|

|

|

|

21 |

% |

|

|

|

|

IFRS Ad-Supported revenue |

|

|

281 |

|

|

|

217 |

|

|

|

745 |

|

|

|

678 |

|

Foreign exchange effect on 2020 Ad-Supported revenue using 2019 rates |

|

|

21 |

|

|

|

|

|

|

|

27 |

|

|

|

|

|

Ad-Supported revenue excluding foreign exchange effect |

|

|

302 |

|

|

|

|

|

|

|

772 |

|

|

|

|

|

IFRS Ad-Supported revenue year-over-year change % |

|

|

29 |

% |

|

|

|

|

|

|

10 |

% |

|

|

|

|

Ad-Supported revenue excluding foreign exchange effect year-over-year change % |

|

|

39 |

% |

|

|

|

|

|

|

14 |

% |

|

|

|

|

Free Cash Flow |

||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||

(in € millions) |

||||||||||||||||||||

|

|

Three months ended |

|

Year ended |

||||||||||||||||

|

|

December 31,

|

|

September 30,

|

|

December 31,

|

|

December 31,

|

|

December 31,

|

||||||||||

Net cash flows from operating activities |

|

|

107 |

|

|

|

122 |

|

|

|

203 |

|

|

|

259 |

|

|

|

573 |

|

Capital expenditures |

|

|

(35 |

) |

|

|

(17 |

) |

|

|

(32 |

) |

|

|

(78 |

) |

|

|

(135 |

) |

Change in restricted cash |

|

|

2 |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

|

2 |

|

|

|

2 |

|

Free Cash Flow |

|

|

74 |

|

|

|

103 |

|

|

|

169 |

|

|

|

183 |

|

|

|

440 |

|

| ________________________ | ||

| 1 | Free Cash Flow is a non-IFRS measure. See “Use of Non-IFRS Measures” and “Reconciliation of IFRS to Non-IFRS Results” for additional information. |

|

| 2 | As of December 31, 2020, we have no material outstanding indebtedness, other than lease liabilities recognized under IFRS 16. |

|

Contacts

Investor Relations:

Bryan Goldberg

Lauren Katzen

ir@spotify.com

Public Relations:

Dustee Jenkins

press@spotify.com