NEW YORK--(BUSINESS WIRE)--Piedmont Lithium Limited (ASX: PLL; NASDAQ: PLL) (“Piedmont” or “Company”) is pleased to present its December 2020 quarterly report.

Highlights during and subsequent to the quarter were:

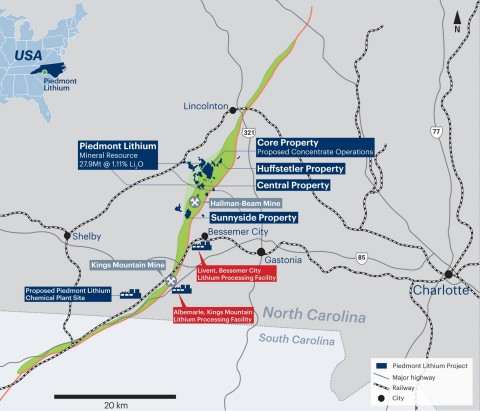

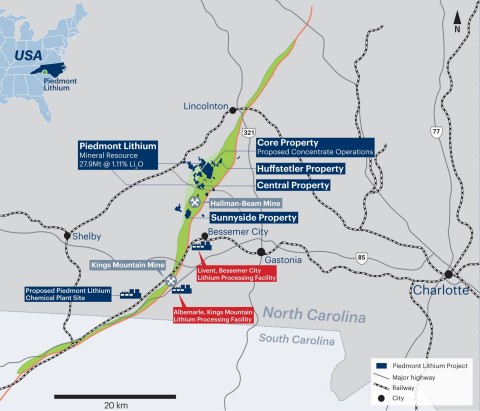

- Commenced a definitive feasibility study (“DFS”) for Piedmont’s planned 160,000 t/y spodumene concentrate operation in North Carolina led by Primero Group and Marshall Miller & Associates with a planned completion date in mid-2021;

- Expanded drill programs by an additional 25,000 meters using five drill rigs with the intention of updating the Company’s Mineral Resource estimates on the Central and Core properties in the first half of 2021 in advance of completing the DFS for its planned spodumene concentrate operations;

- Received key permit for Piedmont’s planned 22,700 t/y lithium hydroxide plant in Kings Mountain, North Carolina, comprising a Title V Air Permit from the North Carolina Department of Environmental Quality’s Division of Air Quality authorizing construction and operations of the planned lithium hydroxide plant;

- Launched a pilot-scale testwork program at SGS Canada to produce a bulk sample of spodumene concentrate from a 50t bulk sample collected from the Company’s Core property in early 2020;

- Substantially increased the Company’s land position within the Carolina Tin-Spodumene Belt to 2,322 acres including highly prospective properties contiguous to or in the near vicinity of the Company’s Core property;

- Commenced process to re-domicile Piedmont from Australia to the United States via a Scheme of Arrangement subject to shareholder, regulatory, and court approval. If the Scheme is approved the Company’s primary listing will move from the Australian Securities Exchange (“ASX”) to Nasdaq Capital Market and the Company will retain an ASX listing via Chess Depositary Interests;

- Entered into agreements to acquire a 19.9% interest in Sayona Mining Limited (“Sayona”) through shares and convertible notes. Piedmont will also purchase a 25.0% stake in Sayona’s 100% owned Quebec subsidiary, Sayona Quebec Inc (“Sayona Quebec”). Sayona Quebec owns the Authier lithium project, the highly prospective Tansim lithium project, and is pursuing a bid to acquire Quebec-based North American Lithium’s assets out of bankruptcy;

- Piedmont and Sayona Quebec have also entered into a binding SC6 supply agreement pursuant to which Sayona Quebec will supply to Piedmont the greater of 60,000 t/y or 50% of Sayona Quebec’s spodumene concentrate production at market prices on a life-of-mine basis;

- Expanded the Company’s senior management team through the addition of Ms. Malissa Gordon – Community and Government Relations, Mr. Jim Nottingham – Senior Project Manager Concentrate Operations, Mr. Pratt Ray – Production Manager – Chemical Operations, and Mr. Brian Risinger – Vice President Corporate Communications and Investor Relations;

- Completed of a U.S. public offering of 2,300,000 of Piedmont’s American Depositary Shares (“ADSs”), with each ADS representing 100 of Piedmont’s ordinary shares, including full exercise of the underwriters’ option, at an issue price of US$25.00 per ADS, to raise gross proceeds of US$57.5 million (A$81.2 million); and

- Following successful completion of the U.S. public offering, the Company repaid 100% of the Paycheck Protection Program funds received by the Company in May 2020.

Keith D. Phillips, President and CEO of Piedmont, commented:

“It is an exciting time for the battery materials industry in North America. Our North Carolina location places us in an ideal position to play a pivotal role in helping power North America’s electric vehicle and clean energy storage revolutions.

“Recent activity in the US battery materials equity markets validates our efforts to re-domicile Piedmont, and we look forward to completing the work moving our primary listing to Nasdaq, while maintaining a secondary Australian listing.

“Following our highly successful equity offering in October, Piedmont enters 2021 with a strong balance sheet that will enable the Company to meet its development objectives for the coming year. Our expanded team continues to do a great job on the ground in North Carolina in mineral exploration, metallurgical testwork, technical studies, and permitting that may make it possible for Piedmont to begin construction of our project by the end of this year. We expect 2021 will be a pivotal year for Piedmont Lithium, and we are excited about the months ahead.”

To view the ASX Release, please click here.

For further information, contact: