Satisfaction Increases as Dealerships Up Service Game Amid COVID-19, J.D. Power Finds

Satisfaction Increases as Dealerships Up Service Game Amid COVID-19, J.D. Power Finds

Audi Dealerships Rank Highest in Customer Satisfaction

TORONTO--(BUSINESS WIRE)--Against a backdrop of sagging new-vehicle sales, temporary closures and other operational and financial challenges posed by the COVID-19 pandemic, dealerships in Canada are improving service satisfaction while also increasing both market share and per-visit cost for maintenance and repair of vehicles four to 12 years old. According to the J.D. Power 2020 Canada Customer Service Index—Long-Term (CSI-LT) Study,SM released today, dealers not only capture 49% of all service visits for vehicles four years old and older but are experiencing an increase in cost-per-visit ($375 in 2020 vs. $323 in 2019) compared with non-dealer facilities ($241 in 2020 vs. $222 in 2019).

In an industry estimated at $9.2 billion annually, the high cost-per-visit means dealerships capture 60% of service revenue in Canada (approximately $5.5 billion). Furthermore, the dealership segment also sees a slight increase in the average number of customer visits (1.4 in 2020 vs. 1.3 in 2019), while non-dealer facilities have declined to 1.5 visits from 1.6 visits in 2019.

“Despite the challenges facing dealers and aftermarket service providers due to the pandemic, we’re seeing markedly improved levels of customer satisfaction this year,” said Virginia Connell, automotive research and consulting manager at J.D. Power Canada. “This is quite a testament to the commitment and resiliency of brands, dealers and independent service facilities to deliver an effective—and sometimes exceptional—service experience to their customers.”

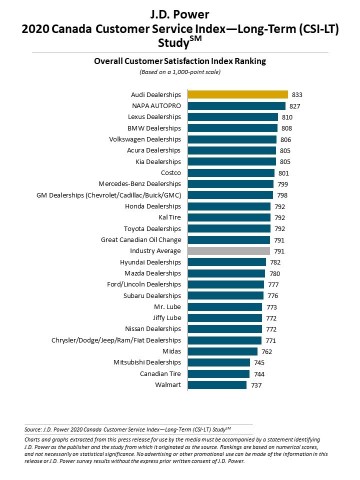

According to the study, dealerships and non-dealers combined to achieve an overall satisfaction score of 791 (on a 1,000-point scale), up from 779 in 2019. Notable, too, is that non-dealers average 795 compared with 788 for dealerships.

“As COVID-19 put new-vehicle purchase intentions on hiatus, vehicle owners are—and will be—holding on to their current and aging vehicles for a longer period, which means more potential for repair opportunities,” Connell added. “Considering that nearly 40% of the auto service business for dealers comes from repair work, which is also a more lucrative revenue source than maintenance, dealerships should focus on improving all aspects of this service offering, mainly around service advisor and vehicle pick-up.”

Following are some key findings of the 2020 study:

- Dealers increase share of service visits: Dealers are doing a good job of capturing returning customers for paid service, stemming from increased satisfaction while vehicles are still under warranty. In 2020, 60% of owners of three-year-old vehicles say they “definitely will” return for paid service, up from 53% in 2015. This has helped dealers increase their overall share of service visits among owners of four- to seven-year-old vehicles during that same time period (58% in 2020 vs. 39% in 2015).

- Two simple tasks that elevate customer satisfaction being overlooked: Two areas that can drive a notable increase in satisfaction are greeting customers immediately as they enter the shop and returning the vehicle cleaner than when it arrived. Overall, non-dealers continue to do a better job of greeting customers immediately than do dealers (49% vs. 35%, respectively), but dealers are more likely to return vehicles cleaner (38% vs. 12%, respectively).

Study Rankings

Audi Dealerships ranks highest in overall customer satisfaction with a score of 833. NAPA AUTOPRO (827) ranks second and Lexus Dealerships (810) ranks third.

The Canada Customer Service Index—Long-Term (CSI-LT) Study measures satisfaction and intended loyalty among owners of vehicles that are four to 12 years old and analyzes the customer experience in both warranty and non-warranty service visits. Overall satisfaction is based on five factors (in order of importance): service initiation (24%); service quality (23%); service advisor (20%); service facility (17%); and vehicle pick-up (16%). The study is based on responses of 7,882 owners and was fielded from March through June 2020.

To learn more about the Canada Customer Service Index—Long-Term (CSI-LT) Study, visit https://canada.jdpower.com/automotive/canadian-customer-service-index-long-term-study.

See the online press release at http://www.jdpower.com/pr-id/2020110.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

Contacts

Media Relations Contacts

Gal Wilder, Cohn & Wolfe, Toronto, Canada; 647-259-3261, gal.wilder@cohnwolfe.ca

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com