Strategy Analytics: Q1 2020 Cellular Baseband Market Share: 5G Fuels Baseband Revenue Growth

Strategy Analytics: Q1 2020 Cellular Baseband Market Share: 5G Fuels Baseband Revenue Growth

Increasing Competition in 5G Baseband Market

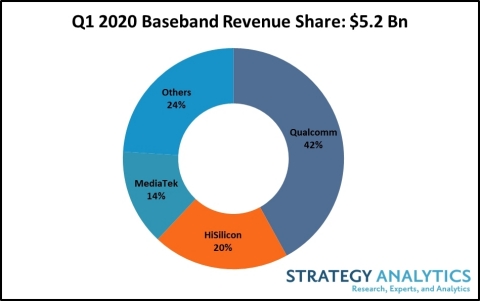

BOSTON--(BUSINESS WIRE)--The global cellular baseband processor market grew 9 percent year-over-year to reach $5.2 billion in Q1 2020, according to Strategy Analytics Handset Component Technologies service report, “Baseband Market Share Tracker Q1 2020: 5G Drives Baseband Revenue Growth .”

This Strategy Analytics research shows Qualcomm, HiSilicon, MediaTek, Intel and Samsung LSI featured in the top-five cellular baseband processor revenue share rankings in Q1 2020. Qualcomm maintained its baseband market share leadership with 42 percent revenue share in Q1 2020 followed by HiSilicon with 20 percent and MediaTek with 14 percent.

- The COVID-19 pandemic coupled with weak seasonal demand affected baseband shipments in Q1 2020. However, 5G baseband shipments powered the baseband market to revenue growth as 5G basebands command a significant premium over 4G basebands.

- 5G baseband shipments accounted for almost 10 percent of total baseband shipments in Q1 2020 but captured up to 30 percent of total baseband revenues.

- 4G baseband shipments declined for the seventh consecutive quarter in Q1 2020 as device vendors continue to prioritize 5G over 4G. Despite the decline, the 4G segment continues to represent an attractive volume opportunity for baseband vendors.

Sravan Kundojjala, Associate Director, commented, “In Q1 2020, Qualcomm solidified its 5G market share leadership with its second-generation 5G products including the X55 slim modem and Snapdragon 765/G 5G SoCs. Strategy Analytics estimates that Qualcomm shipped more 5G basebands in Q1 2020 than the company shipped in all of 2019, driven by significant flagship and mid-range 5G launches by its customers including Samsung, Xiaomi, Oppo, Vivo and Others. Despite the pandemic, Qualcomm managed to post revenue growth in its baseband business, thanks to high average selling prices for 5G chips.”

According to Stuart Robinson, Executive Director of the Strategy Analytics Handset Component Technologies service, “MediaTek continued its recovery and gained share in 4G LTE basebands with the help of its Helio P, A and G range of 4G chips. MediaTek’s Dimensity-branded 5G chips were off to a great start in Q1 2020 and we expect MediaTek to gain market share with the help of its 4G and 5G share gains in the next few quarters. Also, MediaTek is well-positioned to gain share at Huawei for now in the wake of restrictions on Huawei’s chip unit’s ability to manufacture chips at TSMC.”

Christopher Taylor, Director of the Strategy Analytics RF & Wireless Components service, added, “Unlike the early phase of 4G, we are already seeing intense competition in early 5G. Qualcomm, for example, commanded over 90 percent share in early 4G days but the company now contends with HiSilicon, MediaTeK, Samsung and Unisoc in 5G. In Q1 2020, both HiSilicon and Samsung LSI performed well in the 5G baseband market. Samsung LSI’s efforts to expand beyond Samsung Mobile shown fruitful results as its 5G chip adoption by vivo progressed well during the quarter. Samsung LSI’s ability to sustain its merchant 5G chip ambition remains to be seen.”

Report URL: Baseband Market Share Tracker Q1 2020: 5G Drives Baseband Revenue Growth

#SA_Components

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

Contacts

European Contact:

Stuart Robinson, +44 1908 423 637

srobinson@strategyanalytics.com

US Contact:

Christopher Taylor, +1 617 614 0706

ctaylor@strategyanalytics.com