Advisors Prospecting for New Clients During Pandemic Find Success With a Multi-Channel Approach: Fidelity® Survey

Advisors Prospecting for New Clients During Pandemic Find Success With a Multi-Channel Approach: Fidelity® Survey

Across the Industry, Rates of Prospecting Lower as Advisors Adjust to Fully Remote Work

Fidelity Introduces Digital Marketing Resources with 100+ Actionable Ideas To Help Advisors As They Navigate Current Challenges And Develop Longer-Term Marketing Strategies To Fuel Growth

BOSTON--(BUSINESS WIRE)--Fidelity Investments® today released findings from its most recent COVID-19 Financial Advisor Community survey*, which explored how advisors have adapted their prospecting and client engagement approaches during the pandemic. Two-thirds of advisors surveyed reduced their prospecting activity in the first few months of the pandemic and 51% reported below average results from the prospecting they have done as they adjusted to a fully remote environment. Advisors reporting the most success with prospecting leveraged a multi-channel approach, using email, phone and video, with 74% reporting average or above average results. Three-quarters of those who used email alone reported below average results.

“During the COVID-19 pandemic, advisors have been stepping up to help clients navigate the complex emotional and financial impacts of the crisis while continuing to manage their own businesses,” said David Canter, head of the registered investment advisor (RIA) and family office segments for Fidelity Institutional. “Increased demand for financial planning and advice has led many firms to rapidly pivot how they engage with prospects and clients in a virtual environment. The crisis has been a catalyst for growth-oriented advisors to embrace more digitally-minded business development strategies.”

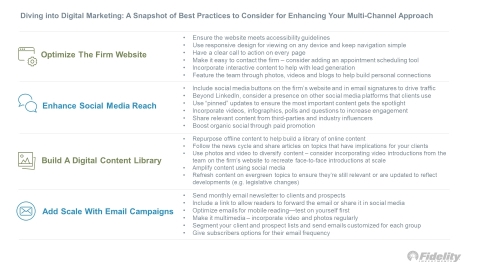

According to Fidelity research, although 90% of advisors surveyed are leveraging at least one digital marketing tactic, many indicated that lack of skills and resources are a barrier to marketing their firm effectively1. To help advisors navigate the business development challenges presented by the current environment and drive lead generation and organic growth, Fidelity introduced a new interactive resource, “Diving into Digital Marketing: A Practical Guide to Deepening Connections with Clients and Prospects.” Its 10 modules provide hundreds of actionable ideas to explore, including the foundations of integrated marketing, tactics for to making and reinforcing connections, and frameworks for measurement.

How Advisors are Adapting to a Remote Environment*

- Advisors under the age of 35 are using more digital prospecting tools and were more likely to use a combination of video, social media and email. Among these advisors, 41% reported using social media.

- Phone continues to be the most used channel to connect with prospects; however, half of advisors under 35, and 40% of advisors aged 36 to 54 are using video for prospecting during the pandemic.

- Comfort with working from home appears to be playing a role in how advisors have managed prospecting. Advisors who enjoy remote work were less likely to have reduced their prospecting than those who would prefer to be in the office.

Many of the changes implemented during this pandemic period will become foundational for advisors when communicating with clients and prospects. This reflects both an acknowledgement of the efficiencies of using tools like video conferencing and the evolving advisor demographic. For example, Fidelity’s survey revealed that RIAs anticipate doubling the use of video conferencing with clients, with 14% of client interactions occurring via video versus 7% pre-pandemic. Currently, one-fifth of RIAs reported using video for client meetings.

“It’s encouraging to see advisors embrace more digital tools, but it’s clear that there is still opportunity for them to do more and scale their reach by incorporating more digital marketing tactics in addition to optimizing how they use social media and email,” said Canter.

Visit go.fidelity.com/digitalmarketing for more actionable ideas for enhancing your digital marketing strategy and to access the Diving into Digital Marketing resource.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $8.1 trillion, including discretionary assets of $3.3 trillion as of May 31, 2020, we focus on meeting the unique needs of a diverse set of customers: helping more than 32 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 40,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

*The COVID-19 Financial Advisor Community survey was fielded between May 15 and May 21, 2020. Results are based on responses from 408 advisors currently working at a registered investment advisor, broker dealer or wirehouse.

The content provided herein is general in nature and is for informational purposes only. This information is not individualized and is not intended to serve as the primary or sole basis for your decisions as there may be other factors you should consider. Fidelity Clearing & Custody Solutions does not provide financial or investment advice. You should conduct your own due diligence and analysis based on your specific needs.

Fidelity Clearing & Custody Solutions® provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC. 200 Seaport Boulevard, Boston, MA 02210.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

933804.1.0

© 2020 FMR LLC. All rights reserved.

1 2019 Fidelity Financial Advisor Community—Digital Marketing Study

Contacts

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Megan Griffin

(617) 392-1313

megan.griffin@fmr.com

Follow us on Twitter @FidelityNews

Visit our online newsroom