Subscription Businesses Remain Resilient Amid COVID-19

Subscription Businesses Remain Resilient Amid COVID-19

Latest Zuora Report Shows That 4 of 5 Subscriptions Companies are Still Growing Despite Economic Impact of the Global Pandemic

REDWOOD CITY, Calif.--(BUSINESS WIRE)--Zuora, Inc. (NYSE: ZUO), the leading subscription management platform provider, today released the newest edition of its Subscription Impact Report designed to measure the economic impact of COVID-19 on subscription businesses from March 1 - May 31, 2020 compared to the previous 12 months (February 2019-February 2020). The report, analyzing both subscriber acquisition rates and average revenue per subscriber, compares Software and High Tech, Media, Consumer Membership and Internet of Things industry segments.

COVID-19 has significantly impacted the global economy, prompting companies across all industries to quickly adapt to shifting market demands and shelter-in-place orders. Through it all, however, subscription businesses are proving their resilience. While S&P 500 sales in Q1 2020 contracted at a -1.9% annual rate, subscription-based revenue continued to thrive, growing at 9.5% in the same quarter, according to Zuora Chief Data Scientist, Carl Gold.

The latest Subscription Impact Report found that half (50%) of companies are still growing but have not seen a significant impact to their subscription growth rates amid COVID-19, while 18% actually experienced an acceleration. And while 17% of companies experienced slower growth, they are still growing, and only 14% of the companies analyzed experienced a contraction in subscriber growth.

"It shouldn't come as a surprise, but Subscriptions continue to deliver above market growth. If these moments of time tend to accelerate underlying trends, we believe the current crisis will only accelerate the shift of the modern global economy towards digital services and subscription models,” said Tien Tzuo, cofounder and CEO at Zuora.

But no two subscription businesses are the same, and the economic crisis is impacting industries differently. While some focused on new subscriber acquisition via incentives such as free trials, others focused on retaining customers by providing payment relief, pausing services and more.

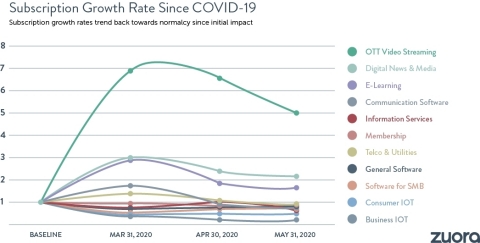

Growth rates by industry,1 for Subscription and Average Revenue Per Subscriber, include:

- Media and Publishing: Free trials and high demand for digital media lead to a surge in new subscribers. OTT Video Streaming increased subscription growth by 400% while Digital News increased growth by 110%. Average Revenue Per Subscriber is still growing, though the growth rate slowed by 59%.

- Software and High Tech: Overall, software companies experienced limited impact on subscription growth. However, E-Learning software saw growth above the average at an 80% increase in subscriptions. While the sector’s Average Revenue Per Subscriber slowed by 77%, it is still growing.

- Internet of Things: While IoT services saw a decline in subscriber sign-ups, subscriptions are still growing. The subscription growth rate for Consumer IoT slowed by 40%, Business IoT experienced a slowdown of 75%. However, spending for existing subscriptions actually accelerated by 42%, indicating greater adoption amongst existing subscribers.

- Consumer Membership: While subscription growth remained positive, these companies experienced a decline by 30%. Additionally, Average Revenue Per Subscriber contracted by -27% as existing subscribers spent less on memberships than before.

For most companies experiencing growth in subscriptions, revenue associated with each subscription did not grow as fast. While it’s typical to see average revenue per subscriber slow as subscription growth increases, the report findings point to a slowdown in upsells and expansions amid COVID-19. As subscription growth rates begin returning to their pre-COVID-19 baseline levels, it’s critical for subscription businesses to shift their focus from subscriber acquisition to subscriber retention and take care of existing subscribers to grow those relationships.

“If the Subscription Economy is about anything, it’s about a fundamental return to customer relationships. It’s the agility of the subscription model that uniquely positions businesses to adapt quickly to customer needs and provides them with consistent, ongoing value - regardless of economic climate,” continues Tzuo.

"While it’s still early in the lifecycle of the pandemic, it appears that companies with recurring business models have weathered the COVID-19 storm better than other models. Due to contracts and recurring revenue, companies are more closely aligned to their customers’ success,” said Mark Thomason, Research Director, IDC. “Leading recurring revenue companies have formal customer success teams which leverage usage data to provide real time insights to automate customer engagement and training.”

Download the full Subscription Impact Report here with business strategies and stories of adaptation used to build long-lasting customer relationships amid COVID-19.

1. Media and Publishing sector includes OTT Video Streaming and Digital News subscriptions; Software and High Tech sector includes General Software, Communication Technology, Software for SMB, Information Services and E-Learning Software subscriptions; Consumer Membership sector includes fitness, classes, clubs, subscription boxes, and various lifestyle memberships; Internet of Things sector includes Consumer IoT and Business IoT subscriptions.

About Zuora, Inc.

Zuora provides the leading cloud-based subscription management platform that functions as a system of record for subscription businesses across all industries. Powering the Subscription Economy®, the Zuora platform was architected specifically for dynamic, recurring subscription business models and acts as an intelligent subscription management hub that automates and orchestrates the entire subscription order-to-revenue process seamlessly across billing and revenue recognition. Zuora serves more than 1,000 companies around the world, including Box, Rogers, Schneider Electric, Xplornet and Zendesk. Headquartered in Silicon Valley, Zuora also operates offices around the world in the U.S., EMEA and APAC. To learn more about the Zuora platform, please visit www.zuora.com.

© 2020 Zuora, Inc. All Rights Reserved. Zuora, Subscribed, Subscription Economy, Powering the Subscription Economy, and Subscription Economy Index are trademarks or registered trademarks of Zuora, Inc. Third-party trademarks mentioned above are owned by their respective companies. Nothing in this press release should be construed to the contrary, or as an approval, endorsement or sponsorship by any third parties of Zuora, Inc. or any aspect of this press release.

SOURCE: Zuora Financial

Forward-Looking Statements

This press release contains forward-looking statements that involve a number of risks, uncertainties and assumptions, including but not limited to statements regarding the expected growth and trends in the market for subscription businesses,, and the expected benefits of any such trends, and the expected impact of the COVID-19 pandemic on companies with subscription-based business models. Any statements that are not statements of historical fact may be deemed to be forward-looking statements, and actual results could differ materially from those stated or implied in forward-looking statements. This press release also includes market data and certain other statistical information and estimates from industry analysts and/or market research firms. Zuora believes this third party information to be reputable, but has not independently verified the underlying data sources, methodologies or assumptions. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information.

Contacts

Jayne Gonzalez

press@zuora.com

408-348-1087