Elliott Advisors Sends Letter to Board of Directors of Alexion

Elliott Advisors Sends Letter to Board of Directors of Alexion

LONDON--(BUSINESS WIRE)--Elliott Advisors (UK) Limited sent the following letter to the Board of Alexion today.

A full copy of the letter can also be downloaded at www.elliottletters.com/alexion.pdf

May 12, 2020

Mr. David R. Brennan

Chairman of the Board

Alexion Pharmaceuticals, Inc.

121 Seaport Blvd

Boston, MA 02210

Dear Mr. Brennan,

On behalf of funds advised by Elliott (“Elliott” or “we”), which remain a significant and long-term investor in Alexion Pharmaceuticals, Inc. (“Alexion” or the “Company”), we are writing to share with you our latest perspectives on the Company’s future.

Since the beginning of our engagement with the Company in 2017, we have been and remain firm believers in the unique strengths of Alexion’s long-term prospects and its essential role in the healthcare system. This conviction stems from our thorough diligence and analysis of the Company’s markets, positioning, products, culture and dedication to its patient population. Over the past three years, we have observed with growing frustration a divergence between the favorable operational improvements that have taken place at the Company and the increasingly negative market sentiment weighing down its valuation and share price performance.

A detailed review of the underlying reasons for the persistent underperformance of the Company’s share price is what led us to conclude last year that the best approach for the Company and its stakeholders is the immediate exploration of a sale, which, as explained below, would create significant upside for shareholders while creating a more stable footing for all those with a vested interest in Alexion’s future – including its patients.

Despite your disagreement with that conclusion last December, we took note of your apparent good-faith focus on finding an optimal path forward, encouraged by our shared conviction in the Company’s strong potential and shared frustration with its deep undervaluation. We respectfully acknowledged your December announcement, which sought additional time for Alexion to prove its prospects as a stand-alone company while remaining open to the potential for incoming strategic interest.

Nearly half a year later, with heightened urgency amidst a public health crisis and considerable economic turmoil, the market continues to render a decisive verdict for Alexion’s “go-it-alone, trust-us” approach. The announcement of your acquisition of Portola – and the harsh negative market reaction that followed – offers the latest evidence in support of our view that the Board is taking Alexion in the wrong direction, and that the Company’s current strategy is unlikely to restore the market’s perceptions of Alexion’s attractiveness and uniqueness. We believe that this Board is in urgent need of fresh perspectives and a new direction.

To date, we have kept our dialogue with you private for the most part in an effort to be as constructive as possible. However, the Portola announcement’s profoundly negative impact on shareholder value – erasing approximately $1.7 billion from the Company’s market capitalization in a single day1 – has led us to conclude that a broader public discussion about the best path forward for Alexion is necessary.

We are therefore making today’s letter public to share our thoughts and analysis more broadly, both to inform the market and to draw the Board’s attention to the intense and growing dissatisfaction of shareholders with the Company’s current course.

Alexion Has Been a Persistent Underperformer

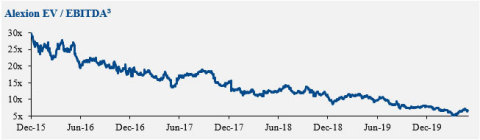

Despite Alexion’s attractive franchise and favorable operating performance, the Company’s share price has persistently struggled over the last few years. As detailed in the below charts, Alexion’s valuation multiple has steadily eroded, with an over 75% reduction in its EV/EBITDA multiple since 20152.

See Figure 1: Alexion FY1 EV / EBITDA Development from 2015 to 2020

This has contributed to a significant underperformance in total shareholder return relative to any relevant stock market index over the last one-year, two-year, and three-year periods, as well as over the course of your tenure as Chairman.

See Figure 2: Cumulative Relative Total Shareholder Returns vs. Indices (%)

Indeed, during your tenure, Alexion is the worst performer across the broader large-cap biopharma sector:

See Figure 3: Total Shareholder Return vs. Peers over ALXN Chairman Tenure (%)

Negative market sentiment continues to weigh heavily on Alexion’s share price. Significant skepticism has persisted with respect to the resilience and longevity of its complement franchise. We believe this skepticism is unwarranted, which only underscores the depths of Alexion’s trust deficit and communication problems with investors. This dynamic has kept many investors away as the existential debate around the Company has obscured its achievements to date and its unique strengths and positioning for the future. Examples of widely held market perspectives on these topics include the following:

- “One of the challenges we’ve had with ALXN shares has been the existential nature of the investment debate, and that the bull / bear discussion – even as management execution has been strong – seems largely focused on the stock's terminal value” – Stifel, August 30, 2019

- “We expect ALXN to remain in its current trading range until there is greater visibility in the strategy beyond C5” – MS, May 6, 2020

Unfortunately, as we have highlighted to you throughout our engagement, this overhang cannot be addressed through incremental improvements to the business, with analysts repeatedly highlighting the inability of the market to look beyond the longevity debate and reward the substantial operational improvements that the Company has made over the last few years:

- “The shares are not expensive. However, we remain neutral given yet-to-be materialized success in pipeline diversification beyond the C5 franchise (~86% of revenue) & potential entry of competitors for the C5 franchise” – Jefferies, May 6, 2020

- “Still, we think the lowered guidance will overshadow the 1Q results and along with persistent doubts about the longer-term future of the C5 franchise prior to competitor launches we would remain on the sidelines for now” – BAML, May 6, 2020

- “We expect execution to remain strong, though the stock suffers from a so-so near term catalyst path, as well as a theoretical (hard-to-refute) bear case” – Stifel, May 6, 2020

More recently, as highlighted in the table below, several unfortunate missteps have reinforced this negative sentiment, and the market consequences of these events have been exacerbated by poor communication.

See Figure 4: Several missteps have reinforced negative sentiment around Alexion

In all the examples above, Alexion’s attempts to reassure an already skittish investor base failed. The Company’s deficient communication more often than not left doubts unaddressed and questions unanswered. Paul Clancy’s departure is a case in point. Paul had earned his reputation as an experienced and perceptive CFO who reliably guided market expectations and consistently managed to surprise to the upside. His sudden departure, announced in a press release that provided no background or rationale for the move, led to troubling investor speculation, with one broker commenting, “It’s impossible to know if there’s anything else beyond the surface here.”8 Similarly, the new CFO’s 2020 EPS growth guidance announced in January 2020, at just 2% at the midpoint of the guidance range, marked a surprising and poorly explained reversal to the Company’s stated ambition of “double digit revenue and EPS growth” at its Investor Day just ten months earlier.9

Two of the most instructive missteps listed above include the recent acquisitions of Achillion and Portola, which highlight the degree to which the Company is at odds with market expectations. Conceptually, there is an M&A framework for Alexion that makes sense – prudently invest in assets that bring optionality and enhance the existing franchise:

- “Our acquisition strategy has really been focused on rebuilding our pipeline over the last 2 years […] our plan is still to keep rebuilding that pipeline, continue the path that we are on from a diversification standpoint, and most importantly, sort of stay disciplined on matching the risk that we take with a particular BD or partnership or license or acquisition with the value that we pay for it” – Aradhana Sarin, CFO, March 3, 2020

Indeed, this stated goal has drawn praise from analysts:

- “We like ALXN's BD focus on largely under-the-radar/under-appreciated assets” – RBC Europe Limited, June 11, 2018

- “ALXN Investor Day Marked By Incremental But Smart BD … with respect to Alexion's [BD] strategy going forward: (1) the company continues to emphasize a transition toward "orphan" [not "ultra" orphan] assets and (2) management noted that they'll be aggressive, but also disciplined when leveraging external innovation to build the pipeline” – Stifel, March 20, 2019

Yet the announcements of Alexion’s acquisitions of Achillion and Portola both destroyed significant shareholder value:

See Figure 5: The announcements of Alexion’s acquisitions of Achillion and Portola both destroyed significant shareholder value

It is possible to argue that Achillion provides a coherent strategic fit given the complementarity of Achillion’s key assets with Alexion’s portfolio, with Danicopan enabling Alexion to better treat the subset of PNH patients with EVH. Yet Alexion failed to appreciate the appearance of defensiveness in the timing and communication around this transaction, creating the impression that the Company was on the back foot and worried about PNH competitors, as highlighted by a number of analyst comments at the time:

- “In our view, the transaction has strong strategic rationale as a defensive play for ALXN vs. competitors (esp. APLS)” – Evercore ISI, October 16, 201912

- “The deal … implies either Alexion knows the “Apellis thesis” is accurate or PNH is not the main value driver” – Raymond James, October 16, 2019

Likely bruised by the market’s reaction to this first business development initiative, Alexion nonetheless went on to announce the acquisition of Portola, a move that – at best – can be described as an execution improvement play with a likely positive NPV. But this deal is a far cry from the kind of nimble rare-disease tuck-ins that investors, including ourselves, believe could further strengthen Alexion as a rare-disease powerhouse. In our experience, it is quite rare – even among poorly received transactions – for an acquirer’s market capitalization to collapse by an amount in excess of the total value of the announced transaction. Such a disproportionate decline in a company’s share price is the sign of much deeper concerns regarding a company’s perceived strategy.

Putting aside the price paid for the asset, which could have been softened with a commercial milestones CVR, Portola’s lack of obvious strategic fit with Alexion is what drove the bulk of the market’s negative reaction, in our view. Portola has no chronic rare-disease exposure, the core of Alexion’s focus and know-how, and instead targets a broad patient population in the acute hospital setting. The company’s main product, AndexXa, has limited channel overlap with the majority of Alexion’s products. In addition, the acquisition levers Alexion to a hospital-based product in the midst of an ongoing pandemic in which non-COVID-19-related hospital admissions have gone down significantly.

This view of the Portola acquisition is supported by analysts and other investors, who have expressed broad skepticism towards the transaction:

- “Buying a Biotech on the Cheap Not Helping to Restore Investor Sentiment … While we expected ALXN would remain active on the BD front, we were surprised to see it go after a beaten down story … Portola’s early commercial struggles will likely induce skepticism that today’s deal can meaningfully diversify … accordingly, client feedback on the deal has been mixed at best” – JPM, May 5, 2020

- “Portola acquisition provides mgt. with an additional revenue generating product, but at a high initial cost… [ALXN] has no cardiovascular exposure, is acquiring a product that has struggled for multiple years given narrow utilization criteria and mgt. is paying a 12.5x trailing revenue multiple … we expect a material earning contribution to take time” – MS, May 5, 2020

- “From our discussions with investors we’ve heard almost universally negative feedback on this deal, ranging from concerns that Andexxa could be over-priced (a reason behind weak initial uptake/reimbursement), to broader reservations surrounding ALXN levering itself to a hospital-based product in the midst of an ongoing pandemic” – Stifel, May 6, 2020

These two transactions have dealt an additional blow to the already fragile credibility of Alexion’s Board and management team. The dismal track record also calls into question whether the Board and management team are receiving strong, impartial advice from their external advisors. To avoid these repeated mistakes, Alexion would benefit from both fresh perspectives on the Board and better advice given to the Board. There is mounting confusion among investors regarding the core focus of Alexion’s business development efforts, and the Company’s next move now faces an even greater hurdle for regaining trust.

Self-Reinforcing Underperformance is Obscuring the Attractiveness of the Company

The above assessment of the untenable status quo is especially frustrating given both the Company’s underlying strengths and all that this team has achieved from an operational point of view.

Serving the unique needs of its patients with life-saving therapies, Alexion is a leading biopharmaceutical company supported by a world-class complement franchise, strengthened by the launch of Ultomiris, which offers patients significant improvement to their lives through a more convenient approach to dosing, and featuring a substantial competitive moat in its existing markets. Alexion is a fundamentally strong company, operating in a fundamentally strong industry.

For the past several years, Alexion’s management team has taken a number of positive steps forward to improve the underlying business. Alexion rightly noted the following in its December 2019 statement: “Over the course of our engagement, Elliott has been extremely complimentary of our Board, management team and business. We appreciate Elliott’s recognition of the uniqueness and strength of Alexion’s business.”

As we have referenced previously, when Dr. Ludwig Hantson joined as CEO in early 2017, Alexion was in a period of significant turmoil and uncertainty. At that time, he recognized that Alexion’s past challenges offered a significant opportunity for value creation given the sound fundamentals of the franchise and the tangible benefits the Company’s products have brought to patients. We saw the same potential in Alexion, and in 2017, we approached the Company with a number of suggestions to improve the Company’s governance, operational efficiency, R&D productivity, transparency and communication. We went on to have an extensive dialogue with the management team on these points, and we were encouraged that Alexion delivered on a number of these suggestions, including the following:

- Strong cost controls delivering an 11% increase in operating margins since 2017;13

- Measured and sensible capital deployment strategy with a focus on smaller tuck-in acquisitions and collaborations;

- Improved governance through the appointment of new Board members, which enhanced the Board’s diversity, expertise and independence; and

- Well-managed market expectations and guidance with 12 / 13 revenue beats and 13 / 13 EPS beats since YE2016.14

In addition and more importantly, the Company succeeded in obtaining the approval of ALXN1210, now Ultomiris, and launching its commercialization. This development removed a key area of uncertainty and strengthened the long-term sustainability of the complement franchise by offering patients an even better drug to treat their life-threatening conditions. The sensible and responsible pricing policy of this improved product (at a meaningful discount to Soliris), coupled with the successful ongoing switching of Soliris patients, is creating a unique basis for future sustainable growth across an increasing number of therapeutic indications.

By all key operating measures, Dr. Hantson and his team have taken meaningful steps to improve the business during his relatively short tenure. As a result, Alexion is now well-positioned for long-term value creation, as highlighted by the following key attributes:

- Long runway of volume-driven revenue growth, driven by:

- Expansion into new indications, with excellent ongoing gMG and NMOSD launches and the potential to expand further into neurology with ALS;

- A rapidly growing metabolic franchise which offers a meaningful area of diversification and earnings, with the franchise growing at a 43% CAGR from 2016-19 and expected to contribute 14% of overall sales in 2020;15

- A coherent (albeit small) pipeline, with ten potential launches by 2023, driving a potential incremental $3.7 billion of peak risked revenues;16

- Strong commercial positioning, with:

- High patient loyalty, driven by the chronic nature of Alexion’s key indications, the high efficacy of Soliris and Ultomiris, and the Company’s leading patient support network, with Alexion providing high-touch support for all patients;

- Leading market position with high visibility over the entire patient population through OneSource;

- Industry leading relationships with physicians and KOLs driven by years of educational efforts to drive increased disease awareness and diagnosis;

- Strong payor value proposition:

- Ultomiris offers meaningfully lower cost for payors, with a roughly 19% reduction in overall gross cost per PNH patient and 37% saving for aHUS, gMG and NMO patients;17

- A highly responsible pricing strategy, which should help protect the Company in any potential US drug pricing reforms; and

- A highly profitable and cash-generative business, with annual free cash flow of over $2 billion,18 protected by IP until 2035.

Our assessment of the relevant competitive landscape, including potential branded and biosimilar competition, has informed our conviction that Alexion’s strengths and sustainable positioning are highly underappreciated, as reflected in the Company’s depressed valuation.

The Company benefits from a highly attractive financial profile, with Alexion expected to grow revenues at an 8% 5yr CAGR while consistently generating EBITDA margins of over 55%.19 Despite this, Alexion now trades at just 6.1x 2021 EV / EBITDA and 8.3x 2021 P/E,20 which are amongst the lowest multiples in the entire large cap biopharma universe. Indeed, comparing a regression of peer forecast revenue growth to valuation multiples implies that Alexion is expected to underperform its five-year consensus revenue CAGR by over 8%, in our view a highly unlikely scenario:

See Figure 6: 2020E EV / EBITDA vs. 5yr Revenue CAGR

Even based on conservative estimates – which assume the market share of Alexion’s complement franchise decreases substantially to the benefit of potential future competitors and Soliris biosimilars – we believe Alexion shares now trade at a 40-50% discount to fair value. Sell side analysts seem to agree with such conclusions, with a median upside to target price of 40% (vs. 6% on average for large cap biotech peers).23

Indeed, based on our analysis, the current market value ascribed to Alexion suggests that investors expect the Company’s core complement franchise market share to decline to less than 30% (from 100% currently in its core indications) over the next seven years.24 In our view, this is a highly implausible scenario given Alexion’s best-in-class Ultomiris drug from an efficacy, safety and convenience standpoint, and the extent to which the Company is embedded within, and trusted by, the relevant patient and doctor populations. This also implies share losses to biosimilars well beyond precedent cases in which patients have successfully switched to improved drug formulations. In the case of Copaxone, 20mg generics initially gained less than 10% share until the launch of 40mg generics, driven by Teva switching over 80% of patients to 40mg Copaxone.25

A company that possesses the aforementioned strengths yet trades at such a deep discount offers a highly attractive profile for a potential acquirer. The acquisition valuation of Alexion would primarily be driven by the acquirer’s cost of capital in underwriting the Company’s future cash flows, not the current trading price. In valuing Alexion’s cash flows at a large-cap pharma discount rate, a sale would close the valuation gap between the Company’s current valuation (which implies in our view a WACC in excess of 11%) and a large-cap pharma valuation, with additional benefit beyond this from synergies. Closing this gap would potentially crystallize significant upside for shareholders, and create a more stable footing for all those with a vested interest in Alexion’s future – including its patients.

Alexion provides a number of pharmaceutical companies with a unique value proposition, especially those instrumental in combatting rare diseases. We believe Alexion represents a highly strategic asset for any such player, providing an acquirer with a unique and dominant platform in the complement space with rare longevity and growing diversification across several attractive therapeutic areas. Today, the market ascribes no value to Alexion’s pipeline, which offers the unique mix of early stage but complementary programs that would be particularly well-suited to a long-term oriented pharmaceutical company.

Further, an acquisition would be very financially attractive, generating significant bottom-line accretion, and substantially inflecting top-line growth even for the largest acquirers, given the scale of the Company. While Alexion’s top-line growth could temporarily slow at the time of entry of Soliris biosimilars, even in a worst-case scenario (assuming 2023 biosimilar entry), our analysis shows that it should re-accelerate from 2026 onwards, driven by pipeline launches and continued market penetration. This re-acceleration will provide a long-term revenue growth benefit. Finally, Alexion is highly cash generative, with c. 60% of current market capitalization expected to be generated in FCF organically over the next five years.26

This is a unique moment for the global economy, marked by uncertainty and opportunity. Many large potential acquirers have performed well in recent months, as the pharmaceutical industry faces high hopes and heavy demands. As has long been the case, several have a clear need to secure a more stable footing in rare disease, and they will be hard-pressed to find a more attractive profile than the one offered by Alexion.

Investor Patience Has Eroded, and Available Pathways Forward Are Limited

While there is plenty of wider market uncertainty today, there is no doubt that the public market has not been hospitable to Alexion in any recent environment. For years, Alexion’s share price has failed to properly reflect the Company’s strengths and future prospects, a belief in which there is full alignment between the Company’s management and many market participants, including Elliott. The significant historical underperformance coupled with an escalating series of missteps have eroded trust in the Board and management and have obscured the attractiveness of the franchise.

This is a deeply disappointing reality and a disservice to those who have built up the franchise over many years. The credibility of the management team has continued to decline in the wake of Paul Clancy’s departure, as the market credited Clancy with many of the operational improvements. The current executive team has struggled to find its footing, and the Board has struggled to provide any satisfactory answers for the disappointing results. For investors, the frustration is palpable. The duty rests upon the Board of Directors to act with focus and urgency to address the situation. Many shareholders, ourselves included, have provided constructive private feedback over the years and offered support for the new management team. Management’s smart operational improvements have been encouraging. But the Board’s strategic incoherence has been exasperating. Public boards have a duty to represent their owners, not test their patience.

Unfortunately, there are few workable options remaining to restore investor confidence. The following levers could be considered, yet all fall short of what is needed:

- Operational improvements? It is possible that intensive operational focus and delivering on the franchise’s growth could prove the market wrong. We believed in such a pathway back in 2017, and to the team’s credit, Alexion has delivered operationally and implemented most of our suggestions at the time. These improvements have resulted in a better business and a stronger franchise, yet market sentiment and share-price performance have gone from bad to worse over this same three-year period. With management credibility fast eroding, it seems unrealistic to assume that the pursuit of further organic operational improvements over the next few years will be sufficient.

- Diversification through M&A? As noted above, there is a coherence to the consideration of small-scale opportunities. Yet the past two transactions provide a clear (and costly) cautionary tale. Both Achillion and Portola were met with investor disappointment and dramatic share-price underperformance, with this latest acquisition appearing to represent the straw that has broken the camel’s back in terms of investor confidence. In our view, any large-scale M&A would be seen as an act of desperation at odds with the Company’s stated objectives and could lead to an even more severely negative reaction, triggering reminiscence of the disastrous past Synageva acquisition.

- Merger? Given the current depressed share price, such a transaction would be value-destructive, especially in the absence of a meaningful premium for Alexion shareholders.

- Capital returns? Among Alexion’s many strengths, the Company delivers healthy cash flow generation. Given the market’s reactions to its ill-advised acquisitions as of late, the best investment Alexion could make would be an investment in itself. This is especially true given management’s stated belief that Alexion is deeply undervalued today. An investment in Alexion at a 40-50% discount to fair value is uniquely attractive, yet a more value-creative capital return policy would not address the deeper issues with negative market sentiment. There is an existential debate swirling around the future of the Company, and a buyback program is an insufficient response.

Having spent the last several years deeply engaged with Alexion, working through a number of considerations directly with management, we return to the same conclusion: Alexion is a great company, but cannot reach its full potential as a listed stand-alone company. Selling the Company is the best and (at this point) the most viable pathway forward to solve its prolonged market issues and deliver an optimal outcome to all with a stake in Alexion’s future.

***

We respectfully urge the Board to acknowledge the limitations of the current strategy in light of the Company’s persistent underperformance and to act with urgency in exploring strategic alternatives. We appreciate the natural resistance to conceding that a company you oversee cannot thrive on its own, and we do not make the recommendation lightly. When we first engaged with the Company in 2017, we were strong believers in Alexion’s standalone prospects. The progress made to date has improved many aspects of the Company, but those improvements have not gotten to the core challenge of the market’s concerns. We first made this case to you only after a thorough consideration of all other alternatives.

The events of recent months have strengthened the case. Late last year, you insisted that Alexion simply needed more time to prove that its strategy was sufficient to turn things around. Since then, Alexion has continued to disappoint investors with its persistent share-price underperformance and further missteps. At the same time, the quick stock-market recovery from the March crash and the growing strength of pharmaceutical markets have bolstered the prospects of a win-win transaction. There are healthy acquirers who would benefit immensely from acquiring a company of Alexion’s strength and profile.

Alexion’s Board has overseen significant and consistent value destruction for shareholders over many years. Those who continue to cling to a failed strategy do not make a compelling case that they are best fit to steer Alexion into the future. Just as the Board has struggled to defend its current strategy given these suboptimal results, we anticipate that you and many of your fellow Board members will struggle to defend your track records when asking shareholders to support your continued service on the Board in the future. We strongly encourage fresh thinking and bold action without further delay.

We look forward to your response, and as always, we would be happy to answer any questions that you have as they pertain to this letter. We remain hopeful that we can work together now as we have in the past to advance the best interests of the Company and its stakeholders.

Sincerely,

Elliott Advisors (UK) Limited

Cc: Alexion Board of Directors, Alexion CEO Dr. Ludwig Hantson

1 Daily change in market capitalization, adjusted for iShares NASDAQ Biotechnology Index move

2 Based on Bloomberg EV / FY1 EBITDA as of 8-May-2020

3 Bloomberg EV / FY1 EBITDA from 31-Dec-2015 to 8-May-2020

4 Alexion total shareholder return to 8-May-2020 vs. peers listed by Alexion in its 2020 proxy statement, comprising Abbvie, Alkermes, Allergan, Amgen, Biogen, Biomarin, Celgene, Gilead, Incyte, Jazz, Regeneron, Seattle Genetics, United Therapeutics, Vertex

5 Alexion total shareholder return to 8-May-2020 vs. iShares NASDAQ Biotechnology Index

6 Alexion total shareholder return from 10-May-2017 to 8-May-2020. Peers include US and EU large-cap biopharma players

7 Event date share price performance vs. iShares NASDAQ Biotechnology Index

8 Stifel, 17-Sept-2019

9 Page 10, Alexion Investor Day Presentation, 20-Mar-2019

10 Announcement date share price performance vs. iShares NASDAQ Biotechnology Index

11 Announcement date change in market capitalization, adjusted for iShares NASDAQ Biotechnology Index move

12 Underlining in quote added for emphasis

13 Based on FY2019A operating margins

14 Based on Bloomberg consensus

15 Based on the midpoint of 2020 guidance

16 Based on Elliott analysis

17 Assumes a gross price of $510k for Soliris based on public disclosure, a 10% base discount for Ultomiris for PNH and $3k net costs per hospital visit (based on expert feedback). For PNH patients, this equates to total costs of $588k for Soliris assuming 26 hospital visits vs. $477k for Ultomiris assuming 6.5 hospital visits per year. For aHUS, NMO and gMG this equates to total costs of $758k for Soliris assuming 26 hospital visits vs. $477k for Ultomiris assuming 6.5 hospital visits per year

18 Based on 2021E analyst consensus estimates

19 2019-2024 revenue CAGR and EBITDA margins based on Bloomberg consensus as of 8-May-2020

20 Bloomberg analyst consensus estimates

21 2019-2024 revenue CAGR, revenues and multiples based on Bloomberg consensus as of 8-May-2020. 2020-2025 CAGR used for BMS given CELG acquisition. Large cap pharma players comprise Amgen, AstraZeneca, BMS, Eli Lilly, GlaxoSmithKline, J&J, Merck & Co., Merck KGAA, Novartis, Pfizer, Roche and Sanofi. Large cap biotech players comprise Biogen, Gilead, Regeneron

22 “Ambition to maintain double digit revenue growth” as per page 28 of the Alexion 2019 Results presentation, 30-Jan-2020

23 Based on Bloomberg as of 8-May-2020. Large cap biotech peers comprise Biogen, Biomarin, Gilead, Incyte, Regeneron, Seattle Genetics and Vertex

24 DCF valuation assuming 8% WACC and biosimilar entry in 2023

25 Copaxone market shares based on IMS Trx data as of Sep-2017, the final month before the launch of 40mg generics

26 Based on Bloomberg consensus FCF from 2020-2024 as of 8-May-2020

Contacts

London

Sarah Rajani CFA

Elliott Advisors (UK) Limited

+44 (0) 20 3009 1475

srajani@elliottadvisors.co.uk

New York

Brian Schaffer

Prosek Partners

+ 1 646 818 9229

bschaffer@prosek.com