E*TRADE Advisor Services Study Reveals RIA Mindset Amid Market Sell-Off

E*TRADE Advisor Services Study Reveals RIA Mindset Amid Market Sell-Off

ARLINGTON, Va.--(BUSINESS WIRE)--E*TRADE Advisor Services, a provider of integrated technology, custody, and practice management support for registered investment advisors (RIAs), today announced results from the most recent wave of its Independent Advisor Tracking study, which covers advisor views on the market, the industry, their business, and clients.

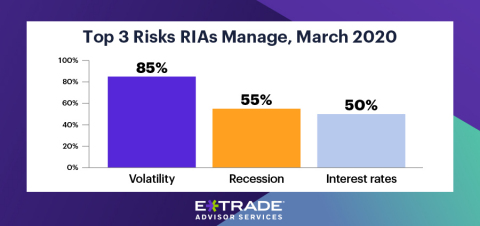

- Volatility management skyrockets. More than four out of five advisors (85%) are actively managing against market volatility—shooting up 20 percentage points this quarter. More than half (55%) are managing against a recession, shifting up eight percentage points from December.

- Clients aligned on volatility concerns. Clients are contacting their advisors most about volatility (53%) and the coronavirus (38%), in stark comparison to December, when clients most asked about the threat of recession (28%), and the ongoing trade tensions (21%).

- Advisors see opportunity in health care investments. Health care (22%) is the number one sector where advisors see potential, moving up six percentage points since the end of the year.

- Clients are increasingly trying to time the market. The top mistake advisors see their clients make is attempting to time the market (45%), ticking up seven percentage points since December.

“We are in unprecedented times, and with the length of the pandemic a big question mark, it’s undoubtedly a major driver of client anxiety,” said Gabriel Garcia, Managing Director of E*TRADE Advisor Services. “As client inquiries surge, filled with emotional decision-making and temptations to time the market, advisors are uniquely positioned to help them navigate through these turbulent waters. The first step is to acknowledge client concerns. This can help alleviate angst and give them the reassurance they need to help stay the course. Then, help them refocus on their goals and see where they might need to make adjustments—like recalibrating their risk tolerance or understanding liquidity needs—to remain on track. Proactive communications and ongoing education can also go a long way.”

To learn more about E*TRADE Advisor Services, visit etrade.com/advisorservices.

For news and thought leadership from E*TRADE Advisor Services, follow us on LinkedIn.

About the Survey

This survey was conducted in-house from March 10 to March 19, 2020, among a convenience sample of 225 independent registered investment advisors.

About E*TRADE Financial and Important Notices

E*TRADE Advisor Services is a provider of integrated technology, custody, and practice management support for registered investment advisors (RIAs). E*TRADE Advisor Services is dedicated to helping RIAs realize their full potential and provide them the support they need to manage their practices and clients’ financial futures. More information is available at etrade.com/advisorservices.

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank doing business as “E*TRADE Advisor Services,” both of which are federal savings banks (Members FDIC). Securities products and services are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. More information is available at www.etrade.com.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial Corporation. ETFC-G

© 2020 E*TRADE Financial Corporation. All rights reserved.

Referenced Data

What risks are you actively managing right now when it comes to client portfolios? Select all that apply. |

||

|

December 2019 |

March 2020 |

Market volatility |

65% |

85% |

Recession |

47% |

55% |

Interest rates |

50% |

50% |

Political instability |

41% |

32% |

Flattening/inverted yield curve |

23% |

24% |

Inflation |

25% |

14% |

Armed conflict, war, or terrorism |

5% |

8% |

None of these |

7% |

2% |

Other |

4% |

17% |

When it comes to the market, what are your clients contacting you most about? |

||

|

December 2019 |

March 2020 |

Market volatility |

21% |

53% |

Coronavirus and other pandemic concerns |

-- |

38% |

Recession |

28% |

5% |

Federal reserve monetary policy |

2% |

1% |

US trade tensions |

21% |

0% |

Economic weakness abroad |

2% |

0% |

Flattening/inverted yield curve |

2% |

0% |

Gridlock in Washington |

11% |

0% |

Other, please specify: |

5% |

1% |

None |

9% |

0% |

What industries do you think offer the most potential for your clients this quarter? (Please choose your top three) |

||

|

December 2019 |

March 2020 |

Health care |

16% |

22% |

Information technology |

19% |

18% |

Consumer staples |

9% |

15% |

Real estate |

10% |

9% |

Utilities |

7% |

8% |

Energy |

8% |

7% |

Consumer discretionary |

9% |

6% |

Financials |

13% |

6% |

Communication services |

4% |

5% |

Industrials |

3% |

3% |

Materials |

2% |

2% |

What is the biggest mistake you see your clients making? |

||

|

December 2019 |

March 2020 |

Trying to time the market |

38% |

45% |

Not saving enough for retirement |

20% |

20% |

Acting on stock tips that don't align with long-term goals |

8% |

7% |

Prioritizing their dependent's financial needs over their own |

10% |

6% |

Not preparing an estate or will |

7% |

6% |

Asking for early withdrawals from retirement accounts |

8% |

5% |

Avoiding international investments |

1% |

1% |

Other, please specify: |

6% |

5% |

None |

3% |

4% |

Contacts

E*TRADE Media Relations

646-521-4418

mediainq@etrade.com

E*TRADE Investor Relations

646-521-4406

IR@etrade.com