Fidelity Simplifies Investing Again With Launch of Real-time Fractional Shares Trading for Stocks and ETFs

Fidelity Simplifies Investing Again With Launch of Real-time Fractional Shares Trading for Stocks and ETFs

- Investors Can Now Build a Diversified Portfolio of Stocks and ETFs Based on the Dollar Amount They Want to Invest

- New Capability Adds Even More Value to the Industry’s Only Brokerage Platform to Offer $0 Commission Online Trading, Automatic Default to Investment in a Higher Yielding Cash Option and Quality Trade Execution

BOSTON--(BUSINESS WIRE)--Fidelity Investments®, the largest online brokerage firm with more than 23 million retail brokerage accounts, today announced availability of real-time fractional shares trading of stocks and ETFs (also known as dollar-based investing). This simplified way of investing, which is being rolled out to Fidelity’s retail customers beginning today and will continue over the next several weeks, allows investors to trade as little as 0.001 of a share using Fidelity’s Mobile® app for iOS® and AndroidTM.

Fidelity is the only brokerage firm to offer zero online commissions for stock and ETF trades, zero account minimums, zero account fees for retail brokerage accounts, a higher cash sweep rate versus the other largest online brokerage firmsi regardless of investable assets1, and continues to forgo payment-for-order-flow from market makers for stock and ETF trades, helping facilitate industry leading price improvement for customers.

Fidelity will execute all fractional trades in real-time during market hours, meaning customers will always know the share price, unlike some firms that execute fractional trades at the end of a trading day or wait for multiple orders to add up to full shares. Fractional share or dollar-based trades, which must be market or limit order types and are good for the day only, are available in eligible Fidelity retail accounts, including brokerage, HSAs, IRAs, and self-directed brokerage accounts via a workplace retirement plan.

“Investing at Fidelity just got easier, and more accessible, with dollar-based investing,” said Scott Ignall, head of Fidelity’s retail brokerage business. “Leveraging Fidelity’s award-winning mobile apps and brokerage platform, customers can now own a piece of their favorite companies and ETFs based on how much they want to invest, independent of the share price.

“Fidelity’s size, private structure, and leading positions across various marketplaces (including retail, institutional, and intermediary) are unmatched in our industry and put us in a unique position to deliver greater value to our customers,” continued Ignall. “In addition, customers have access to unmatched stock and ETF research to confirm or generate new investing ideas.”

How Investors May Benefit from Dollar-Based Trading

Based on customer feedback, we expect investors to use dollar-based trading in a variety of ways, including:

- A customer saves $500 to begin investing in several high-priced companies they have been following for their diversified portfolio. With this new capability the price of a single share is not a concern, and the investor buys $100 worth of shares in five different companies, potentially helping with diversification.

- A customer may implement dollar-cost averaging, a strategy in which an investor divides the total amount to be invested across periodic purchases of a stock or ETF to help reduce the impact of volatility. With zero online commissions and the ability to buy in fractional shares or dollars, a customer could set up an automatic deposit from their paycheck or bank account into a Fidelity brokerage account and easily make multiple purchases of a stock or ETF over time, e.g. $50 each month, and pay nothing in commissions.

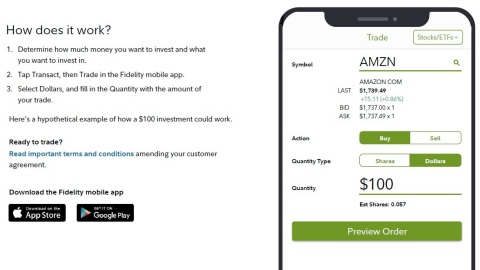

Dollar-Based Trade Ticket on Fidelity Mobile:

Dollar-based trading will be rolled out on Fidelity Mobile apps for iOS and Android, available in the App Store and on Google Play.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $8.3 trillion, including discretionary assets of $3.2 trillion as of December 31, 2019, we focus on meeting the unique needs of a diverse set of customers: helping more than 30 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 financial advisory firms with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 40,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about.

$0.00 commission applies to online U.S. equity trades and Exchange-Traded Funds (ETFs) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). Other exclusions and conditions may apply. See Fidelity.com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Clearing & Custody Solutions® are subject to different commission schedules.

Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

Fidelity, Fidelity Investments, Fidelity Investments and the pyramid logo are registered service marks of FMR LLC.

Investing involves risks, including the loss of principal.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company, LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

200 Seaport Boulevard, Boston, MA 02110

914835.1.0

© 2020 FMR LLC. All rights reserved

1 Competitor bank sweep retirement product is eligible for FDIC insurance. Fidelity sweep investment not FDIC insured; may lose value; consider each product carefully.

i Comparative Yields: When you open a new retail Fidelity Brokerage Account, we automatically put your uninvested cash into the Fidelity Government Money Market Fund with a seven-day yield of 1.22% as of 01/22/2020 (unless you choose another cash option). The Fidelity fund yield is compared to: Schwab Default Sweep APY of .06% as of 01/22/2020 for the Schwab One Interest for retail and Bank Sweep Account for retirement; TD Ameritrade Default Sweep APY of 0.01% as of 01/22/2020 for the TD Ameritrade FDIC Insured Deposit Account Rate—Core; and E*Trade Default Sweep APY of 0.01% as of 01/22/2020 for the Extended Insurance Sweep Deposit Account. Yields may vary due to market conditions. See Fidelity.com/cashvalue for current yields.

Contacts

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Robert Beauregard

(401) 292-7440

robert.beauregard@fmr.com

Nicole Goodnow

(617) 563-3785

nicole.goodnow@fmr.com