LONDON--(BUSINESS WIRE)--Nearly seven out of 10 (67%) Europeans demand direct bank transfers as their most preferred method to be paid, indicating the growing need for businesses to provide fast and secure payments in consumers’ preferred payout methods.

That’s according to a new report released by Rapyd, the leading fintech-as-a-service partner, after conducting research to understand consumer choices, considerations and preferences in nine European countries; including data on how consumers prefer to pay and receive payments.

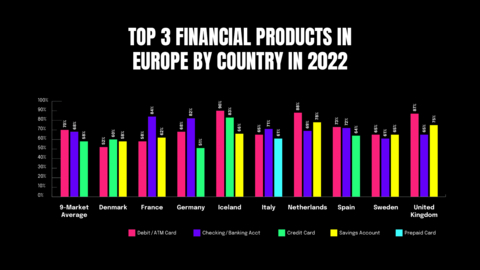

Rapyd’s European State of Disbursements report finds that access to, and interest in, financial technology apps is very high among consumers in the nine European markets surveyed. Europeans are embracing financial services apps for everything from banking, everyday spending and managing their investments. The findings show that 74% of European consumers use a mobile banking app, 50% use an eWallet app, 50% use a credit or debit card app, approximately one in six (16%) use an investment fund app and approximately one in eight (12%) use a personal financial management app.

Rapyd’s European eCommerce and Payment Methods report also indicates that Europeans increasingly rely on phones for payments, financial management and eCommerce. Over half (52%) of Europeans report purchasing clothes online via mobile over the past three months, compared to 46% via laptop. Furthermore, the overwhelming majority of Europeans who purchased takeaway over the last 3 months did so via mobile (70%) compared to laptop (28%).

Rapyd’s State of Disbursements report also noted that Europeans are early adopters of fintech, prioritizing data security and lower costs when receiving payments. Only 16% are hesitant or lagging in the adoption of fintech. The data shows that 82% rank keeping their personal information secure as the most important feature for payouts, and over 70% of respondents do not want to pay any transaction fees.

The report further analyzes and compares each market’s attitudes towards fintech adoption. Interestingly, Spain had the highest number of early adopters or consumers more likely to be open to new fintech solutions (27%), followed by Iceland (22%) and Germany (20%). On the other hand, Denmark (54%), France (47%) and the UK (44%) had the highest number of consumers who identified as the ‘late majority.’ The analysis notes that these consumers are less likely to explore new financial technology, instead preferring to use the same platforms as family and friends.

Over half of global online transfers are currently made with local or alternative payment methods. This, coupled with the rapid growth of marketplaces and gig economy models, is driving the need for new payout technology in Europe, notes the report.

Rapyd also notes that with the roll-out of the Single Euro Payments Area (SEPA) continuing and the Nordics’ P27 payments initiative unfolding, real-time payments in Europe are here to stay, emphasizing the need to keep abreast of country-specific regulations. As such, the company is calling on businesses to ensure they have the infrastructure in place to guarantee reliable mass payouts driven by local preferences.

Commenting on the findings, Arik Shtilman, CEO of Rapyd, said:

“The companies that solve the technological challenges of disbursing funds in Europe will surge ahead of their competition. It’s critical that businesses responsible for online financial transactions have partners that can support them in delivering reliable payout and payment solutions, can keep on top of local regulations and can stay on top of consumer preferences. The businesses that invest in dynamic tech solutions to guarantee reliable mass payouts will no doubt enjoy stability and growth through better engagement, loyalty and beneficiary preference.

“Furthermore, given the growth of marketplaces and gig-economy platforms, working with partners that understand the evolving fintech space is key. Disbursing funds to a seller or worker is typically tied to individual sales on different platforms. This can be incredibly complex, as in many cases, the buyer, seller and platform provider are all in different locations. We recommend that businesses ensure local preferences are driving their payout strategy, with a particular focus on speed, security and choice, as these factors help drive greater use and adoption and build loyalty and trust.”

Rapyd’s 2022 European eCommerce and Payment Methods report and 2022 European State of Disbursements report are available here.

Notes to Editors:

Survey Methodology

Rapyd surveyed 4,286 adults (18+) in Denmark, France, Germany, Iceland, Italy, Netherlands, Sweden, Spain and the United Kingdom online in March and April 2022. All respondents made an online purchase in the previous month and were nationally representative across age and income scale.

About Rapyd

Rapyd lets you build bold. Liberate global commerce with all the tools your business needs to create payment, payout and fintech experiences everywhere. From Fortune 500s to ambitious business and technology upstarts, our payments network and powerful fintech platform make it easy to pay suppliers and get paid by customers—locally or internationally.

With offices worldwide, including Tel Aviv, Dubai, London, Iceland, San Francisco, Miami and Singapore, we know what it takes to make cross-border commerce as easy as being next door. Rapyd simplifies payments so you can focus on building your business.

Get the tools to grow globally at www.rapyd.net. Follow: Blog, Insta, LinkedIn, Twitter.