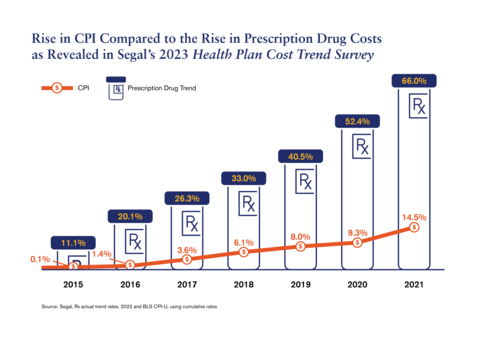

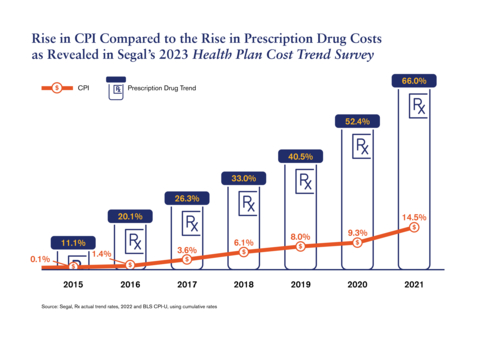

NEW YORK--(BUSINESS WIRE)--Health care spending in 2021 spiked an average of 14% per covered participant, the highest increase in a decade. The surge was primarily driven by the return of previously deferred medical care and the uptick of COVID-19 vaccines and therapeutics, according to data released today by leading benefits and HR consulting firm Segal in its 2023 Health Plan Cost Trend Survey. In the 26th annual survey respondents reported 2023 trend forecasts as well as actual health cost trends for 2021 for medical, prescription drug, dental and vision coverage, based on group health plan experience.

Last year’s medical actual plan cost increase was nearly double the projected rise of 7.7%, a stark contrast to the -2.1% medical trend rate experienced in 2020. This survey of employer-sponsored health plans also noted that per employee monthly medical claim costs is forecasted to increase at a rate of 7 to 8% in 2023. The survey found that forecasts for annual prescription drug costs increases are approaching almost 10%. Specialty drug prices, which now account for 55% of pharmacy benefit costs, are projected to increase by 13.5% as more expensive medications are introduced to the market.

“Inflation is at a 40-year high and is expected to drive up medical plan costs in 2023. While the full effect of inflation on health care costs may not yet be realized, it is expected to impact medical trend rates in the next year,” said Eileen Flick, Senior Vice President, Director of Health Technical Services at Segal. “Continued pressures on the health care sector related to health professional labor supply shortages and demand for greater wage increases, combined with the acceleration of new to market high cost technologies and treatments, are likely to drive higher health care cost trends in the next several years. Plan sponsors should expect higher health plan cost increases which put added pressure on overall compensation costs in the near term.”

The 2023 Segal Health Plan Cost Trend Survey polled health insurers, managed care organizations (MCOs), pharmacy benefit managers (PBMs) and third-party administrators (TPAs).

About Segal

Segal delivers trusted advice that improves lives. Segal is a privately-owned benefits, human capital, communications, technology, insurance brokerage and investment consulting firm with more than 1,000 employees throughout the U.S. and Canada. Segal, Segal Marco Advisors and Segal Benz are all members of the Segal family.