Candor Technology Introduces First Loan Scoring Engine

Candor Technology Introduces First Loan Scoring Engine

Proprietary Metascore Ushers in a Standardized Data Quality and Integrity Diagnostic That Provides Never-Before Confidence in Overall Strength of Underwrite

- Metascore fills a gaping void across mortgage markets by providing confidence in data quality and integrity

- Metascore + Blockchain-type database offer never-before access to the meta data used in underwriting.

- 45,733 pivot point architecture assesses investor guideline eligibility, >1,100 simultaneous crosschecks identify and mitigate defects

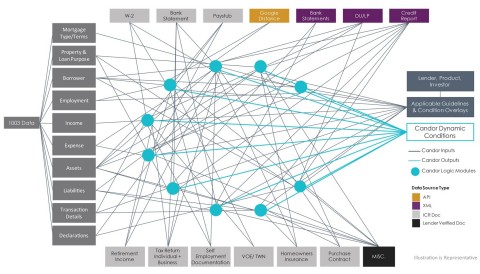

ATLANTA--(BUSINESS WIRE)--Candor Technology today announced an additional dimension to its Loan Engineering System: The Candor Metascore. The patent pending Metascore indicates the overall quality of a loan manufactured by Candor’s machine. To produce the score, all loan data is first run through a dynamic 45,733 pivot point architecture to accurately assess investor guideline eligibility, then through a corroboration engine that conducts >1,100 crosschecks to identify and mitigate defects. For never-before transparency all underlying metadata used during the autonomous process are saved to a Blockchain-type database. A Metascore of 85 or higher triggers eligibility for a defect insurance policy from a major international insurer.

Candor’s is the only solution able to autonomously conduct detailed, nuanced crosschecks across a vast and complex set of dynamic data. The painstaking corroborations exceed guideline requirements and mirror those conducted by seasoned underwriters. Except, Candor’s crosschecks are conducted in seconds, not weeks.

The constant influx of new and updated loan data required dynamic capabilities not yet available in mortgage lending. To meet this need Candor built its corroboration engine using aerospace principles. This is how the platform can simultaneously assess guideline eligibility and conduct crosscheck across multiple points of corroboration to identify and mitigate defects, ensuring integrity of the loan and the underlying metadata (see illustration).

The Metascore provides proof that The Loan Engineering System’s defect identification and resolution actions and lending decisions have been exhaustively tested, are sound and reliable, and are free of subjectivity, and bias.

The introduction of The Candor Metascore ushers in a standardized loan quality and integrity diagnostics that will have a profound impact on the mortgage market, from Origination to the Capital Markets. With the Loan Engineering System Lenders have speed, improved profitability, and defect free credit risk assessment. All data and steps taken during the autonomous manufacturing process are saved to a Blockchain-type database which gives investors never-before access to 100% of the metadata used to make lending decisions. This leads to a confident expectation on loan performance and pricing that maps to that expectation.

“We developed the Metascore to benefit lenders manufacturing loans in the primary market and to benefit loan buyers in the secondary market,” said Candor’s CEO Tom Showalter. “If a loan has a high Metascore, a secondary market analyst can be confident a rigorous credit analysis was conducted, that guideline eligibility has been met, that the loan data faithfully reflect the status of the loan, and that loan can be efficiently priced.”

Candor Technology’s Loan Engineering System is in a category all its own: Mortgage Decision Sciences Technology. The first of its kind credit and information risk analysis, identification, and mitigation machine empowers lenders to optimize their workforce and positions them for the type of sweeping process innovation that fundamentally improve the economics of making a mortgage. Calculate your ROI here.

Contacts

Alyson Austin

949-403-0484

alyson@gaffneyaustin.com