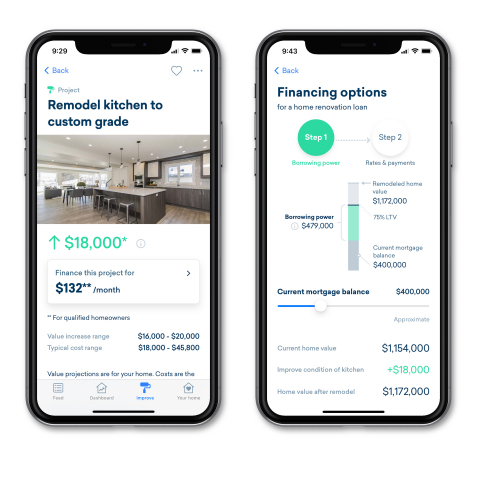

BELLEVUE, Wash.--(BUSINESS WIRE)--Funding home improvement just got easier and a lot more cost effective. Plunk, the first mobile app using AI and machine learning to help homeowners make smarter decisions about their largest and most important investment, today announced its new home renovation loan, designed specifically for financing major home improvements.

Plunk’s Home Renovation Loan provides homeowners:

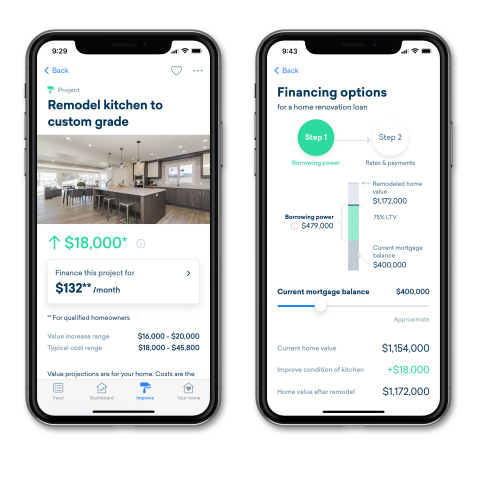

- Greater borrowing power—up to 75% of their forecasted home value post-renovation

- A significantly better rate1 than offered on credit cards, retail cards, and unsecured personal loans

- The fastest and easiest loan process—all digital, no paperwork, and no appraisal required

- Funding in 10 days or less

Plunk brings this new loan program to homeowners in partnership with Portage Bank, a financial institution best known for its trusted history of community lending. The partnership comes at a time when the average home age in the U.S. is 46 years old and the housing market is struggling to keep up with demand. The number of new homes built has been slashed in half since the previous decade, leaving many homes well overdue for upgrades.

“We’re all about empowering homeowners—first with accurate and trusted advice and now with access to better financial products,” said Plunk co-founder and president David Bluhm. “Our Home Renovation Loan is fully powered by Plunk’s advanced analytics. It saves homeowners time, stress and money; this is pure rocket fuel for home improvement.”

As an example, a homeowner looking to upgrade their kitchen with a $50,000 renovation project would save from $200 to over $1,0001 per month versus using a personal loan or credit card— while potentially adding much more to their home’s value.

“Helping homeowners turn their current house into their dream home is a new initiative we’re very excited about, and it’s very much rooted in our DNA,” said Matthew F. Moran, president and CEO at Portage Bank. “We have a track record of providing personal banking products that help our customers manage their futures worry-free that spans over a century.”

The Home Renovation Loan is now available in the greater Seattle area. To learn more or to apply for a loan, visit https://go.getplunk.com/remodel.

About Plunk

Plunk is the first mobile app using AI and machine learning to help you make the best financial decisions and grow your home’s value. Get real-time, data-driven insights, and personalized recommendations on the best ways to improve your home, project by project. Plunk also offers a new home renovation loan, which makes financing major remodeling projects simpler, faster and smarter. For more information, visit https://www.getplunk.com/.

About Portage Bank

Portage Bank is a trusted community lender with world-class customer service. At Portage, you have direct access to decision-makers who prioritize you and your needs above algorithms and policies. Portage leverages new technologies and innovations to make your banking experience simpler, more efficient, and more personal. For more information, check out www.portage.bank.

1 – Comparing payment amounts on Plunk’s Home Renovation Loan at a 5% fixed rate on a $50,000 loan amortized over 25 years versus the average credit card rate of 18.24% (and up to 32% per WalletHub, May 2021) or average personal loan rate at 11.84% per Bankrate (July 2021). |