KINGSPORT, Tenn.--(BUSINESS WIRE)--Eastman Chemical Company (NYSE:EMN) announced its fourth-quarter and full-year 2020 financial results.

(In millions, except per share amounts) |

|

4Q20 |

|

4Q19 |

FY20 |

FY19 |

|||||

Sales revenue |

$ |

2,186 |

$ |

2,205 |

$ |

8,473 |

$ |

9,273 |

|||

|

|

|

|

|

|||||||

Earnings before interest and taxes (“EBIT”) |

|

76 |

|

62 |

|

741 |

|

1,120 |

|||

|

|

|

|

|

|||||||

Adjusted EBIT* |

|

329 |

|

279 |

|

1,216 |

|

1,389 |

|||

Earnings per diluted share |

|

0.23 |

|

0.19 |

|

3.50 |

|

5.48 |

|||

|

|

|

|

|

|||||||

Adjusted earnings per diluted share* |

|

1.69 |

|

1.42 |

|

6.15 |

|

7.13 |

|||

Net cash provided by operating activities |

406 |

671 |

1,455 |

1,504

|

|||||||

Free cash flow* |

|

301 |

|

554 |

|

1,072 |

|

1,079 |

|||

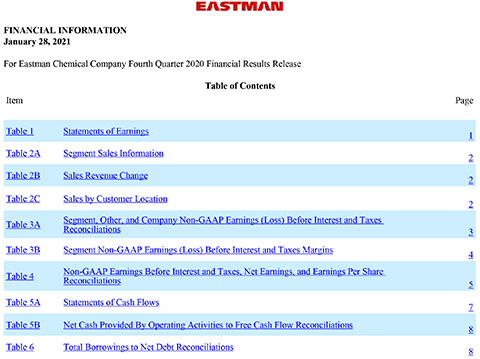

*For non-core and unusual items excluded from adjusted earnings and for adjusted provision for income taxes, calculation of free cash flow, segment adjusted EBIT margins, and net debt, and reconciliations to reported company and segment earnings and to cash provided by operating activities and total borrowings for all periods presented in this release, see Tables 3A, 3B, 4, 5A, 5B, and 6.

“Despite unprecedented challenges related to COVID-19, our financial performance in the fourth quarter and for the full year demonstrates the resilience of our people and our portfolio,” said Mark Costa, Board Chair and CEO. “We delivered record fourth-quarter adjusted EPS and resilient full-year EPS, reflecting the value of serving a diverse set of end markets, the benefit of our innovation-driven growth model, and our continued aggressive management of costs. We did an outstanding job of protecting our employees and maintaining the operational integrity of our facilities around the world during the global pandemic. In addition, given the uncertainties through the year, we took aggressive actions to prioritize cash flow and liquidity that resulted in greater than $1 billion of free cash flow for the fourth consecutive year. I’m incredibly proud and appreciative of all that our employees did to deliver these excellent results.”

Segment Results 4Q 2020 versus 4Q 2019

Additives & Functional Products – Sales revenue increased 1 percent driven by 2 percent volume / mix growth. Lower pricing of 3 percent was mostly offset by a favorable currency impact of 2 percent.

Double-digit growth in coatings additives was due to improving demand in the transportation end market and continued solid demand in building and construction. Care chemicals also had double-digit growth due to continued strength in the personal care end market. These gains were partially offset by continued weakness in the aviation end market, which has minimally recovered from the impact of COVID-19. The decline in price was mostly due to lower raw material prices and competitive pressure in product lines constituting about one-third of AFP segment revenues (including adhesives and tire additives) that are under strategic review.

Adjusted EBIT increased due to cost reduction actions, partially offset by higher inventory costs resulting from lower capacity utilization earlier in the year and modest spread compression for products in the one-third of the AFP segment. The adjusted EBIT margin increased by 100 basis points.

Advanced Materials – Sales revenue increased 6 percent driven by 6 percent volume / mix growth. Lower pricing of 2 percent was offset by a favorable currency impact of 2 percent.

All businesses delivered revenue growth in the fourth quarter, led by performance films, which delivered mid-teens growth, continuing what has been a resilient year due to our innovation and market development efforts. Specialty plastics had a record fourth quarter for both revenue and earnings driven by continued strength across its end markets, including consumer durables and packaging. The decline in price was due to lower raw material prices, particularly for paraxylene.

Reported and adjusted EBIT increased to record fourth-quarter levels due to volume / mix growth and cost reduction actions. The adjusted EBIT margin increased by 290 basis points.

Chemical Intermediates – Sales revenue declined 8 percent driven by a 6 percent volume / mix decline. Lower selling prices of 3 percent were partially offset by a 1 percent favorable currency impact.

Demand across many products lines strengthened during the fourth quarter. The 6 percent volume decline was mostly due to site maintenance shutdowns and the discontinuation of certain product lines at our Singapore facility. The discontinuation of these products is expected to negatively impact CI sales volume / mix approximately 5 percent in 2021 but have a favorable impact on EBIT. Lower pricing was due to lower raw material and energy prices.

Reported and adjusted EBIT increased due to lower maintenance shutdown costs and cost reduction actions, partially offset by modest spread compression.

Fibers – Sales revenue declined 8 percent due to a 6 percent decline in volume / mix and a 2 percent decline in price.

Product mix was negatively impacted by the discontinuation of a tobacco specialty product and volume declined due to continued weakness in the textiles end market as a result of COVID-19. Acetate tow volume was stable. Price declined due to previously negotiated multi-year contracts for acetate tow.

EBIT decreased due to less favorable product mix and lower prices.

Corporate Results 2020 versus 2019

Sales revenue decreased 9 percent, mostly attributed to the negative impact of COVID-19 on global economic growth and on demand for certain products. Volume / mix was lower by 5 percent, which was resilient given the challenging market conditions. The slowdown in the global economy impacted all segments, particularly product lines used in transportation, building and construction, consumer durables, and textiles end markets. Pricing declined 4 percent with the largest impact in Chemical Intermediates. The drop in prices in 2020 was primarily driven by lower raw material and energy prices. Currency exchange impact was neutral for all segments.

In response to the global pandemic, Eastman took several actions to improve results, further bolster our strong financial position, and ensure the integrity of our operations. Cost savings, both temporary and structural, totaled approximately $150 million for the year. These savings were more than offset by approximately $200 million of higher costs resulting from lower capacity utilization in response to weakened demand for certain products as a result of COVID-19 including approximately $100 million of costs related to inventory reduction as part of the prioritization of cash generation in 2020.

Adjusted EBIT decreased due to lower capacity utilization and lower volume / mix, partially offset by cost reduction actions. Spreads were flat.

Segment Results 2020 versus 2019

Additives & Functional Products – Sales revenue declined 8 percent due to 4 percent lower pricing and 4 percent lower volume / mix.

The decline in price was mostly due to lower raw material prices and competitive pressure in the one-third of the AFP segment. Product lines serving end markets most impacted by COVID-19 had the largest decline in revenue, particularly aviation fluids and tire additives. Care chemicals had 5 percent volume / mix growth due to strengthened demand in more resilient end markets, particularly personal care.

Adjusted EBIT decreased due to lower volume / mix and lower capacity utilization, partially offset by cost reduction actions.

Advanced Materials – Sales revenue declined 6 percent due to a 4 percent decline in volume / mix and a 2 percent decline in price.

An advanced interlayers volume decline more than offset specialty plastics volume growth. COVID-19 had a significant impact on advanced interlayers results, mostly due to lower auto builds. Specialty plastics had a record year for both revenue and earnings as end-market diversification proved valuable as demand remained solid for durables and packaging applications due to the pandemic. Performance films leveraged recent innovation and market development investments and significantly outpaced global auto sales in 2020. The decline in price was due to lower raw material prices, particularly for paraxylene. The strong recovery in the second half of the year helped to mitigate the impact of higher costs resulting from aggressive inventory management in the second quarter.

Reported and adjusted EBIT decreased due to lower capacity utilization and lower volume / mix, partially offset by cost reduction actions and lower raw material costs.

Chemical Intermediates – Sales revenue declined 14 percent due to 7 percent declines for both volume / mix and price.

The segment revenue declines were mostly due to reduced demand and lower raw material prices due to COVID-19 for olefins, acetyls, and plasticizers products. Revenue for the functional amines product line, sold mostly into agriculture end markets, was stable.

Reported and adjusted EBIT decreased due to lower capacity utilization, lower volume, and lower spreads, and partially offset by cost reduction actions and technology licensing earnings.

Fibers – Sales revenue declined 4 percent due to 2 percent declines for both volume / mix and price.

The volume decline was primarily due to the negative impact on demand from COVID-19 on the global textiles market. Volume was also negatively impacted by the discontinuation of a tobacco specialty product. Price declined due to previously negotiated multi-year contracts for acetate tow.

EBIT decreased due to lower capacity utilization and less favorable product mix, partially offset by cost reduction actions.

Cash Flow

In 2020, cash from operating activities was $1.5 billion and free cash flow (cash from operating activities less net capital expenditures) was $1.1 billion and flat to 2019, despite headwinds from lower cash earnings. See Tables 5A and 5B. In 2020, the company returned $418 million to stockholders through dividends and share repurchases and reduced net debt (total borrowings less cash and cash equivalents) by $656 million excluding the impact of foreign currency exchange rates. See Table 6.

Priorities for uses of available cash for 2021 include payment of the quarterly dividend, the reduction of net debt, bolt-on acquisitions, and share repurchases.

2021 Outlook

Commenting on the outlook for full-year 2021, Costa said: “We enter 2021 having delivered record fourth-quarter 2020 adjusted earnings per share (EPS) and strong free cash flow, as the global economy continues to recover. However, we still face uncertainty due to COVID-19 as we move forward into 2021. In this uncertainty, I am incredibly proud of how our team is focused on what we can control, starting with growing new business revenue by leveraging our innovation-driven growth model, which is enabling us to perform better than our recovering end markets, particularly for many of our specialty products. We also continue to aggressively manage costs and remain focused on disciplined capital allocation. Building on our strong recovery in the fourth quarter, we expect 2021 adjusted EPS to be 20 to 30% higher than 2020 adjusted EPS. And with our continued emphasis on cash generation, we expect our free cash flow to be greater than $1 billion for the fifth consecutive year.”

The full-year 2021 projected earnings exclude any non-core, unusual or nonrecurring items. Our financial results forecasts do not include non-core items (such as mark-to-market pension and other postretirement benefit gain or loss and asset impairments and restructuring charges) or any unusual or non-recurring items, and we accordingly are unable to reconcile projected earnings excluding non-core and any unusual or non-recurring items to reported GAAP earnings without unreasonable efforts.

Forward-Looking Statements

This news release includes forward-looking statements concerning current expectations and assumptions for future global economic conditions and the impact of the COVID-19 coronavirus pandemic on demand in key end markets; competitive position and acceptance of specialty products in key markets; mix of products sold; capacity utilization, manufacturing costs, and cost reductions; and revenue, earnings, cash flow, cash and cash equivalents, and debt repayment for first quarter and full-year 2021. Such expectations and assumptions are based upon certain preliminary information, internal estimates, and management assumptions, expectations, and plans, and are subject to a number of risks and uncertainties inherent in projecting future conditions, events, and results. Actual results could differ materially from expectations and assumptions expressed in the forward-looking statements if one or more of the underlying assumptions or expectations prove to be inaccurate or are unrealized. Important factors that could cause actual results to differ materially from such expectations are and will be detailed in the company's filings with the Securities and Exchange Commission, including the Form 10-Q filed for third quarter 2020 available, and the Form 10-K to be filed for full year 2020 and to be available on the Eastman web site at www.eastman.com in the Investors, SEC filings section.

Conference Call and Webcast Information

Eastman will host a conference call with industry analysts on January 29, 2021 at 8:00 a.m. ET. To listen to the live webcast of the conference call and view the accompanying slides and prepared remarks, go to investors.eastman.com, Events & Presentations. The slides and prepared remarks to be discussed during the call and webcast will be available at investors.eastman.com at approximately 5:00 p.m. ET on January 28, 2021. To listen via telephone, the dial-in number is 323-794-2588, passcode number 4526034. A web replay, a replay in downloadable MP3 format, and the accompanying slides and prepared remarks will be available at investors.eastman.com, Events & Presentations. A telephone replay will be available continuously from 11:00 a.m. ET, January 29, 2021 to 11:00 a.m. ET, February 8, 2021 at 888-203-1112 or 719-457-0820, passcode 4526034.

Founded in 1920, Eastman is a global specialty materials company that produces a broad range of products found in items people use every day. With the purpose of enhancing the quality of life in a material way, Eastman works with customers to deliver innovative products and solutions while maintaining a commitment to safety and sustainability. The company’s innovation-driven growth model takes advantage of world-class technology platforms, deep customer engagement, and differentiated application development to grow its leading positions in attractive end markets such as transportation, building and construction, and consumables. As a globally inclusive and diverse company, Eastman employs approximately 14,500 people around the world and serves customers in more than 100 countries. The company had 2020 revenues of approximately $8.5 billion and is headquartered in Kingsport, Tennessee, USA. For more information, visit www.eastman.com.