TROY, Mich.--(BUSINESS WIRE)--Among the early adopters who own an electric vehicle (EV),1 82% say they “definitely will” consider purchasing another EV in the future, according to the inaugural J.D. Power U.S. Electric Vehicle Experience (EVX) Ownership Study,SM released today. However, satisfaction with the current ownership experience is a key influencer for whether owners will purchase the same brand of EV again.

The overall EVX ownership index score measures electric vehicle owners’ satisfaction (on a 1,000-point scale) in premium and mass market segments across seven factors: accuracy of stated battery range; availability of public charging stations; battery range; cost of ownership; driving enjoyment; ease of charging at home; and vehicle quality and reliability.

“Brand loyalty can be fickle among EV owners,” said Brent Gruber, senior director of global automotive at J.D. Power. “While early adopters of EVs say they’ll remain loyal to EVs in general, staying with the same brand is not a sure thing. Auto manufacturers will have to keep EV owners and shoppers interested in their products beyond just the cost equation. With automakers expected to flood the market with EV launches during the next three years, to capture a share of the market they need to offer vehicles that evoke excitement and meet owners’ broader needs.”

The study finds that 95% of EV owners whose overall ownership satisfaction exceeds 900 points say they will purchase another EV. Nearly two-thirds (64%) of these owners say they “definitely will” repurchase the same brand. However, likelihood to repurchase the same brand lessens as satisfaction declines. Among owners whose satisfaction is between 600 and 750 points, 77% indicate they “definitely will” purchase another EV—although their likelihood of repurchasing the same brand is only 25%.

Following are key findings of the 2021 study:

- It’s mostly about range: When deciding which electric vehicle to buy, the most-often-cited factor in the purchase decision is battery and driving range. Even after the purchase is made, range is still a critical element of the ownership experience. In both premium and mass market segments, accuracy of the stated battery range and actual battery range experienced by the owner account for about 20% of owners’ overall satisfaction. “Even though most owners drive less than the stated range of their vehicle’s battery, they still want to know that the actual battery range is close to the stated battery range,” Gruber said. “It’s still about peace of mind.”

- Where to plug in: The public charging infrastructure is a key determinant of satisfaction for EV owners of both premium and mass market brands, yet significant differences exist between the two groups. Satisfaction among owners of premium battery electric vehicles (BEVs) with availability of public charging is 235 points higher than among owners of mass market BEVs, largely due to Tesla owners’ higher level of satisfaction with the Tesla public charging network. Regionally, satisfaction with the availability of public charging infrastructure is highest in the West (616) and lowest in the West North Central region (563), which includes Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota. Satisfaction with the availability of public charging is 305 points higher among Tesla owners than among owners of other brands.

- Driving enjoyment vs. quality concerns: While driving enjoyment varies significantly by segment (892 for premium BEV and 758 for mass market BEV), only in the mass market segment does driving enjoyment outweigh quality and reliability. Quality and reliability is the most important factor of the premium electric vehicle ownership experience. It’s notable that, while Tesla is seen to have poor quality, Tesla owners are more highly satisfied overall, indicating their willingness to overlook quality problems.

- Show me the savings: Owners of both premium and mass market EVs agree on one reason for choosing electrification over internal combustion engines (ICE): the expected lower operating costs of an electric vehicle. Cost of ownership is a key driver in the purchase of an EV that typically has fewer parts to maintain, has less frequent service requirements and results in lower fuel costs than ICE vehicles.

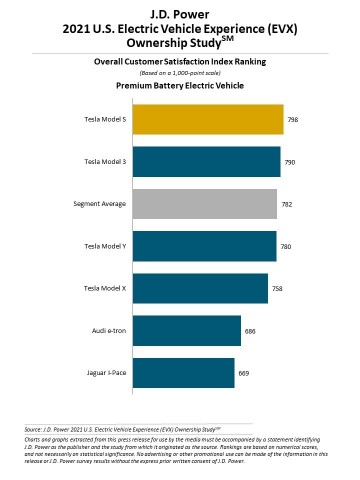

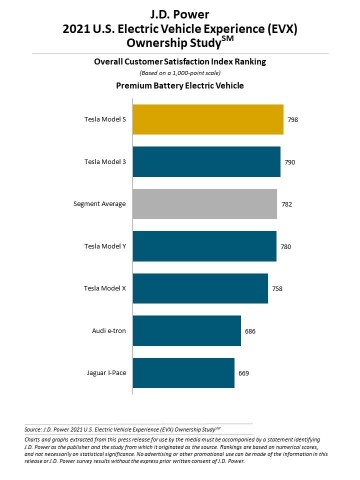

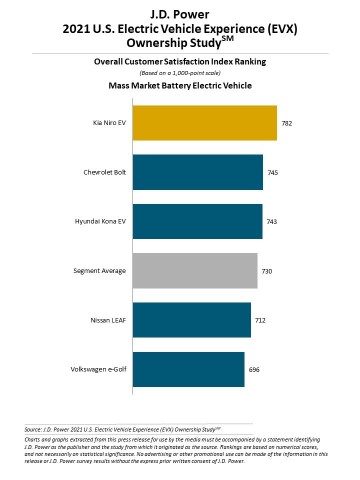

Study Rankings

Tesla Model S ranks highest overall and highest in the premium BEV segment with a score of 798. Tesla Model 3 (790) ranks second. Overall satisfaction in the premium segment is 782.

Kia Niro EV ranks highest in the mass market BEV segment with a score of 782. Chevrolet Bolt (745) ranks second and Hyundai Kona EV (743) ranks third. Overall satisfaction in the mass market segment is 730.

The U.S. Electric Vehicle Experience (EVX) Ownership Study is driven by a collaboration with PlugShare, the leading EV driver app maker and research firm. This study sets the standard for benchmarking satisfaction with the critical attributes that affect the total or overall EV ownership experience for both BEV and PHEV vehicles. Survey respondents for the inaugural study include 9,632 owners of 2015-2021 model year BEVs and PHEVs. The study was fielded in October-November 2020.

For more information about the U.S. Electric Vehicle Experience (EVX) Ownership Study, visit https://www.jdpower.com/business/automotive/electric-vehicle-experience-evx-ownership-study.

See the online press release at http://www.jdpower.com/pr-id/2021005.

Based in El Segundo, Calif., PlugShare maintains the most comprehensive census of EV infrastructure in the world. They make the PlugShare app for iOS, Android and the Web, the most popular EV driver app globally, in use by most drivers in North America and over one million EV drivers worldwide. PlugShare also provides sophisticated data tools, reports, custom consulting and comprehensive research on EVs for automakers, utilities, charging networks, government and the rest of the EV industry. It operates the world’s largest EV driver survey research panel, PlugInsights, now with over 63,000 members.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info

_______________________________

1 An electric vehicle (EV) is a category that includes battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV) and hybrid electric vehicle (HEV).