RESTON, Va.--(BUSINESS WIRE)--John Marshall Bancorp, Inc. (OTCQB: JMSB) (the “Company”), parent company of John Marshall Bank (the “Bank”), earlier today reported its financial results (“Earnings Release”) for the three and nine months ended September 30, 2020. This release constitutes a supplement to and should be reviewed in conjunction with the Earnings Release.

The human and financial tolls wrought by COVID defy belief. While there are no words for those having experienced the deepest loss, we offer our sincere condolences. We believe that the efforts of governments, universities, pharmaceutical firms and others to slow and ultimately eradicate this disease will be successful. Leaving the estimated timing of that success to others decidedly more qualified, we would like to take a few minutes of your time to demonstrate that, despite the challenges, John Marshall Bancorp, Inc. has performed quite well during the pandemic.

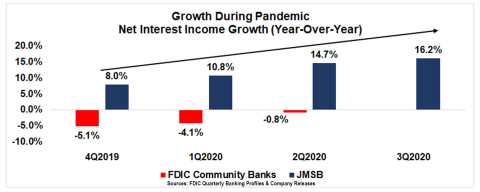

Governments and central banks have deployed unprecedented fiscal and monetary policy measures to blunt the pandemic’s economic impact. Much like epidemiologists sought to disperse the impact of the pandemic by “flattening the curve,” the United States averted a depression by committing to a prolonged period of economic stimulus. The Federal Reserve cut interest rates to near zero in March and, based upon their Statement of Economic Projections, indicated that rates could remain low until at least sometime in 2023. In addition, the United States Treasury commenced buying trillions of dollars of securities which drove bond prices up and the yields banks earn on investments down. Most banks derive the overwhelming majority of their income from the interest earned on loans and investments less the interest paid on deposits and borrowings, known as net interest income. With interest rates on loans and investments decreasing and banks’ limited ability to reprice their deposits and borrowings downward to the same extent, we believe that bank stock investors became concerned that net interest income would stop growing or even contract. Based upon Federal Deposit Insurance Corporation (“FDIC”) data that is, in fact, what happened to many community banks. That was not the case at John Marshall Bancorp, Inc., where our year over year net interest income growth since the 4th quarter of 2019 has accelerated and far exceeds the negative growth of our FDIC Community Bank Peers. Please note that 3rd quarter FDIC data is not yet available. Refer to Growth During Pandemic Net Interest Income Growth chart above.

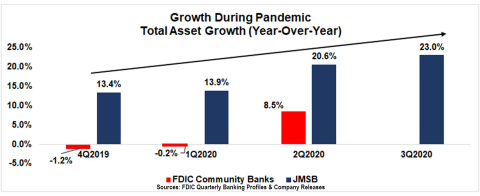

John Marshall Bancorp, Inc.’s net interest income growth reflects its growth in total assets. As of September 30, 2020, the Company’s total assets were $1.86 billion. Refer to Growth During Pandemic Total Asset Growth chart above.

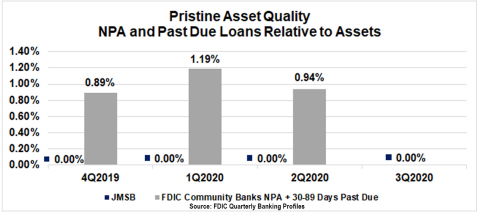

The Company’s non-performing assets (“NPA”), defined as the sum of other real estate owned, loans in nonaccrual status and loans 90 or more days past due, has been zero for each of the past four quarters and is unsurpassed by peers. In fact, the Company had no loans that were 30 or more days past due for each of the past four quarters, too. As you can see in the graph above, this is significantly below the FDIC Community Bank peer level. Refer to Pristine Asset Quality chart above.

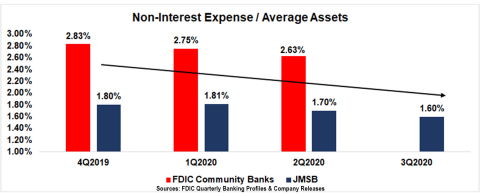

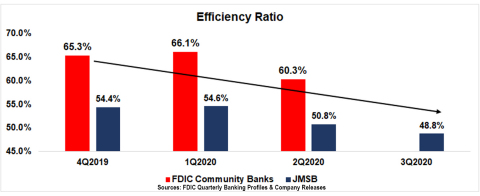

In addition, the Company has been vigilant with regard to managing overhead. We are committed to investing in our growth and enhancing the customer experience with greater convenience and broader product offerings. We refer to our approach as cost consciousness, which simply means getting the best value for the money spent. It is integral to our procurement and contract management processes. As shown by the following charts, we have demonstrated significant progress in lowering our overhead or non-interest expense to average assets. In addition, the efficiency ratio (non-interest expense relative to the sum of our net interest income and non-interest income) captures our progress on both revenue growth and expense management. Of course when it comes to expenses, lower is better for both the non-interest expense to average assets and efficiency ratios. Refer to Non-Interest Expense / Average Assets & Efficiency Ratio charts above.

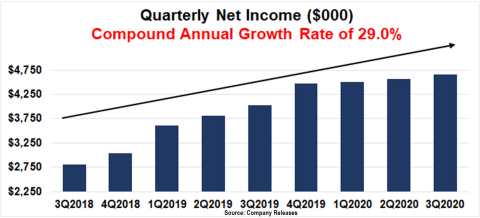

Unsurpassed asset quality, accelerating revenue growth and a reduced cost structure have produced seven consecutive quarters of record earnings. Over the past two years, the compound annual growth rate of our quarterly earnings was 29.0%. Refer to Quarterly Net Income chart above.

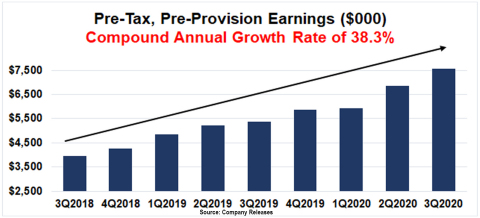

Despite our superior asset quality, we have increased our allowance for loan losses materially in 2020 to prepare for unexpected losses that might result from the pandemic. The provision expense that increases the allowance is run through the income statement and lowers earnings for losses that may or may not occur at some point in the future. Some investors analyze banks’ pre-tax, pre-provision earnings to assess their core earnings power. This measure adds the provision expense back to income before taxes to provide an estimate of how much in losses a bank could absorb without impacting capital. As you can see from the chart above, the compound annual growth rate of our quarterly pre-tax, pre-provision earnings over the past two years has been 38.3%. Refer to Pre-Tax, Pre-Provision Earnings chart above.

Despite the turbulent times, the associates at John Marshall Bank have remained focused on growing revenues, managing costs and maintaining superior asset quality. By continuing to do so, we believe we can maintain a strong, conservative balance sheet, increase earnings faster than peers and create value for our shareholders.

About John Marshall Bancorp, Inc.

John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank. John Marshall Bank is headquartered in Reston, Virginia with eight full-service branches located in Alexandria, Arlington, Loudoun, Prince William, Reston, Rockville, Tysons, and Washington, D.C. and one loan production office in Arlington, Virginia. The Company is dedicated to providing an exceptional customer experience and value to local businesses, business owners and consumers in the Washington D.C. Metro area. The Bank offers a comprehensive line of sophisticated banking products, services and a digital platform that rival those of the largest banks. Dedicated relationship managers serving as direct point-of-contact along with an experienced staff help achieve customer’s financial goals. Learn more at www.johnmarshallbank.com.

In addition to historical information, this press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiary include, but are not limited to the following: changes in interest rates, general economic conditions, public health crises (such as the governmental, social and economic effects of the novel COVID), levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, accounting principles and guidelines, and other conditions which by their nature are not susceptible to accurate forecast, and are subject to significant uncertainty. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.