TROY, Mich.--(BUSINESS WIRE)--During the height of the COVID-19 pandemic, 37% of retail bank customers said they were using their bank’s mobile app more frequently than ever before, and 48% said their preferred means of depositing a check during that period was via mobile phone. Years of digital investments are paying off as banks support homebound customers to continue their banking activities, based on a series of new studies of bank and credit card mobile app and online users, released today by J.D. Power. The studies find that ease-of-use, speed and accessibility of common features are the common variables shared by the best-performing digital platforms.

The studies—J.D. Power 2020 U.S. Banking Mobile App Satisfaction StudySM, 2020 U.S. Online Banking Satisfaction StudySM, 2020 U.S. Credit Card Mobile App Satisfaction StudySM and 2020 U.S. Online Credit Card Satisfaction Study—track overall customer satisfaction with banking and credit card providers’ digital offerings.

“Banks have been investing heavily in digital over the last several years and those investments paid off over the last three months as the COVID-19 pandemic dramatically accelerated the shift to digital, forcing many remaining hold-outs to finally take the plunge,” said Jennifer White, senior consultant for banking and payment intelligence at J.D. Power. “It’s never been more important for banks and credit card companies to make their digital offerings easy to access and use. Across these studies, the common trait among top performers is clear, smooth functionality that loads quickly and puts the information that customers need front and center.”

Following are some key findings of the 2020 studies:

- Customers looking for the “Netflix of banking”: Bank and credit card customers have come to expect a seamless experience across all channels and contact methods, so if they are using the mobile app at lunch, they want to be able to pick up where they left off on their desktop after dinner. Accordingly, the most important indicators driving overall satisfaction with banking apps and credit cards focus on ease and speed of finding information that’s most important in the moment. When the customer’s most important information is displayed right on the overview page, overall satisfaction scores improve 57 points (on a 1,000-point scale).

- Mobile app expectations differ for national and regional bank customers: National bank customers tend to have higher expectations for their apps, with a higher expectation for proactive guidance and help and a higher expectation for advanced digital capabilities. Regional bank satisfaction scores, by contrast, are driven by ease of navigation, due to their simpler feature sets.

- Mobile apps outperform websites: Across the studies, customer experience with mobile apps is generally better than their online experience, due largely to greater levels of perceived visual appeal and streamlined layout on mobile apps.

- Focused functionality wins for credit card app users: Credit card apps continue to outperform banking apps in overall satisfaction. This is largely due to credit card apps being task-focused and easier to understand.

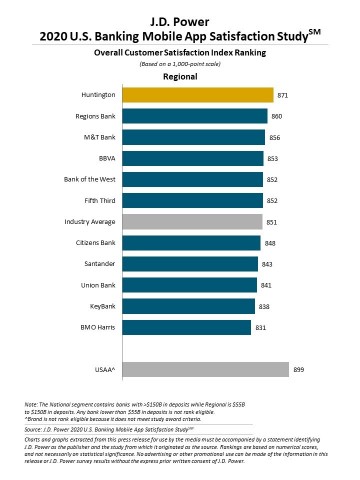

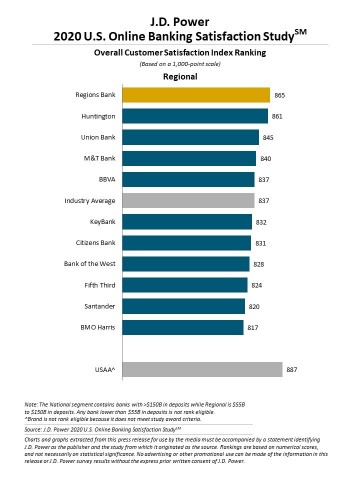

Study Rankings

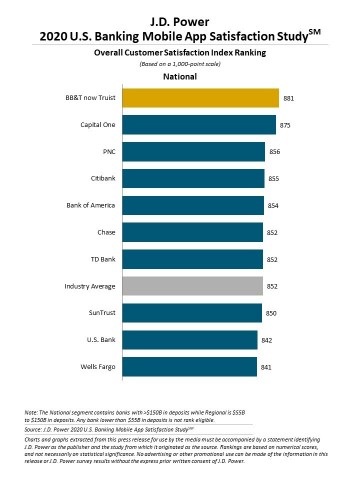

BB&T now Truist ranks highest in U.S. banking mobile app satisfaction among national banks, with a score of 881. Capital One (875) ranks second and PNC (856) ranks third.

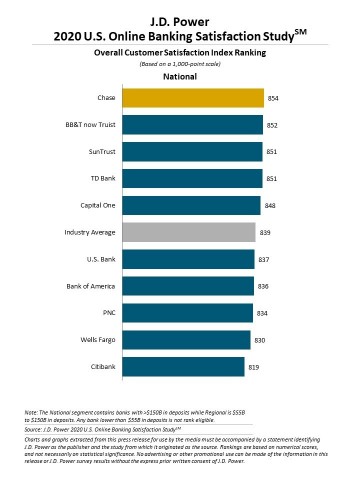

Chase ranks highest in U.S. online banking satisfaction among national banks, with a score of 854. BB&T now Truist (852) ranks second, while SunTrust (851) and TD Bank (851) rank third in a tie.

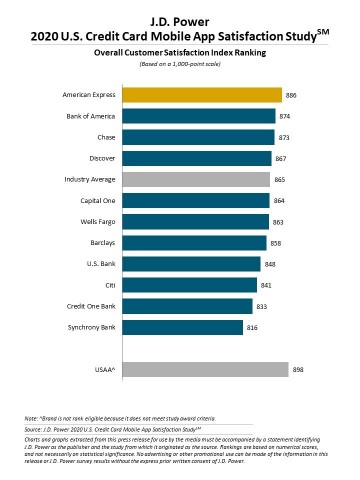

American Express ranks highest in U.S. credit card app satisfaction, with a score of 886. Bank of America (874) ranks second. Chase (873) ranks third.

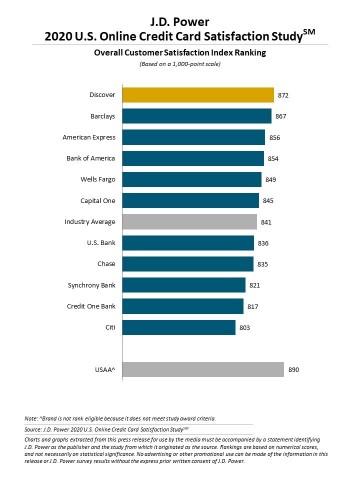

Discover ranks highest in U.S. online credit card satisfaction, with a score of 872. Barclays (867) ranks second and American Express (856) ranks third.

Huntington ranks highest in U.S. banking mobile app satisfaction among regional banks, with a score of 871. Regions Bank (860) ranks second and M&T Bank (856) ranks third.

Regions Bank ranks highest in U.S. online banking satisfaction among regional banks, with a score of 865. Huntington (861) ranks second and Union Bank (845) ranks third.

The 2020 U.S. Banking App Satisfaction, U.S. Online Banking Satisfaction, U.S. Credit Card App Satisfaction and U.S. Online Credit Card Satisfaction studies measure overall satisfaction with banking and credit card digital channels based on four factors: navigation; speed; visual appeal; and information/content. The studies are based on responses from 17,516 retail bank and credit card customers nationwide, and were fielded in March-April 2020.

To learn more about these studies, visit https://www.jdpower.com/business/resource/us-banking-and-us-credit-card-mobile-app-satisfaction-studies.

To view the online press release, please visit http://www.jdpower.com/pr-id/2020064.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe.

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info