OMAHA, Neb.--(BUSINESS WIRE)--The new American dream is the ability to be your own boss, with the freedom to work whenever and wherever you want, according to a new survey conducted by The Harris Poll on behalf of TD Ameritrade. Six in 10 Americans (60 percent) said freelancing is the modern version of the American dream. While that number was highest among those who have already joined the on-demand workforce (71 percent), more than half (57 percent) of traditional workers agreed.

“With more than 16.5 million people in the U.S. working in 'contingent' or 'alternative work arrangements,'1 we’re seeing an enormous shift in the way people spend their working lives,” said Christine Russell, senior manager of retirement and annuities at TD Ameritrade. “While some see drawbacks, a lot of people put a premium on the increased freedom and flexibility this evolution is enabling. And however they feel about it, there’s widespread agreement that freelancing is the future of work.”

Work is getting reworked

The workplace landscape is

shifting. Employees have lost trust in employers, leading many to become

more like the “CEO of one” – responsible for their own income, and

retirement.

-

Compared to 10 years ago, respondents say employers are less loyal to

employees (56 percent) and less trustworthy (38 percent), and think

they see employees as more expendable (50 percent).

- This has made employees more responsible for their own savings/retirement (51 percent), less loyal to their employers (48 percent), as well as more responsible for their own income, beyond salary (33 percent).

Full-time freelancers report being happier than traditional workers

Those

who do decide to take the plunge and join the on-demand workforce

full-time report a higher quality of life, experiencing higher levels of

happiness and lower levels of stress.

- Eighty-four percent of full-time freelancers report being happy with work, while 77 percent of traditional workers report the same.

- Fifty-nine percent of traditional workers report being stressed with work, while only 41 percent of full-time freelancers report feeling stressed.

Side hustlers are bridging the gap

Unlike full-time

freelancers, whose primary reason for joining the on-demand workforce

was to pursue their dreams (47 percent), side hustlers (those with a

traditional job and a freelance gig on the side) are primarily driven by

financial needs (52 percent). Most begin side hustling for financial

reasons, including paying off debt (44 percent), saving for major

purchases (42 percent), meeting current spending needs (38 percent),

increasing their nest egg (36 percent), and saving for retirement (32

percent).

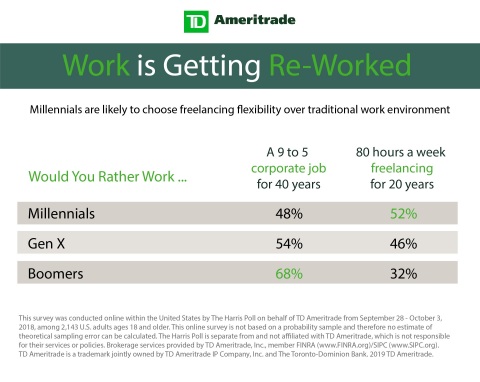

Millennials value flexibility

Millennials are especially

likely to choose freelancing flexibility over traditional corporate

employment: 52 percent of millennials would rather work 80 hours a week

freelancing for 20 years than work a nine-to-five corporate job for 40

years, and 76 percent expect to have a side hustle at some point in

their life. Forty-eight percent of millennials would ideally have both

freelance and traditional work, while just 24 percent want to freelance

full-time.

The Dark Side

While many people are excited by the

opportunity to be their own boss and chart a unique career path, others

see a dark side with a lifestyle that is unsustainable and leaves them

(and/or others) at risk financially.

- Fifty-six percent of respondents say the on-demand workforce is the future of the American economy, but 57 percent of respondents agree that an economy driven by on-demand work is not sustainable long-term.

- The biggest barriers to joining the on-demand workforce are financial uncertainty (41 percent of traditional workers, 28 percent of side hustlers, and 27 percent of full-time freelancers) and lack of traditional benefits (22 percent of traditional workers, 25 percent of side hustlers, 22 percent of full-time freelancers).

- Sixty-six percent of on-demand workers say it’s harder to plan for retirement as part of the on-demand workforce.

“While being your own boss can give you the freedom to be more flexible with your hours, that freedom also extends into how you build your financial future,” explained Russell. “Unlike their traditional counterparts, on-demand workers probably don’t receive friendly emails from their HR department reminding them to take advantage of the company retirement benefits – which is why it’s important to be proactive and learn about various tools available for the on-demand workforce.”

Russell highlights some of the tools available to the on-demand workers:

- Roth Individual Retirement Account (IRA) can be one approach for planning retirement. When it’s time to withdraw, there is no need to pay any taxes on the earnings, because they’re paid upfront. The 2019 contribution limit is $6,000 or $7,000 for those who are 50 or older. While there are income limits on who can contribute, anyone can convert existing IRA or 401(k) assets to Roth.

- Simplified Employee Pension (SEP) allows one to contribute and deduct 25 percent of their freelance/gig income up to $56,000 for the 2019 tax year. With SEP, it’s possible to change the percentage of contributions every year, skip years or even contribute once and never repeat it again.

- Solo 401(k), also known as Individual 401(k)s, also provides ability to contribute and deduct 25 percent of the freelance/gig income up to $56,000 for the 2019 tax year. Those 50 years or older may qualify for $6,000 in catch-up contributions.

Note that these are not the only tools available to on-demand workers. Be sure to consult with a qualified tax-planning professional with regard to your personal circumstances before making a decision. TD Ameritrade does not provide tax advice.

Source: TD Ameritrade Holding Corporation

About TD Ameritrade Holding Corporation

TD Ameritrade

provides investing

services and education to

more than 11 million client accounts totaling approximately $1.2

trillion in assets, and custodial

services to more than 7,000 registered investment advisors. We are a

leader in U.S. retail trading, executing an average of approximately

900,000 trades per day for our clients, more than a quarter of which

come from mobile devices. We have a proud history

of innovation, dating back to our start in 1975, and today our team

of 10,000-strong is committed to carrying it forward. Together, we are

leveraging the latest in cutting edge technologies and one-on-one client

care to transform lives, and investing, for the better. Learn more by

visiting TD Ameritrade’s newsroom

at www.amtd.com,

or read our stories at Fresh

Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org)/SIPC (www.SIPC.org).

About The Harris Poll

The Harris Poll is one of the

longest-running surveys in the U.S., tracking public opinion,

motivations and social sentiment since 1963. It is now part of Harris

Insights & Analytics, a global consulting and market research firm that

strives to reveal the authentic values of modern society to inspire

leaders to create a better tomorrow. We work with clients in three

primary areas; building twenty-first-century corporate reputation,

crafting brand strategy and performance tracking, and earning organic

media through public relations research. Our mission is to provide

insights and advisory to help leaders make the best decisions possible.

The Harris Poll is separate from and not affiliated with TD Ameritrade,

which is not responsible for their services or policies.

Survey Methodology

This survey was conducted online within

the United States by The Harris Poll on behalf of TD Ameritrade from

September 28 - October 3, 2018, among 2,143 U.S. adults ages 18 and

older. Key populations include: 438 on-demand workers (220 full-time

freelancers and 218 side hustlers) and 975 traditional workers. The

remaining sample pool consists of part-time workers, students and

retirees.

1 https://www.bls.gov/news.release/conemp.nr0.htm