NEW YORK--(BUSINESS WIRE)--In its latest Global Claims Review, Allianz Global Corporate & Specialty® (AGCS) reveals the top causes of claims in the corporate insurance segment based on an analysis of 470,000 claims from more than 200 countries over the past five years (July 2013 to July 2018) with an approximate value of €58bn (US $66.5bn).

Globally, the largest financial losses stem from fires/explosions, aviation incidents, faulty workmanship/maintenance incidents, and storms, which collectively account for more than 50% of all claims by total value. Over 75% of financial losses arise from 10 major causes of loss.

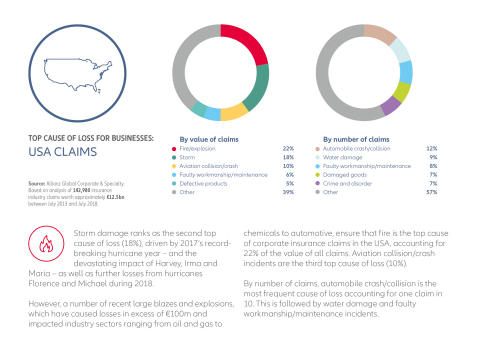

In the United States, fire/explosion (22%) ranks as the top cause of loss followed by storm damage (18%) - driven by 2017’s record-breaking hurricane year as well as further losses from hurricanes Florence and Michael in 2018. By number of claims, automobile crash/collision is the most frequent cause of loss, accounting for one claim in 10, in the U.S.

“In today’s interconnected and globalized business environment, financial losses are increasing due to geographical concentration of values - often in risk-exposed areas - and from the cumulative effect of global supply chains and networks,” says Philipp Cremer, Global Head of Claims, AGCS. “Looking to the future, new technologies bring business benefits but also risks and claims. However, they also provide an opportunity to prevent and mitigate losses and improve the claims settlement process for our customers.”

More expensive fires and aviation repairs

Over the past five years, fire and explosion incidents have caused in excess of €14bn worth of losses and are responsible for more than half (11) of the 20 largest non-natural catastrophe events analyzed globally. The average claim is about €1.5mn.

Costs associated with the impact of business interruption (BI) can significantly add to the final loss total from fire and explosion incidents, as well as many of the other major causes of loss identified in the report. Almost all large property insurance claims now include a major BI element: The average BI property insurance claim now totals over €3mn (€3.1mn). This is nearly 39% higher than the corresponding average direct property loss (€2.2mn).

The global aviation industry recently experienced its safest year ever, but claims activity shows no sign of abating. Aviation collision/crash incidents – on the ground and in the air – are the second major cause of losses. Increasing repair costs from composite materials and more sophisticated higher- value engines on aircrafts are also a factor.

Liability trends and InsurTech improvements

Defective products and faulty workmanship incidents, which account for 14% of all claims by value, are the top cause of liability losses for businesses. Product liability claims are becoming larger and product recalls are increasing in size. Supply chains in industries like auto manufacturing are now more complex. As companies restrict their number of worldwide suppliers, it increases product liability risks for these few suppliers exponentially.

It is estimated that about a third of large corporate liability claims involve litigation with third parties, compared with property insurance where less than 1% of claims do, on average. The U.S. in particular, has seen a trend towards higher settlements and awards in personal injury cases with some facing high punitive damages as recent verdicts around the chemical glyphosate and talc products demonstrate.

Analysis also shows that insurers, collectively, have paid on average €32mn a day over the past five years to cover losses – AGCS alone paid €4.8bn to its insureds in 2017. Insurers are increasingly adopting innovative technologies to improve the claims handling process. Machine learning and robotics can speed up the claims process for low-value, high-frequency claims. To quickly assess wind or flood damage following natural catastrophes, AGCS utilizes satellite imagery and drones, providing faster loss estimates that enable better allocation of resources and earlier claims payments.

The report provides loss break-down statistics for 13 countries and analyzes claims patterns across various industries such as aviation, shipping and energy as well as insurance lines of businesses such as property, engineering, liability and financial lines.

About Allianz Global Corporate & Specialty

Allianz Global Corporate & Specialty (AGCS) is the Allianz Group's dedicated carrier for corporate and specialty insurance business. AGCS provides insurance and risk consultancy across the whole spectrum of specialty, alternative risk transfer and corporate business: Marine, Aviation (incl. Space), Energy, Engineering, Entertainment, Financial Lines (incl. D&O), Liability, Mid-Corporate and Property insurance (incl. International Insurance Programs).

Worldwide, AGCS operates with its own teams in 34 countries and through the Allianz Group network and partners in over 210 countries and territories, employing almost 4,700 people of 70 nationalities. AGCS provides insurance solutions to more than three quarters of the Fortune Global 500 companies, writing a total of €7.4 billion gross premium worldwide in 2017.

AGCS SE is rated AA by Standard & Poor’s and A+ by A.M. Best.

For more information please visit www.agcs.allianz.com or follow us on Twitter @AGCS_Insurance, and LinkedIn.

Cautionary Note Regarding Forward-Looking Statements