NEWPORT BEACH, Calif.--(BUSINESS WIRE)--Engaged Capital, LLC (together with its affiliates, “Engaged Capital” or “we”), an investment firm specializing in enhancing the value of small and mid-cap North American equities with a 20.5% economic exposure to Rent-A-Center, Inc. (“RCII” or the “Company”) (NASDAQ:RCII), is compelled to remind stockholders of the facts following RCII’s recent letters to stockholders which obfuscate the truth of RCII’s corporate governance and make misleading statements about Engaged Capital’s highly qualified nominees.

Reminder #1: The incumbent Board has destroyed significant stockholder value.

Are the shareholder returns below1 indicative of incumbent directors that have proven themselves capable of delivering long-term stockholder value?

| Total Return Performance | |||||||||||||

| 1 yr | 2 yr | 3 yr | 5 yr | 7 yr | 10 yr | ||||||||

| Rent-A-Center | (39%) | (76%) | (72%) | (75%) | (52%) | (66%) | |||||||

| Aaron's | 34% | (5%) | 13% | 11% | 111% | 80% | |||||||

| Russell 2000 | 39% | 18% | 27% | 84% | 144% | 100% | |||||||

| S&P 1500 Specialty Retail Index | 10% | 9% | 43% | 119% | 222% | 154% | |||||||

| S&P 500 | 25% | 18% | 37% | 94% | 143% | 100% | |||||||

|

RCII Relative Returns vs: |

|||||||||||||

| Aaron's | (73%) | (71%) | (85%) | (86%) | (163%) | (147%) | |||||||

| Russell 2000 | (78%) | (94%) | (98%) | (159%) | (196%) | (166%) | |||||||

| S&P 1500 Specialty Retail Index | (49%) | (85%) | (114%) | (194%) | (274%) | (221%) | |||||||

| S&P 500 | (64%) | (94%) | (109%) | (169%) | (195%) | (167%) | |||||||

Reminder #2: A primary cause of RCII’s poor performance is poor corporate governance.

All three incumbent directors up for election at the 2017 Annual Meeting have been on the Board for the above periods of stockholder value destruction and have served on the Finance Committee, with responsibility for RCII’s key shortcomings, such as financial policies, capital structure, operating plans, and critical growth initiatives. The Board is long tenured, with five of seven directors serving on the Board for over ten years and two directors serving for over twenty years. A poor corporate governance structure led to failed succession planning and failed oversight. Furthermore, in response to Engaged Capital’s campaign for Board change, the incumbent directors have used the Company’s corporate machinery to disenfranchise stockholders and challenged Engaged Capital’s nominees on multiple grounds, amounting to what we consider a thinly veiled attempt to perpetuate the status quo.

Reminder #3: RCII is attempting a long-term turnaround under precarious circumstances.

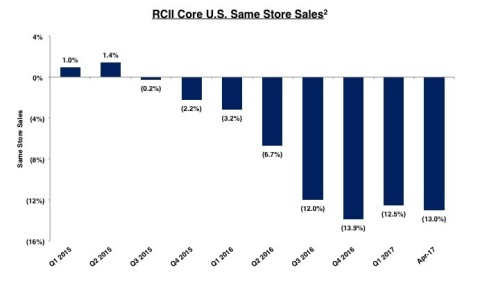

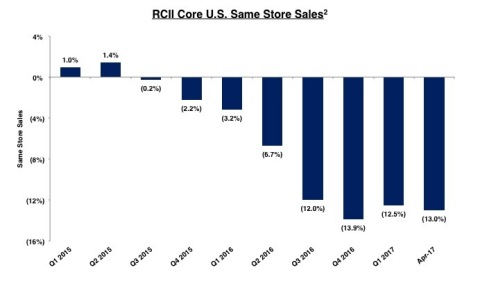

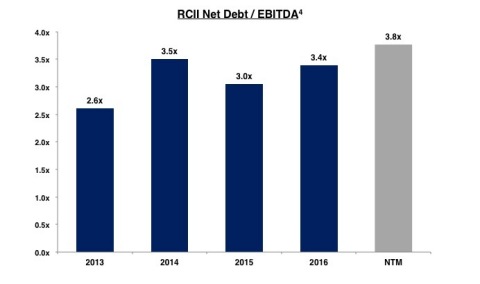

The Board has approved a three-year plan to turn the business around from its own self-admitted mistakes. Progress to date since Mark Speese returned as CEO is indicative of the challenge ahead. Core U.S. same store sales were negative 12.5% in Q1 2017 and negative 13.0% in April 2017. RCII is attempting this turnaround as its sole strategy while breaching debt covenants and requiring a waiver that restricts outstanding borrowings and that may restrict the dividend, which was already cut by 67% in 2016.

Please see accompanying graphics 1, 2 and 3.

Reminder #4: We offer an alternative. Engaged Capital is campaigning for stockholder friendly corporate governance and a commitment to openly and fairly evaluate ALL opportunities to enhance stockholder value to find the best path forward for ALL stockholders.

Engaged Capital has simply requested that the Board objectively evaluate ALL strategic alternatives available to the Company before blindly embarking on a public turnaround plan. The Board has consistently refused our request. The Board also denied our request to seek stockholder approval to declassify the Board in 2018 as the incumbent directors are apparently fearful at the prospect of facing a stockholder vote on re-election every year. Our campaign is about ensuring that the RCII Board does what it was elected to do – represent the best interests of stockholders by acting as our fiduciaries. Given RCII’s significant underperformance under the incumbent Board’s watch, this MUST include evaluating all opportunities for creating stockholder value.

ENGAGED CAPITAL HAS NOMINATED HIGHLY QUALIFIED, INDEPENDENT NOMINEES WITH STRONG TRACK RECORDS OF VALUE CREATION

Jeffrey J. Brown

- Experience on 40 boards of directors, including eight public company boards;

- Significant transaction and corporate governance expertise;

- At Medifast (NYSE: MED), Mr. Brown joined as lead director of a reconstituted board that brought in new executive leadership, returned the company to revenue growth, and improved capital allocation after a strategic alternatives process did not culminate in a sale. MED has generated stockholder returns of 47%, outperforming the S&P 500 by 27%5;

- At Nordion, a strategic review process initiated after Mr. Brown joined the board resulted in an acquisition of the company, generating total shareholder returns of 96%, outperforming the S&P 500 by 56%6;

- At Outerwall, Mr. Brown joined the board in April 2016 to represent stockholders as a new independent director while the company was in the midst of a strategic and financial alternatives process. Outerwall was acquired by a private equity firm at a 51% premium above its unaffected stock price7; and

- RCII has criticized Mr. Brown’s involvement at RCS Capital. Mr. Brown was appointed as an independent board member by a significant Class A stockholder of RCS Capital. Importantly, RCS Capital was a "Controlled Corporation" where all corporate matters were decided by a small group of Class B stockholders, significantly limiting Mr. Brown’s ultimate influence on board matters. RCS Capital and the material stakeholders agreed to a voluntary, pre-arranged Chapter 11 Bankruptcy. RCS Capital was not an Engaged Capital investment.

Mitchell E. Fadel

- Mr. Fadel’s lengthy career in the rent-to-own industry has proven him to be one of the industry’s best operators;

- Unlike current management, Mr. Fadel offers operational excellence without the hindrance of a founder’s mentality; and

- In contrast to the Company’s portrayal of Mr. Fadel, we would like to set the record straight. During Mr. Fadel’s career at RCII which included roles of COO, President, and Director, RCII generated a total stockholder return of 211%, outperforming the S&P 500 by 134%.8 Since Mr. Fadel resigned from the Company as COO, RCII has generated a negative 68% return, underperforming the S&P 500 by 87%9.

Christopher B. Hetrick

- As a Principal of Engaged Capital, Mr. Hetrick represents the largest owner of RCII with a 20.5% economic interest in the Company;

- Dedicated 15-year career unlocking value in publicly traded consumer companies; and

- Brings significant capital allocation, financial and executive compensation expertise.

VOTE THE BLUE ENGAGED CAPITAL PROXY CARD FOR ALL THREE ENGAGED CAPITAL NOMINEES TODAY

If you have any questions, or require assistance with your vote, please contact Saratoga Proxy Consulting LLC, toll- free at (888) 368-0379, call direct at (212) 257-1311 or email: info@saratogaproxy.com

About Engaged Capital:

Engaged Capital, LLC (“Engaged Capital”) was established in 2012 by a group of professionals with significant experience in activist investing in North America and was seeded by Grosvenor Capital Management, L.P., one of the oldest and largest global alternative investment managers. Engaged Capital is a limited liability company owned by its principals and formed to create long-term shareholder value by bringing an owner’s perspective to the managements and boards of undervalued public companies. Engaged Capital’s efforts and resources are dedicated to a single investment style, “Constructive Activism” with a focus on delivering superior, long-term, risk-adjusted returns for investors. Engaged Capital is based in Newport Beach, California.

1 FactSet data as of 1/27/2017, the day before Engaged

Capital 13D filing.

2 Source: RCII SEC filings.

3

Reported on a non-GAAP basis. 2017 EBITDA based on consensus estimates.

Source: RCII SEC filings and FactSet.

4 2013 to 2016 net

debt to EBITDA shown on LTM and non-GAAP basis. NTM EBITDA per

consensus estimates. Source: RCII SEC filings and FactSet.

5

From day before Mr. Brown was elected to the Medifast board to May 16,

2017.

6 From day before Mr. Brown was appointed to the

Nordion board to date of transaction close.

7 Outerwall

press release, July 25, 2016.

8 RCII total shareholder

return from July 2000 to August 2015. Mr. Fadel was President and COO

since July 2000 and December 2002, respectively, to August 2015 and a

director from December 2000 to November 2013.

9 From day

before effective date of Mr. Fadel’s resignation to 1/27/2017, the day

before Engaged Capital 13D filing. All data per FactSet.