OMAHA, Neb.--(BUSINESS WIRE)--Just as college-bound high school seniors are preparing to flee the nest come fall, moms and dads of recent college graduates may find their adult kids boomeranging back to the family home after years away.

Kelly K., 20, who just completed her sophomore year at the University of Illinois, is looking ahead to her life after college, “It’s not easy to go from living with friends and doing whatever you want to moving back in with parents, but it’s something you need to do to save money. My sorority sisters and I share a dream of moving to downtown Chicago together after graduation, but the rent is way too high. Moving back home to our families in the Chicago suburbs is basically a free ride so we can afford that downtown apartment in the future.”

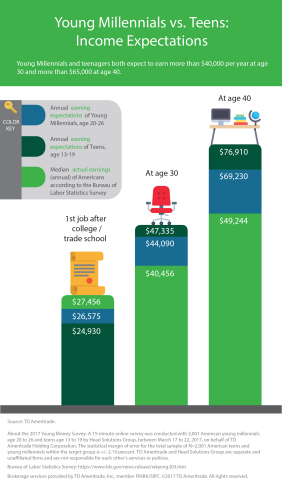

TD Ameritrade’s Young Money survey of 2,000 teens (ages 13 to 19) and young millennials (ages 20 to 26) found several distinct differences between these groups.

- Teenage dream: Two-thirds (65 percent) of teens say they don’t expect to move back home after college

- Adult reality: Nearly half (48 percent) of post-college young millennials moved back in with parents after college

Just how old is too old to be living with parents? On average, teens say age 26 would be embarrassing while young millennials give themselves some wiggle room to age 28. Others are less anxious to flee the nest. More than a quarter (27 percent) of young millennials say they wouldn’t be embarrassed until age 30 to 34 and 11 percent find it acceptable to live at home until age 35.

“Today’s college graduates are clearly under financial strain due to escalating tuition fees and stagnant wages,” said JJ Kinahan, chief strategist at TD Ameritrade. “Moving back in with mom and dad is a short-term sacrifice that could pay off in the long-run. That’s only if the boomerang young adults are saving and wisely investing the thousands of dollars they would’ve spent on rent and other living expenses, and – at the same time – are paying down their student debt. Time is on their side. It’s never too early to start learning how to invest and plan for the future.”

Plans After College Don’t Include Gig Work

Thirty percent of teens and young millennials prefer to work in a corporate/business environment. Slightly fewer (about a quarter) hope to run their own business and even fewer (one in 10) college-educated teens and young millennials prefer independent, gig economy work.

- Medicine is a desired field for all ages: but teens are twice as likely to want to work in the arts than young millennials (17 percent vs. 9 percent). Technology and engineering are third and fourth most popular for teens, while young millennials are more interested in business/finance/accounting

- Promotions and job hopping: millennials expect promotions after three years and teens say four years. Both expect to change employers about every six years

- What’s important to them: owning a home (70 percent teens, 65 percent young millennials), having a high paying job (55 percent, 45 percent), having a job that makes a difference (45 percent), and flexible work hours are more highly valued than telecommuting

Was College Worth it?

- Nearly 6 in 10 (57 percent) young millennials say the cost of college or trade school was a good investment in their future

- Eight in 10 (80 percent) acknowledge the importance of their degree in obtaining their current job

- More than 7 in 10 (76 percent) post-college millennials use their degree on a regular basis

- However, 20 percent believe the education they received will never be worth the debt accumulated

- Student debt for young millennials surveyed who have or are attending college averages $10,205 and is causing many to delay key life milestones: buying a home (39 percent), saving for retirement (31 percent), moving out of parents’ house (27 percent), having children (25 percent), and getting married (21 percent)

College grads who’ve landed that first job should start saving for retirement now. Saving for retirement too late could cost thousands—or even hundreds of thousands—of dollars. Find out how much more you may need to contribute each year to reach your retirement goal if you wait to begin saving. Learn about retirement savings options at https://www.tdameritrade.com/retirement-planning.page.

About TD Ameritrade Holding Corporation

Millions of

investors and independent registered investment advisors (RIAs) have

turned to TD Ameritrade’s (Nasdaq: AMTD) technology, people and education to

help make investing and trading easier to understand and do. Online or

over the phone. In a branch or with an independent RIA. First-timer or

sophisticated trader. Our clients want to take control, and we help them

decide how - bringing Wall Street to Main Street for more than 40 years.

TD Ameritrade has time and again been recognized

as a leader in investment services. Please visit TD Ameritrade’s newsroom

or www.amtd.com for

more information, or read our stories at Fresh

Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org)/SIPC (www.SIPC.org).

Survey conducted by Head Solutions Group

Head Solutions

Group (U.S.) Inc., is a leading market research partner for Financial

Services companies in North America. With offices in New

York, Toronto and Montreal, Head delivers the deep customer insights

that increase institutional knowledge and propel business action. TD

Ameritrade and Head Solutions Group are separate and unaffiliated firms

and are not responsible for each other’s services or policies.

About the 2017 Young Money Survey

A 15-minute online

survey was conducted with 2,001 American young millennials age 20 to 26

and teens age 13 to 19 by Head Solutions Group, between March 17 to 22,

2017, on behalf of TD Ameritrade Holding Corporation. The statistical

margin of error for the total sample of N=2,001 American teens and young

millennials within the target group is +/- 2.19 percent. This means that

in 19 out of 20 cases, survey results will differ by no more than 2.19

percentage points in either direction from what would have been obtained

by the opinions of all target group members in the United States. Sample

was drawn from major regions in proportion to the U.S. Census.

Source: TD Ameritrade Holding Corporation