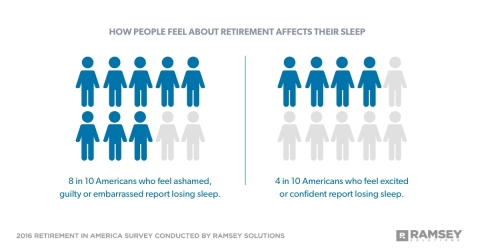

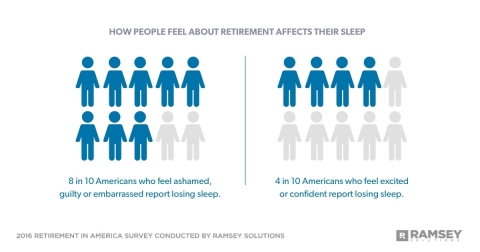

NASHVILLE, Tenn.--(BUSINESS WIRE)--Americans’ concerns and negative emotions about retirement are causing them to lose sleep, according to a new survey by Ramsey Solutions, a leading company in financial education. Results show 56 percent of Americans are losing sleep over retirement. Eight in 10 Americans who feel ashamed, guilty or embarrassed about retirement lose sleep, while less than half of Americans who feel excited or confident about their future lose sleep.

This report is the third in a four-part series evaluating the state of retirement in America as revealed by a survey consisting of more than 1,000 U.S. adults. This installment focuses on how Americans’ thoughts toward retirement affect their stress levels and sleep patterns.

Although saving for retirement leads to positive emotions like confidence, excitement and optimism, it doesn’t guarantee a better night’s sleep. More than 60 percent of active savers lose sleep over retirement, compared to nearly 50 percent of non-savers. And although Gen Xers are more likely to actively save and spend time planning for retirement, half of them admit they are afraid of outliving their money.

“It’s concerning to see so many Americans losing sleep over retirement, even those who save,” says Chris Hogan, financial expert, number one national best-selling author and spokesperson for Ramsey Solutions. “Most people assume saving will eliminate money stress, but what people need is an understanding of how much money they need to live on during their retirement years. Having this knowledge allows people to have a clear path to their retirement goals and reduce their stress surrounding retirement.”

Additional key survey findings include:

- 74 percent of Americans who are very concerned about their future lose sleep. This is compared to just 17 percent of those who have no concerns about their future. And nine in 10 people who feel confident about their future are focused on preparing for retirement.

- Kids activities/needs are the top obstacle those who aren’t saving and feel anxious face, with kid’s schooling coming in second. For those who are saving and feel anxious, lack of planning is the number one obstacle, followed by procrastination.

- Seven in 10 Americans who feel confident about their future know whom to ask about retirement questions. But Americans who aren’t comfortable talking to a financial advisor are three times more likely to feel regret and more than twice as likely to feel guilt and shame than those who are very comfortable talking to a financial advisor.

Additional survey findings for this installment can be found at www.daveramsey.com/research/stress-anxiety. Part four of the study will focus on America’s retirement crisis and will release September 2016.

About the Survey

Retirement in America is a research study

conducted with 1,016 U.S. adults to gain an understanding on attitudes,

behaviors and perceptions around the topic of retirement. The nationally

representative sample was polled between February 26, 2016, and March 1,

2016, using a third-party research panel.

About Ramsey Solutions

Ramsey Solutions is committed to

helping people take control of their money, build wealth, grow their

leadership skills, and enhance their lives through personal development.

Through a variety of mediums, including live events, corporate financial

wellness program, publishing, syndicated columns, and two nationally

syndicated radio shows, Ramsey Solutions uses commonsense education to

empower people to win at life and money. Millions of people across the

country have gone through Financial Peace University, and Ramsey

Solutions’ world-class speakers have brought vision, inspiration and

encouragement to over a million more.

About Chris Hogan

A popular and dynamic speaker on the

topics of personal finance, retirement and leadership, Chris Hogan helps

people across the country develop successful strategies to manage their

money in both their personal lives and businesses. He is the host of the

Retire Inspired Podcast and the author of Retire Inspired: It’s

Not an Age; It’s a Financial Number, a #1 national best seller. For

more than a decade, Chris has served at Ramsey Solutions as a trusted

financial coach and Ramsey Personality. You can follow Chris on Twitter

and Instagram at @ChrisHogan360

and online at chrishogan360.com

or facebook.com/chrishogan360.