SAN FRANCISCO--(BUSINESS WIRE)--Today, Prosper Marketplace announced the release of its new and improved investor site. Built to meet the needs of any retail investor – novice or seasoned – the mobile-friendly experience arms people with more streamlined tools so they can invest more easily, track portfolio performance and reach fixed-income investing goals.

The release of the new experience comes at a time when investors are looking for attractive alternatives to the stock market. A recent Prosper survey revealed that over 80% of Prosper investors had returns that met or exceeded their expectations[1].

“Marketplace lending is quickly establishing itself as an asset class that should be part of everyone’s fixed-income portfolio, the way stocks and bonds are today. However, in order for retail investors to start investing through the Prosper platform, we needed to improve the experience and make it easier,” said Aaron Vermut, chief executive officer of Prosper Marketplace. “Today, we’re excited to deliver a better, more accessible experience that gives our investors more choice, convenience and customization.”

A new cornerstone feature of the platform is Auto Invest, a straightforward and easy-to-use tool that enables customers to automatically purchase Notes based on their personal investment criteria.

“The new platform delivers on one of our top priorities at Prosper – enhancing the investor experience,” said Stephen Smyth, director of product management at Prosper Marketplace. “Our vision for the platform is one that is dynamic, visually appealing, and meets the various investment styles of all of our customers.”

The revamped experience also includes easy-to-use navigation, which allows investors to explore the platform in more depth, browsing through payment information, interest rates, principal and bides on notes.

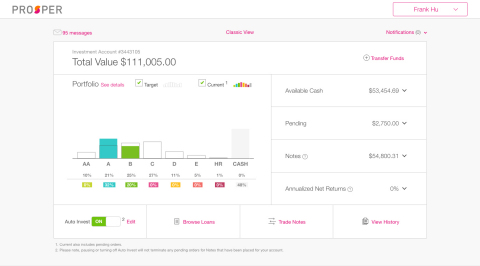

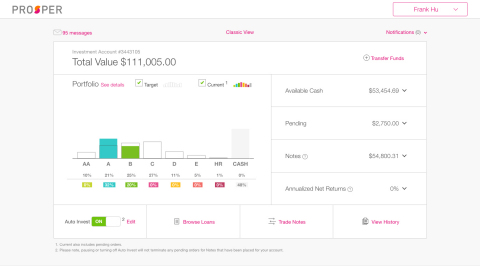

When investors log onto the site for the first time, they’ll immediately notice changes to the visual design. The new features of the retail investor experience include:

- Account Dashboard: The new at-a-glance account overview makes it easy to see how your portfolio is performing.

- Auto Invest in Seconds: Once your investment criteria have been saved, Auto Invest will start investing on your behalf with as little as $25 per Note.

- Portfolio Customization: Use the Auto Invest tool to build your desired portfolio. Pick a target investment mix according to your specified criteria or create your own custom mix.

Prosper is expected to rollout additional product enhancements in the weeks to come. For more information, please visit, www.prosper.com/invest.

Footnotes and Disclaimers:

[1] Results are based on responses from 357 active investors to an e-mail survey sent to 2,600 randomly selected active retail investors conducted between 5/2/16- 5/19/16. Active Investors are defined as retail investors who have bought a Note within the last two months.

Prosper’s borrower payment dependent notes (“Notes”) are offered pursuant to a prospectus filed with the SEC. Notes are not guaranteed or FDIC insured, and investors may lose some or all of the principal invested. Investors should carefully consider these and other risks and uncertainties before investing. This and other information can be found in the prospectus. Investors should consult their financial advisor if they have any questions or need additional information. All personal loans are made by WebBank, a Utah-chartered Industrial Bank, Member FDIC. Loans are unsecured, fully amortized personal loans.

About Prosper Marketplace

Since its launch in 2006 as the first marketplace lender in the US, Prosper Marketplace has evolved into a personal finance company that offers products and services that go beyond access to personal loans to help people get on top of their finances. Through Prosper’s flagship loan product, borrowers get access to low, fixed-rate loans with no hidden fees or prepayment penalties and investors can earn great returns through the platform’s data-driven underwriting for personal loans. The Prosper Daily app helps people stay on top of their money, credit and identity. Prosper Marketplace is headquartered in San Francisco with offices across the country and in Tel Aviv. The Prosper marketplace lending platform is owned by Prosper Funding LLC and the Prosper Daily app is owned by BillGuard, Inc., both of which are subsidiaries of Prosper Marketplace. For more information visit: www.prosper.com and follow Prosper on Twitter @ProsperLoans. Download Prosper Daily from the App Store and Google Play.